Bitcoin may see sharp correction upon spot ETF approval, predicts Bitmex founder Arthur Hayes

Hayes predicts a short-term Bitcoin pullback triggered by central bank actions, but his long-term outlook remains bullish.

Share this article

Leading figures are turning cautious as the outcome of Bitcoin exchange-traded funds (ETFs) edges closer. In a blog post published on January 5, BitMex founder Arthur Hayes predicted that Bitcoin would fall 20-30% in March following the potential approval of a Bitcoin ETF, and the crypto market might enter a major correction.

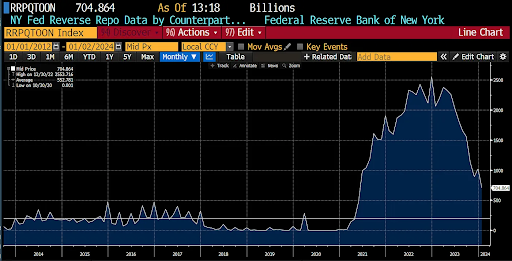

Hayes’ analysis points to a potential setback triggered by the interplay of three key factors: the Reverse Repo Program (RRP) balance, the Bank Term Funding Program (BTFP), and the Federal Reserve’s rate cut.

The RRP is a short-term lending facility run by the Fed. Hayes predicts the RRP balance will drop to $200 billion by early March. The potential decline, coupled with the lack of alternative liquidity sources, could lead to downturns in the bond market, stocks, and cryptocurrencies.

Source: cryptohayes.medium.com

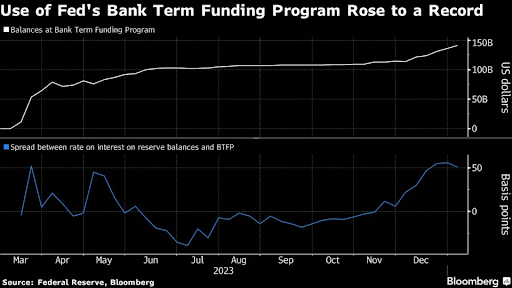

The second risk is the Bank Term Funding Program (BTFP), an emergency lending initiative launched by the Fed in March 2023 in response to concerns about financial stability during last year’s banking crisis. The program offers loans of up to one year to eligible institutions, secured by high-quality collateral like US Treasuries, agency debt, and mortgage-backed securities.

With the BTFP’s expiry date scheduled for March 12, Hayes warns of the potential cash shortfall if banks cannot return the funds. The Fed’s data shows that BTFP lending hit a record high of $141 billion in the week through January 3.

Source: Bloomberg

According to Hayes, some non-Too Big To Fail (non-TBTF) banks could face liquidity crunches, possibly pushing them close to insolvency. This pressure could trigger a domino effect of bank failures. However, with 2024 being an election year and public sentiment against bank bailouts, US Treasury Secretary Janet Yellen might be reluctant to renew the BTFP. Hayes anticipates that if sufficiently large non-TBTF banks face severe financial difficulties, Yellen might consider reintroducing the BTFP.

Predicting a sequence of bank failures and financial strains driven by the interplay of RRP, BTFP, and interest rates, Hayes expects the Fed to respond with rate cuts and a potential BTFP renewal. He forecasts a short-term Bitcoin correction by early March and expects it to be even more severe if spot Bitcoin ETFs are approved.

“Imagine if the anticipation of hundreds of billions of fiat flowing into these ETFs at a future date propels Bitcoin above $60,000 and close to its 2021 all-time high of $70,000. I could easily see a 30% to 40% correction due to a dollar liquidity rug pull.”

However, Hayes remains optimistic about Bitcoin in the long run. He wrote:

“Bitcoin initially will decline sharply with the broader financial markets but will rebound before the Fed meeting. That is because Bitcoin is the only neutral reserve hard currency that is not a liability of the banking system and is traded globally. Bitcoin knows that the Fed ALWAYS responds with a liquidity injection when things get bad.”

Bitcoin is trading at around $43,500, down 1.4% in the last 24 hours.

Share this article