Shutterstock photo by Quality Stock Arts

Celsius Network Soars 18% Alongside Supply Burn

It is unclear how much of those gains are directly related to the supply reduction.

Celsius Network carried out its latest coin burn today, reducing its token supply in order to keep prices high.

Celsius Burns $250,000 of CEL

Celsius announced the news on Twitter, noting that as much as 63,502 CEL (worth $250,000) had been burned.

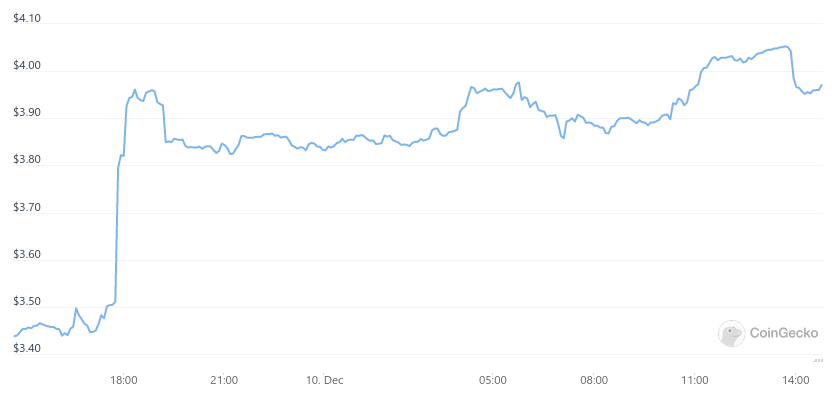

The event seems to have driven up the value of the project’s token. The price of CEL rose from $3.43 to $4.05 at its highest point, representing an increase of 18.08% over a 24 hour period.

This increase may be due to activity in anticipation of the burn rather than the effects of the burn itself. While the burn took place at 6:13 PM UTC on Dec. 10, CEL’s initial price surge took place several hours earlier, around 1:00 AM UTC on Dec. 9.

The price increase could also have been influenced by other factors, such as the anticipation of a live appearance of the project team at Real Vision’s “Takeover” event in Las Vegas.

Some community members also suggest that a whale holder has sold off a large amount of CEL tokens, though this should have caused the price of CEL to decrease instead of increase.

Regardless, Celsius’ token made slight gains post-burn as well. The price of CEL rose from $3.96 to $4.05 in the three hours following the burn, amounting to gains of 2.27%.

This, however, was canceled out by losses over the next hour, as prices fell back to $3.96 once again.

Celsius Is Popular But Controversial

Celsius is highly dependent on coin burns, as it carries out the process on a weekly basis to achieve deflation.

It remains to be seen whether the value gained through the events of today will last, as previous burns have seen a steady decrease in the coin’s value despite any temporary gains.

The news comes after two notable controversies for Celsius. The project appears to have lost funds through a BadgerDAO hack. Additionally, the project’s CFO has been arrested in Israel on charges unrelated to that event and unrelated to Celsius itself.

Regardless, Celsius remains popular as a leading crypto lending platform. The firm claimed to have $20 billion in assets under management as of August 2021.

Disclaimer: At the time of writing this author held less than $100 of Bitcoin, Ethereum, and altcoins.

Earn with Nexo

Earn with Nexo