Chainlink Looks Ready to Start a New Bull Rally

Chainlink could be approaching a new uptrend—but it needs to hold above $20.

Key Takeaways

- Chainlink is currently trading around the lower boundary of a multi-year parallel channel.

- A spike in buying pressure around the current price levels could push LINK into a new bull run.

- However, a breach of the $20 support could lead to significant losses.

Share this article

Chainlink appears to be trading at a crucial support level that has previously marked the beginning of a bull run. Similar price action could push LINK as high as $200.

Chainlink Primed for New All-Time Highs

Chainlink looks ready to run.

LINK has suffered a steep correction since rising to $36.40 on Sep. 6. The decentralized oracle token has shed almost 30% of its value since then, currently trading at around $26.

The downtrend seen over the last two weeks could have been anticipated as LINK got rejected by the middle trendline of an ascending parallel channel, where its price has been contained since May 2018 on the weekly chart.

Every time LINK has risen to this technical formation’s upper boundary since then, the uptrend has reached exhaustion, and prices have retraced to the pattern’s lower edge. From this point, LINK tends to rebound, which is consistent with the characteristics of a parallel channel.

Now that the asset appears to have found support around the channel’s lower trendline, it looks like a bullish impulse could be underway. Chainlink could soon rise toward the channel’s middle or upper trendline. These resistance areas sit at $70 and $200 respectively.

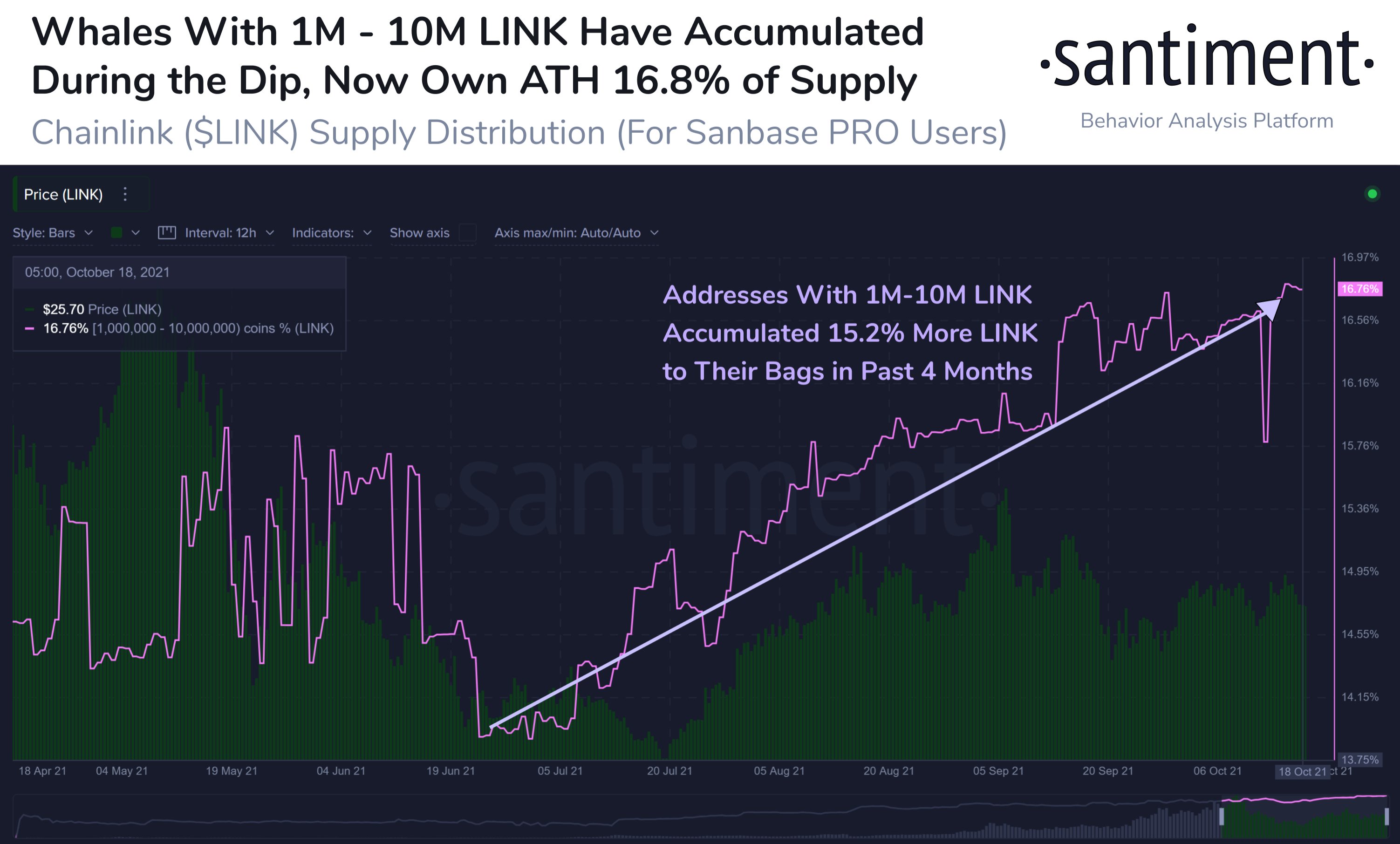

The behavior of whales buying into LINK supports the bullish outlook. Data from on-chain analytics platform Santiment shows that the buying pressure behind Chainlink has dramatically increased in the last few months, with addresses holding between 1 million and 10 million LINK now holding 167.7 million tokens.

Although the odds appear to favor the bulls, the parallel channel’s lower boundary could create a bearish scenario. This significant area of support has contained every wave of downward pressure since May 2018. Breaching such a strong foothold could instigate panic selling among investors, leading to significant losses.

The channel’s lower boundary sits at $20 at press time. Any signs of weakness at this price point could result in a correction towards $13 or even $8.

Share this article