Cosmos Is Stuck in a No-Trade Zone

Cosmos' ATOM token has been underperforming as its price action remains subdued in a no-trade zone.

Key Takeaways

- ATOM's price action is getting squeezed within a tight range.

- There are no clear signals about the direction of the token's trend.

- A decisive close outside the $26 to $31 range should resolve Cosmos' ambiguity.

Share this article

Cosmos’ ATOM token continues to consolidate without providing any clear signals of where it will head next.

Cosmos Remains Stagnant

Cosmos may have generated a significant amount of hype this year, but ATOM is still trading sideways.

The native token for the so-called “Internet of Blockchains” has seen its price endure a squeeze after a prolonged stagnation period, signaling that a spike in volatility is underway.

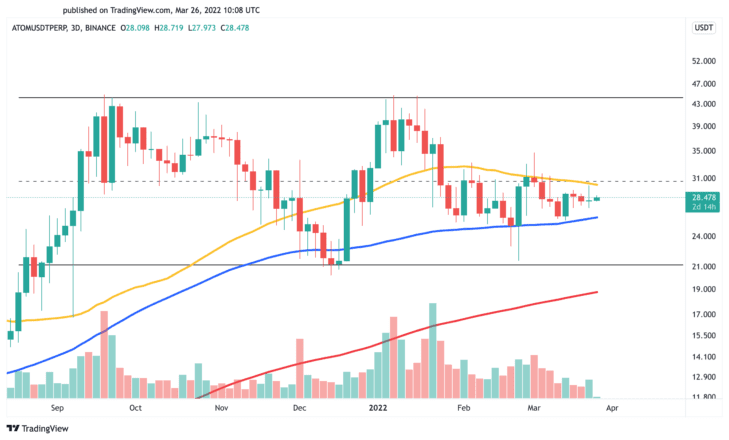

Cosmos has been touted as one of the most promising ecosystems across the crypto community in recent months, with growing interest in projects like JUNO and Osmosis. However, since the beginning of the year, ATOM has been stuck within a $5 price range. From a technical perspective, it appears that the 100-day moving average at $26 on the three-day chart has been acting as support, while the 50-day moving average at $31 serves as resistance.

As long as the token continues trading in between both levels, ATOM looks stuck in a no-trade zone. However, a decisive three-day candlestick close outside the 100-day and 50-day moving average should determine where its price will head next.

Zooming out on the three-day chart reveals that ATOM’s governing pattern is a parallel channel that developed in early September 2021. This technical formation provides potential targets for where ATOM could trade after breaking out of the no-trade zone.

A bullish impulse that sends Cosmos above $31 could have the strength to see it rise towards the channel’s upper trendline at $44. But if sell orders increase and the $26 level is lost as support, it could dive to the channel’s lower boundary at $21.

Given the ambiguity that ATOM currently presents, it is likely that many traders will remain on the sidelines, waiting for confirmation before entering any long or short positions.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article