Blackmoon (BMC) Token Progress Report

The Blackmoon Platform and BMC Token allows users to create, promote, develop, and manage tokenized investment funds. Six months after their ICO, we analyze their roadmap, progress, and partnerships (as well as investor ROI based on token price) to deliver a verdict on Blackmoon's potential.

The Blackmoon Platform and BMC Token allows users to create, promote, develop, and manage tokenized investment funds.

Blackmoon hope their product will further serve to bridge the gap between fiat and crypto. On the platform, investment managers will theoretically be able to run crypto funds without having to set up any legal infrastructure on their own. This effectively eliminates the barriers for crypto fund creation, an aspect of Blackmoon that would represent a significant milestone in their mission to bridge the fiat and crypto economies.

Blackmoon plan to launch their platform by establishing a diverse array of funds in collaboration with external asset managers, simultaneously exposing investors to both the crypto market and traditional assets. Ultimately, they hope to encourage regulators to recognize blockchain tools as a legitimate vehicle for asset trading.

Blackmoon BMC Token Holders

Within the Blackmoon ecosystem, there are two types of token holders:

- Holders of BMC tokens can register as Continuous Contributors to the Platform via the Platform’s website. Continuous Contributors perform specific roles on the Blackmoon Platform such as advising investments and managing tokenized investment funds on the platform. Other roles will include platform promoters, investment analysts, legal advisors and public auditors.

- Each role requires a specific minimum and maximum amount of BMC to be deposited by a Continuous Contributor. Continuous Contributors will in return only receive proceeds from the funds they contribute to. Participants of the Continuous Contributor program do not need to wait for the company to break even to receive their reward.

- All Continuous Contributors, regardless of their role, will be awarded in BMC tokens. Participants of the Continuous Contributor program will have the option to convert accrued BMC tokens to ETH via a Bancor Protocol account. According to the Blackmoon website, BMC tokens won’t be deemed as securities by the SEC.

- Holders of Asset Tokens receive distributions from each corresponding fund’s capital appreciation. The Asset Tokens are comprised of contracts that govern the investment vehicle structure, fees, and assets themselves. According to Blackmoon, Asset Tokens are considered securities.

- Asset Tokens will be acquired directly on the Blackmoon Platform via FIAT, BTC and ETH.

- Each investment fund is incorporated as a Limited Partnership. The fund tokenizer domiciled in the Cayman Islands or comparable jurisdiction is the only limited partner of the fund. This tokenizer performs distribution of the Asset Tokens to attract fiat and/or crypto-currencies, then the proceeds are transferred to the fund to provide capital for future investments.

- All fund transfers will be transparent and their tokens will be continuously tradable to provide investors with necessary liquidity, subject to any applicable legal restrictions in specific jurisdictions.

Blackmoon Proposed Roadmap

Blackmoon have removed their original roadmap from the internet- an archived version of the website containing a copy of the original roadmap is available here for reference.

From a business and operational perspective Blackmoon’s rollout strategy entails:

- Full compliance with applicable laws in the EU and US- in addition to any applicable legal restrictions in specific jurisdictions, such as Singapore

- Marketing and general awareness of their mission and product

- Partnerships with banks that offer crypto-fiat banking solutions and traditional brokerage accounts

For the technical rollout, the main objectives as stated in the original roadmap are:

- Distribution of Fund Tokens (i.e. Asset Tokens)

- Development and launch of the Blackmoon Platform

- Gradual addition of various types of assets for tokenizaton including crypto asset funds

The milestones of the original roadmap are:

- January 2018- Token distribution of the first fund for high yield fixed fiat income

- March 2018- Token distribution of the second fund for low yield fixed fiat income and application for appropriate EU licenses

- April 2018- Release of fund administration system i.e. the Platform

- May 2018- Application to acquire appropriate US licenses

- September 2018- Receive fund management and broker-dealer licenses necessary for unaccredited fiat investors

- December 2019- acquire broker-deal license in the US

- January 2019- begin sale of asset tokens in US

Blackmoon Project Business and Operational Progress:

Compliance is a cornerstone of Blackmoon’s value proposition in that their platform cannot operate legally without it. Blackmoon offers a “depository receipt”, or asset token, on any type of underlying asset. As the legal framework for this tokenized asset varies from jurisdiction to jurisdiction, or sometimes does not exist at all, the compliance team is faced with a complex task ahead.

Not only do the rules differ from country to country, but they are also in a state of constant flux. The chaotic and ambiguous regulatory environment poses one of the biggest roadblocks to the progress of Blackmoon.

1.In November, Blackmoon formed a partnership with global law firm Allen & Overy LLP to help establish the legal framework of their tokenized investment funds to comply with EU securities regulations and to minimize risks.

2. As of February, Blackmoon hired a new Chief Compliance Officer, Anna Cox, to lead the compliance team. Anna has 18 years of experience specializing in providing compliance solutions and strategies for start up investment and asset management firms, with a particular focus on the EU and UK.

3.The compliance team is in the preparatory stages of obtaining all necessary licenses to operate. As Blackmoon provide several pathways to participation in their platform, different regulatory structures apply to their respective tokens. In a chat with CEO Oleg Seydak, he indicated to us that Blackmoon plans to go ahead with the launch of the Platform and Asset Token trading as soon as the UI/UX development and brokerage accounts are ready, despite having not yet obtained formal licensing from EU regulatory authorities. In the same chat, Oleg indicated that while Blackmoon are doing their best to comply with all relevant EU financial regulations, such as the structuring their AML policy, the compliance team is still in the preparatory phase and won’t proceed with the application for licensing until April or May of 2018.

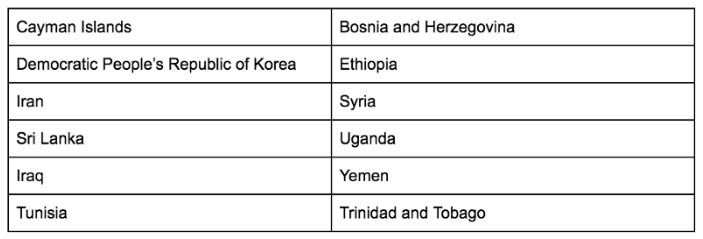

4. While it’s still unclear in which jurisdictions Blackmoon has full legal rights to operate, what is clear are the jurisdictions in which they do not. The jurisdictions can be broken down between holders of BMC and holders of Asset Tokens, as the latter is, according to Blackmoon, considered a security. The team has released tentative lists of restricted countries for their Continuous Contributors and Asset Token Holders schemes which can be viewed below:

Restricted Jurisdictions for Continuous Contributors (not final)

Restricted Jurisdictions for Asset Token Holders (not final)

5. With the Platform launch planned for April, most concerning at this point is that Blackmoon has yet to establish any relationships with banking institutions to open the brokerage accounts necessary for asset trading to begin. In December, Blackmoon held meetings in Liechtenstein and Switzerland which have as of yet not produced results. In our chat with CEO Oleg Seydak, he indicated the launch of the Platform would be delayed until brokerage accounts are setup. Without brokerage accounts, there is no framework to offer Asset Tokens tied to Exchange Traded Funds (ETF) or hedge funds, etc.

Blackmoon Product Development Progress

The latest monthly progress report outlined on the Blackmoon Medium includes information indicating development of the two separate user interfaces is nearing completion. These two interfaces include:

Fund Issuer Administrative Tool: This tool allows investment advisors and asset managers to manage investments for token holders. It is a comprehensive fund management system that covers all the aspects of running the tokenized investment vehicle and provides the investment advisor or asset manager with access to Blackmoon Platform IT and legal infrastructure.

Token Holder Analytical and Management Interface: The Blackmoon Investment Interface provides tools for investment portfolio structuring and management for Asset Token Holders. It also provides an overview of available investment opportunities and historical and current investment performance of funds.

- According to the Blackmoon monthly progress report, February marked the end of all smart contract testing and as of March user dashboards are going through the final stages of UI/UX development. CEO Oleg Seydak confirmed with us that the development process and difficulty in opening brokerage accounts have pushed the tentative launch of the Platform back to April. Despite the reported work on the user interfaces, nothing has been deposited to the official Github to reflect development progress.

- As far as actual asset offerings, the initial roadmap indicated that fixed fiat income tokens would be made available for purchase as early as January 2018, though it’s unclear by what means Blackmoon intended to carry out distribution. CEO Oleg Seydak indicated to us that the team instead chose to focus on ETFs as the first tokenized asset based on feedback from interested parties. Regardless, the Asset Tokens will not be available until the launch of the Platform.

- At this stage, the inclusion of additional Asset Token funds beyond those linked to ETFs seems to be a ways off. While the plan is to include a diverse array of tokenized assets on the Platform, including crypto funds, this won’t be possible until the product is off the ground and there is more certainty regarding the legal and regulatory environment.

Our Verdict on the Blackmoon (BMC) Project

There is no doubt when considering the current regulatory uncertainty surrounding cryptocurrency, any project seeking to bridge this new frontier with the orthodox financial sector has an uphill battle ahead. The significant delays facing Blackmoon are not surprising given the nascent state of the technology and inconsistency across the globe in legislation.

As the value of BMC itself is tied to its utility on the Blackmoon Platform, at this point the token value remains purely at the mercy of speculation. As a platform that will blur the lines between traditional finance and the crypto world, the vulnerability of BMC is particularly acute. Should Blackmoon attain brokerage accounts and begin trading without proper licensing, they risk being shut down at any point.

All of this uncertainty, combined with the lack of any verifiable deliverables on the development front, make for an extremely high-risk scenario for BMC. The depreciation in value since the release of the token on exchanges further reinforces this sentiment.

Learn more about the progress of BMC Token from our Telegram Community by clicking here.

Published: 3/23/18

Token Name: BMC

ICO Date: 9/12/2017

Raised: $30 million

Crowdsale Token Ownership: 50%

ICO Price: 1 BMC = $1 USD

Current Price: $0.65 USD

Token Return: -35%

Market Cap: $14 million

Exchanges: HitBTC, Liqui, TIDEX, EtherDelta, Bancor Protocol and Qryptos