Bitcoin Shorts: 40 Percent Surge Suggests Bearish Crypto Market

Share this article

Bitcoin shorts positions have increased significantly since the start of the week, suggesting investors are adopting bearish outlooks for the crypto market.

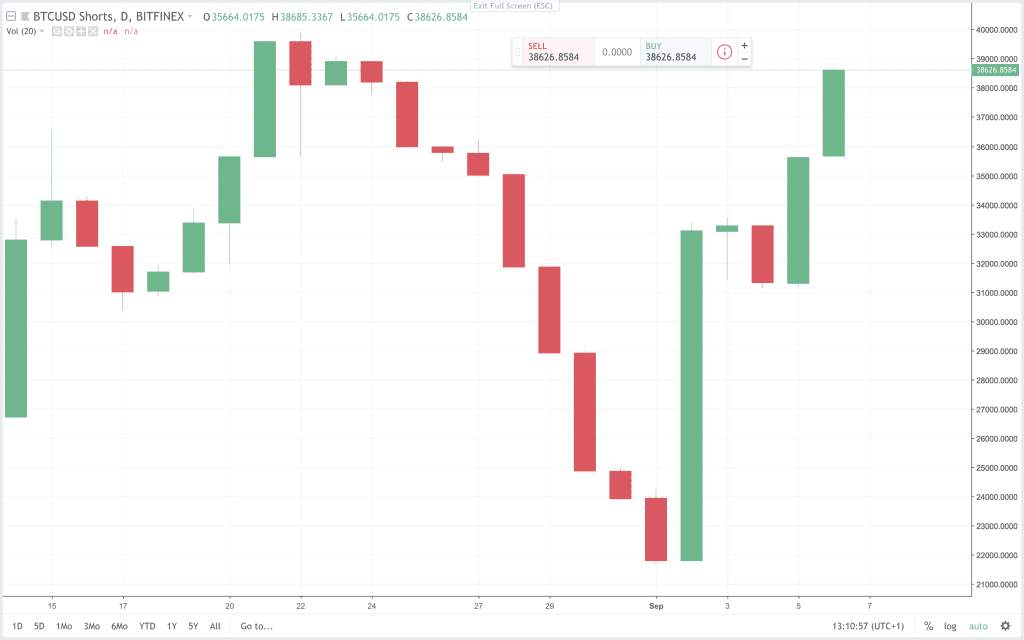

Data collected by TradingView shows the volume of Bitcoin shorts, taken out from the cryptocurrency exchange Bitfinex, has nearly doubled in four days. Short positions stood at 22,000 BTC at the beginning of Sunday but surged by more than 11,000 BTC over the course of the day, to 33,000 BTC.

There was then a slight dip throughout the week, but the number of short positions increased further following the news Goldman Sachs had decided to shelve its Bitcoin trading desk. It rose from around 31,000 BTC to 35,000 BTC over the course of the day; nearly 38,000 BTC at the time of writing.

Futures enable the exchange of assets for an agreed price at some point in the future. Traders adopt short positions when they think the asset’s price will decline and long positions if they think it will increase.

The number of long positions taking out on bitcoin has marginally declined since Sunday, falling from just under 28,000 BTC to 26,000 BTC. Long positions have increased slightly by approximately 100 BTC, so far on Thursday: around $650,000 at current prices.

The number of BTC shorts has increased by 42% since the beginning of the week; 12,000 BTC bigger compared to the total volume of longs.

Bitcoin shorts: the negative outlook

The crypto market has continued to spiral downwards; $40bn has so far been wiped from the total value since yesterday. The majority of coins experienced declines in the 15-30% range and this has caused BTC dominance to increase to 55%. Bitcoin’s price fell by over 10% in the past 24 hours, from $7,300 to $6,400.

An increasing short position trend is not a good sign for the price. The rising amount of bitcoin shorts, against a falling number of long positions, suggests a prevailing negative outlook on where the crypto market is heading.

Other market indicators present a similar picture. Bitcoin’s 50-day moving average fell back below the 200-MA line, as did the MACD, which went below the signal line earlier today. This suggests an increasing downwards momentum against the current trend: prices are, on the whole, likely to continue falling in the near future.

It has already been pointed out that the majority of Bitfinex short positions – worth approximately $74m – were taken out days before the Goldman Sachs news was publically known. There is no way to confirm but sources close to the Wall Street firm may have already begun leaking the decision to large-scale cryptocurrency traders.

It looked like the crypto market was well on the road to recovery, over the past two weeks. Although an increasing number of short positions does not augur well, futures are still sales contracts. Bitcoin as an asset is still being bought by investors, albeit by those anticipating lower prices.

The author is invested in BTC, which is mentioned in this article.

Share this article