BlackRock's Ethereum spot ETF listed on DTCC under ticker $ETHA

The Ethereum ETF still awaits SEC's S-1 filing approval.

Share this article

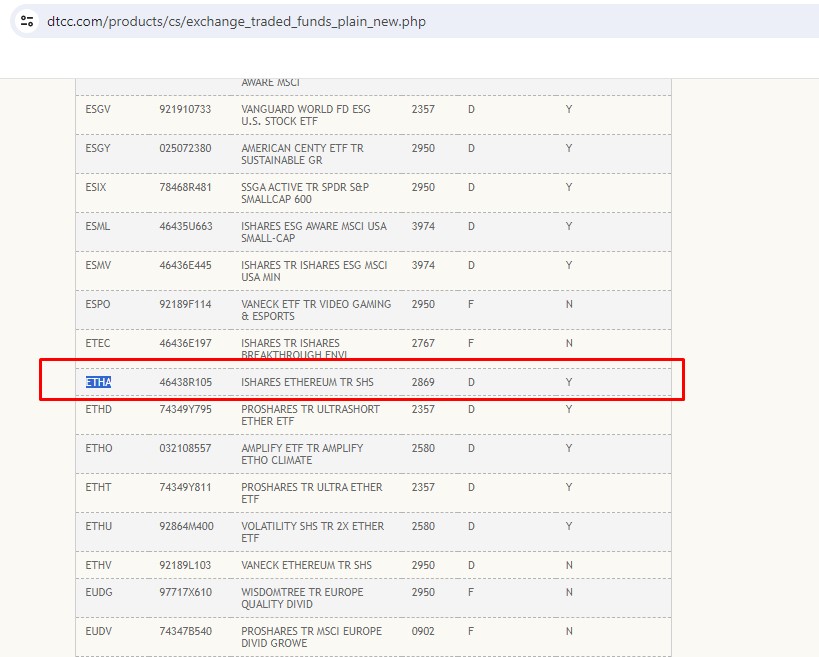

BlackRock’s spot Ethereum ETF has been listed on the Depository Trust and Clearing Corporation (DTCC) with the ticker symbol $ETHA. The listing follows the US Securities and Exchange Commission’s (SEC) approval of eight spot Ethereum exchange-traded funds (ETFs).

The SEC filings list eight Ethereum ETFs from VanEck, Fidelity, Franklin, Grayscale, Bitwise, ARK Invest & 21Shares, Invesco & Galaxy, and BlackRock’s iShares Ethereum Trust, proposed for listing on Nasdaq, NYSE Arca, and the Cboe BZX Exchange, as reported by Crypto Briefing.

Although the SEC has approved the 19b-4 forms associated with these ETFs, trading will remain on hold until the SEC approves each ETF’s S-1 filing. The timeline for this approval process varies, with estimates ranging from a few weeks to several months.

“This does not mean they will begin trading tomorrow. This is just 19b-4 approval. Also needs to be an approval on the S-1 documents which is going to take time. We’re expecting it to take a couple weeks but could take longer,” Bloomberg ETF analyst James Seyffart shared.

The SEC has reportedly begun discussions with ETF issuers regarding S-1 forms. Seyffart suggests that the SEC’s approval of the S-1 filings could take up to five months, after which trading of the spot Ethereum ETFs can commence.

“Typically this process takes months. Like up to 5 months in some examples but [Eric Balchunas] and I think this will be at least somewhat accelerated,” he added.

An SEC spokesperson declined to comment on the recent approval.

Briefly after the approval, asset manager VanEck submitted the amended S-1 form to the SEC. The firm also released a 37-second advertisement to celebrate the landmark approval, inviting viewers to “Enter the ether.”

Share this article