‘Britcoin’ moves to design phase, but final decision awaits

The digital pound is designed to complement, not replace, existing physical currency.

Share this article

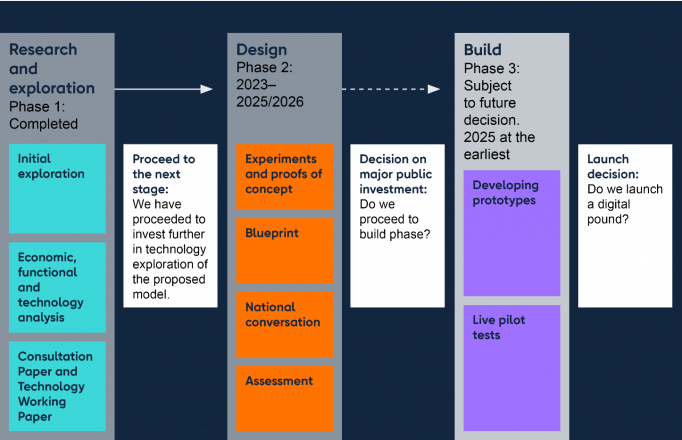

The Bank of England (BOE) is exploring implementation possibilities and design options for ‘Britcoin’, a digital version of the British pound, according to a press release published today by the BOE. However, a final decision on whether to create this Central Bank Digital Currency (CBDC) will await the completion of this phase.

According to the BOE, the new development comes after the release of a joint consultation statement by the BOE and HM Treasury, which details the progress on the proposed digital pound and addresses public concerns regarding privacy and continued access to cash.

The statement indicates that while the concept of a CBDC has gained considerable support from various industries, no final decision has been made to forge ahead with a CBDC. The forthcoming design phase is set to further explore the feasibility of ‘Britcoin’ and its potential to foster convenience and innovation in daily transactions for individuals and businesses.

Addressing the privacy concerns that have been raised, the BOE asserts that any progression towards ‘Britcoin’ would involve primary legislation designed to ensure the privacy and control of users over their data. The BOE and the Government would be precluded from accessing this personal data, emphasizing users’ freedom in managing and spending their digital pounds.

Additionally, the Treasury and the Bank have reiterated their pledge to maintain access to traditional cash, stating that the introduction of a digital pound would be in addition to, not a replacement for, physical currency.

Bim Afolami, Economic Secretary to the Treasury, highlighted the momentous nature of the current innovations in money and payments, expressing the UK’s readiness to adapt should the decision to implement a digital pound be made.

“This is the latest stage in our national conversation on the future of our money – and it is far from the last,” Afolami said. “We will always ensure people’s privacy is paramount in any design, and any rollout would be alongside, not instead of, traditional cash.”

Sarah Breeden, Deputy Governor for Financial Stability, emphasized the importance of trust in any form of money.

“We know the decision on whether or not to introduce a digital pound in the UK will be a major one for the future of money. It is essential that we build that trust and have the support of the public and businesses who would be using it if introduced,” said Breeden.

The BOE noted that the envisioned digital pound would carry the same value as physical cash and be issued by the BOE, easily exchanged with other forms of money. Furthermore, access to the digital pound would be through digital wallets, and it would be intended for transactions rather than savings, not bearing interest and having restrictions on the amounts that can be held.

The roadmap established by authorities suggests a decision on the CBDC will be made between 2025 and 2026, requiring approval from Parliament.

While technically, any country could move swiftly to declare the creation of a CBDC, in practice, the process is far from quick due to many complex factors that need careful consideration. As of January 2024, only 11 countries have fully launched a digital currency, according to data from CBDC tracker Atlantic Council.

Share this article