Centralized crypto exchanges see $2 trillion surge in trading volumes in Q1: CoinGecko

Binance's Q1 performance eclipses regulatory woes with robust trading volumes.

Share this article

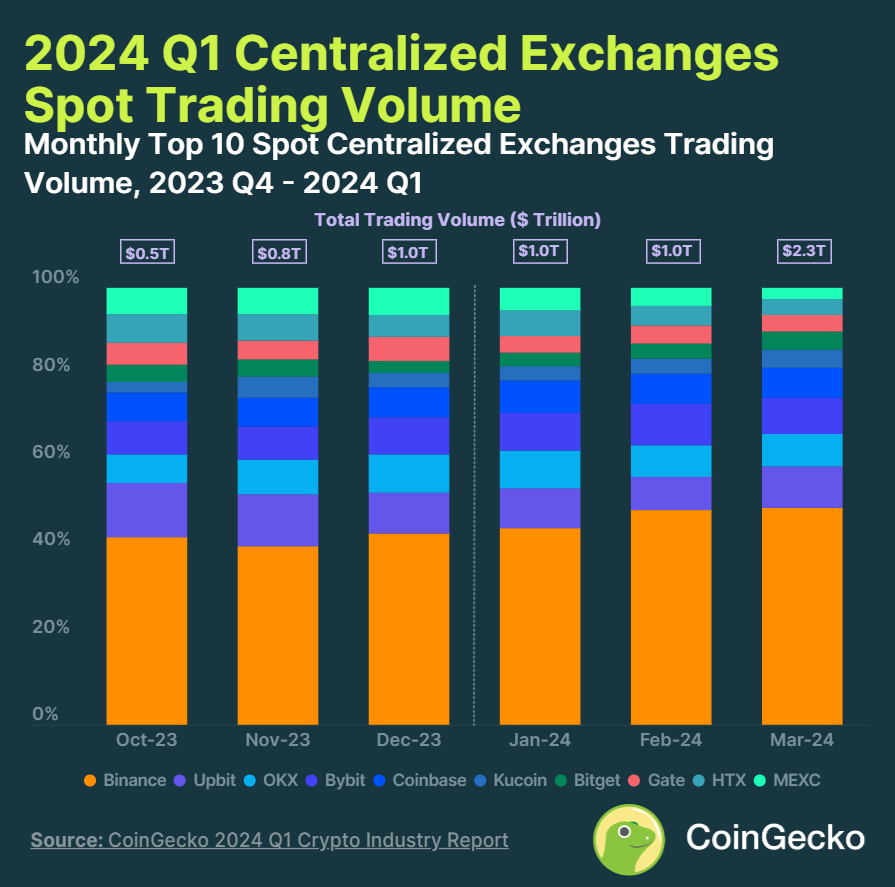

Centralized exchanges registered a crypto trading volume of over $4 trillion in the first quarter, according to a report by data aggregator CoinGecko. Binance recovered its market share gradually during Q1 to reach 49.7% in March, when the exchange registered $1.1 trillion in trading volume, marking a 131% increase from the previous month.

The report highlights that the dominance recovery happened despite Binance facing regulatory challenges in the previous year, and attributes the movement to new listings and project launches that have provided traders with a plethora of opportunities.

Meanwhile, Upbit maintained its status as the second-largest exchange, with a 9.4% market share and a spot trading volume of $216.4 billion, a significant 181.6% growth from February.

Bybit rounded out the top three, commanding an 8.2% market share and $368 billion quarterly trading volume, which represents a 112% quarter-over-quarter increase, pushing OKX to the fourth position.

Moreover, Bybit grew its market share in Bitcoin trading volume by 7.3% in the yearly period, a report by research firm Kaiko shows.

Kaiko analysts also detail how smaller exchanges on offshore markets have gained momentum in the last year, and the movement is particularly noticeable in Bitcoin markets, where Binance has faced increased competition following the removal of its large-scale Bitcoin zero-fee promotion last year.

OKX, Bullish, MEXC, and Bithumb were other crypto trading platforms which registered significant increases.

Share this article