Bitcoin, USDC, and USDT whale numbers have fallen in the past six months

Santiment highlights how important whale accumulation is for a trend shift in crypto prices.

Share this article

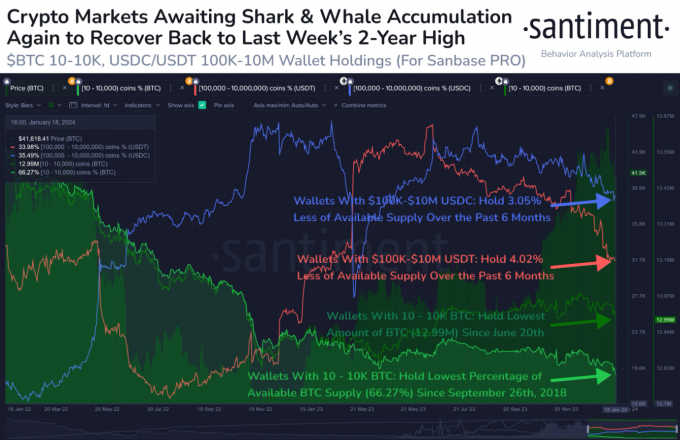

The number of ‘whale’ investors holding Bitcoin (BTC), USD Coin (USDC), and Tether USD (USDT) has shrunk in the past six months, according to data from crypto analytics platform Santiment. Not even the spot Bitcoin ETF approval was enough to keep those qualified investors in the market.

Whales are wallet addresses with significant amounts of a crypto asset. Stablecoin holders with balances between $100,000 and $10 million are considered whales and sharks by Santiment, while Bitcoin whales are addresses holding 10 to 10,000 BTC.

The data published by Santiment reveals that USDC whales, as of January 22, accounted for 35.5% of holders, down 3% from July 23, 2023. USDT whales have shown an even more significant decline, dropping from 38.4% to 34% within the same timeframe.

Bitcoin whales have not been immune to this trend, though their reduction is less pronounced. There has been a slight 0.7% pullback in the number of BTC whale addresses, reaching its lowest level since June 20 of the previous year.

Santiment, in a recent post on X (formerly Twitter), highlighted the significance of whale accumulation in predicting market movements. They suggest that such accumulation could signal a return to bullish trends, similar to those observed from October to December of the previous year.

This is particularly relevant considering the proximity of the Bitcoin halving event, which is widely regarded as a pivotal moment likely to propel BTC prices and, by extension, the broader crypto market.

In the context of these whale movements, it’s noteworthy to mention the role of spot Bitcoin ETFs in the US market. As of Jan. 17, spot Bitcoin ETFs in the US held $27 billion in Bitcoin, or approximately 632,000 BTC. Per a CoinGecko report published on Jan. 18, this amount accounts for 3.2% of BTC’s total supply.

Share this article