Photo: Leonardo Munoz

BlackRock draws $3 billion in digital asset inflows in Q1, AUM reaches $11.6 trillion

Digital assets contributed 2.8% to total iShares ETF inflows last quarter.

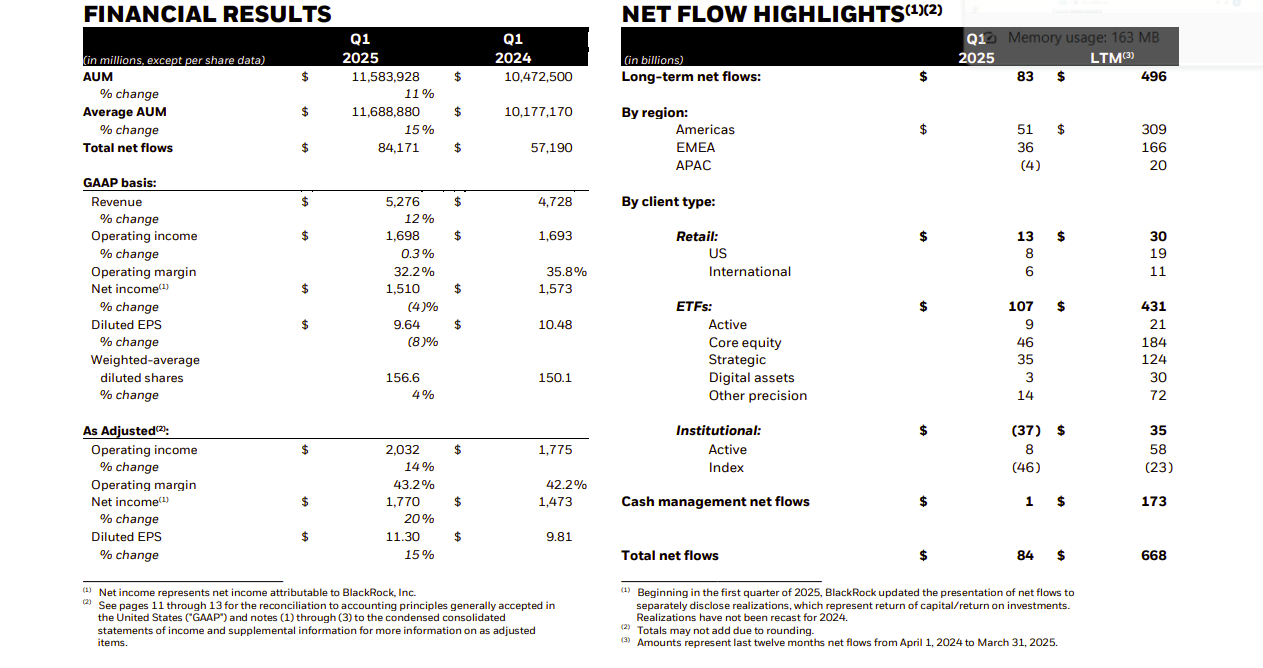

Investors poured around $3 billion into BlackRock’s digital asset products in Q1 2025, contributing to $84 billion in total net inflows for the quarter, according to the firm’s first-quarter earnings release on April 11.

BlackRock’s iShares ETF platform brought in a strong $107 billion in net inflows during Q1 2025. However, the firm’s total net inflows came in lower at $84 billion, as outflows in other segments—notably a $45.5 billion pullback from institutional index funds—offset the ETF gains.

BlackRock’s digital assets under management stood at over $50 billion at the end of Q1, up from $17.5 billion a year ago, which represents a 187% increase year-over-year. This surge dwarfed the growth rate of other asset classes within the firm’s portfolio, such as equities, which was up 8% YoY to $5.7 trillion.

The first quarter also brought notable volatility. Even though digital assets attracted over $3 billion in net inflows, market depreciation reduced their value by over $8 billion.

As of March 31, the global asset manager oversees approximately $11.6 trillion worth of client assets.

Digital assets make up just 1% of BlackRock’s total AUM, with their $3 billion net inflows accounting for 2.8% of total ETF inflows in Q1 2025. For comparison, private market investments brought in $9.3 billion during the same period.

Digital asset-related investment advisory and admin fees reached $34 million in Q1, less than 1% of BlackRock’s total $4.1 billion in long-term revenue as of March 31.

That figure aligns with the segment’s AUM share but underscores the low-fee structure typical of digital offerings.

For example, the iShares Bitcoin Trust (IBIT), BlackRock’s flagship crypto ETF launched in early 2024, operates at a competitive 0.25% fee post-waiver.

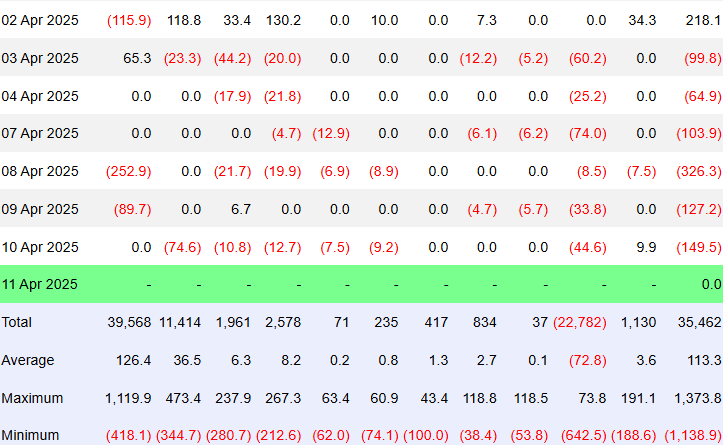

The report comes as US-listed spot Bitcoin ETFs saw their sixth straight day of net outflows, with $149 million in redemptions yesterday, according to Farside Investors.

The withdrawals were led by Fidelity’s FBTC and Grayscale’s GBTC, amidst a broader market movement where investors sought safer assets such as gold and cash, influenced by escalating US-China tariff disputes and market volatility tied to US policy changes.