Cardano Primed for Volatility After Steep Correction

Cardano is attempting to recover after incurring significant losses over the past week.

Key Takeaways

- Cardano has consolidated within a narrow price pocket after a brutal 45% correction.

- A decisive break outside the $0.58 to $0.49 range can determine where ADA will go next.

- A particular technical indicator suggests that a break to the upside is likely to occur.

Share this article

Cardano is showing early signs that it wants to recover despite the precarious market conditions. Still, traders would have to wait for a decisive close above resistance because the technicals present ambiguity.

Cardano Consolidation

Cardano remains stagnant while momentum builds up for a significant price movement.

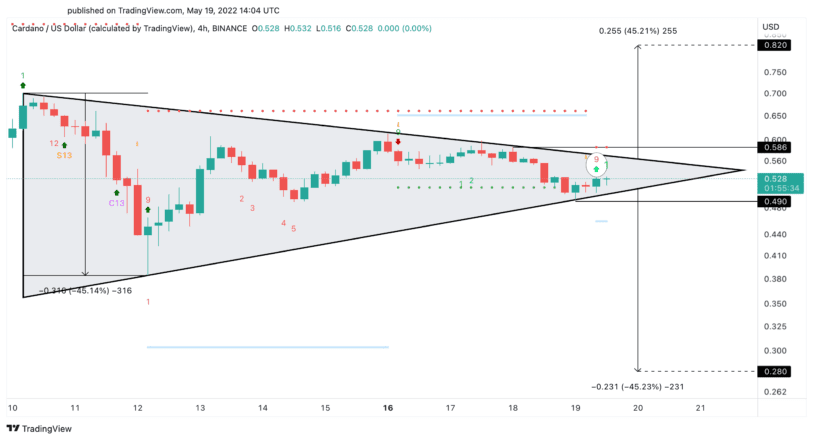

Cardano endured a 45% correction following Terra’s death spiral. It saw its price drop from a high of $0.70 to a low of $0.38 on May 12. Its ADA token has since been consolidating within a tight price range that is becoming narrower over time.

Such erratic price action appears to have led to the formation of a symmetrical triangle on Cardano’s four-hour chart. As ADA approaches the pattern’s apex, it builds momentum for a significant spike in volatility. A sustained close above the $0.58 resistance level or below the $0.49 support level could result in a 45% price swing in that direction.

Despite Cardano’s ambiguous outlook, the odds appear to favor the bulls. The Tom DeMark (TD) Sequential indicator presented a buy signal in the form of a red nine candlestick within the same time frame. The bullish formation anticipates a one to four candlesticks upswing, which could help ADA overcome the $0.58 resistance level.

Breaching this critical supply barrier could encourage sidelined investors to reenter the market and push Cardano toward $0.82.

Still, it is imperative to wait for a sustained close above resistance or below support due to the current market conditions. The lack of trading volume and uncertainty among investors paint a negative picture for the cryptocurrency market.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article