Canary Capital seeks SEC approval for a Sui ETF involving staking

SUI network's dual-layer consensus model plays a key role in its ETF market entry strategy.

Asset manager Canary Capital is seeking approval from the SEC to launch a spot Sui exchange-traded fund that features staking.

The Cboe BZX Exchange has submitted a 19b-4 form to the SEC, proposing a rule change to list and trade shares of the Canary SUI ETF. This is the first proposed ETF designed to track the performance of SUI, the native coin of the prominent layer 1 network.

As noted in the filing, the ETF may stake portions of its holdings through trusted staking providers.

“The Sponsor may stake, or cause to be staked, all or a portion of the Trust’s SUI through one or more trusted staking providers. In consideration for any staking activity in which the Trust may engage, the Trust would receive all or a portion of the staking rewards generated through staking activities, which may be treated as income to the Trust,” the filing wrote.

An asset manager keen on launching crypto-tied ETFs, Canary Capital set up a Delaware trust for its SUI product in early March. More than a week later, the firm lodged its initial registration statement with the SEC, officially joining the Sui ETF race.

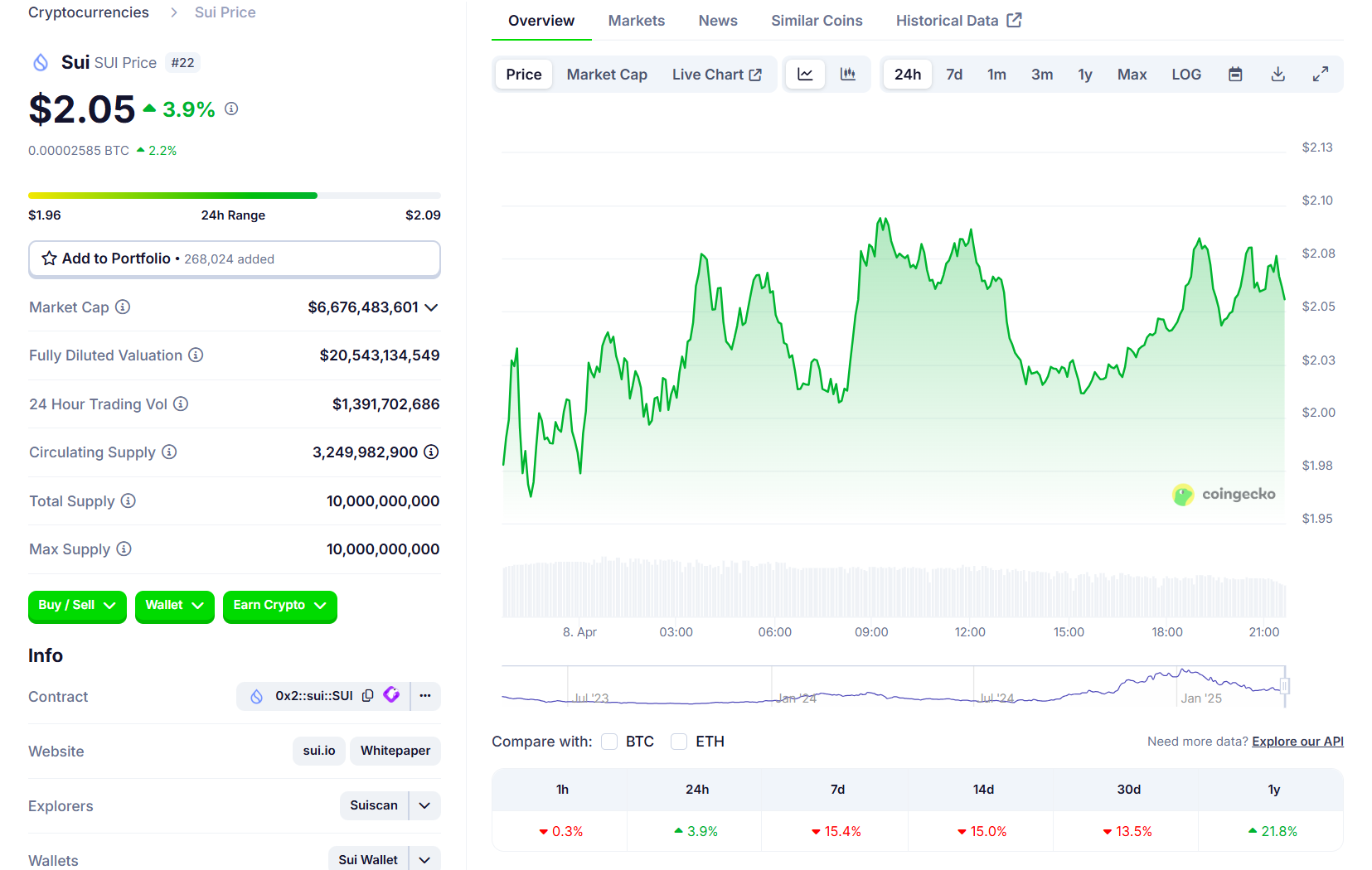

The proposed fund would track the spot prices of SUI, currently ranked as the 21st largest crypto asset with a market cap of around $6.7 billion. The crypto asset saw a minor surge following the new filing revelation, per CoinGecko.

The proposal follows the SEC’s approval of spot Bitcoin and Ethereum ETFs. Cboe stated that sufficient means exist to prevent fraud and manipulation, similar to the justifications accepted in those earlier approvals.

Canary Capital is accelerating its efforts to launch a suite of crypto ETFs. The firm is exploring numerous ETF products tied to other prominent assets, such as Litecoin, XRP, Solana, and Hedera, to name a few.

The firm’s push for a spot SUI ETF began shortly after World Liberty Financial (WLFI) — the Trump-endorsed crypto venture — announced a strategic partnership with the Sui blockchain to co-develop new products. WLFI also revealed plans to include Sui-based assets in its Macro Strategy fund.

Canary’s Litecoin ETF has already appeared on the Depository Trust and Clearing Corporation (DTCC) under the ticker LTCC, a sign that preparations for launch may be well underway.

Earn with Nexo

Earn with Nexo