Crypto fund weekly inflows reach $646m, but ETF enthusiasm is cooling off

ETF investment levels off as Bitcoin leads crypto fund gains.

Share this article

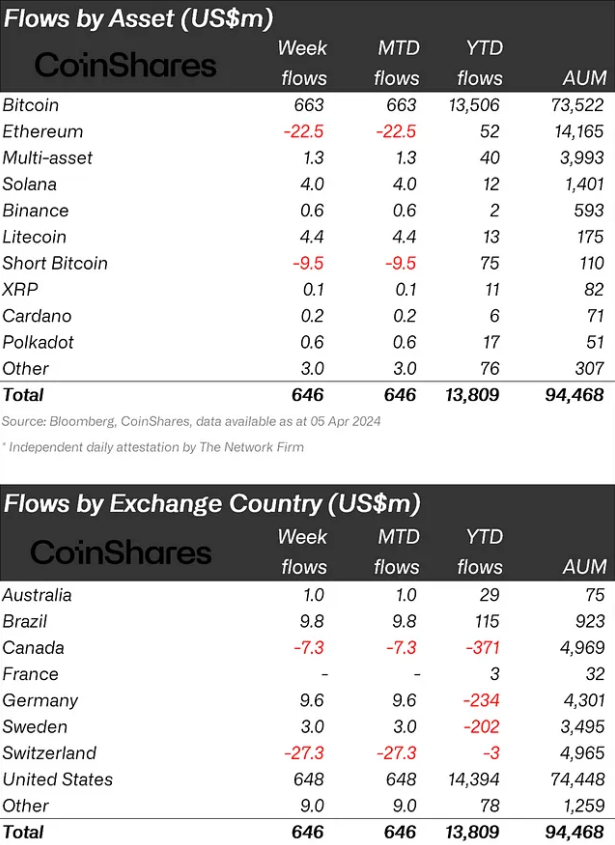

Crypto funds reached $646 million in inflows last week, according to a report by asset management firm CoinShares. This increase brings the year-to-date total to a record $13.8 billion, eclipsing the previous peak of $10.6 billion observed in 2021. However, the report highlights that the enthusiasm for spot Bitcoin exchange-traded funds (ETF) investments appears to be moderating.

Last week’s flow levels reached over $17 billion, yet they are still below early March’s levels, when the ETF flows peaked at $43 billion. Nevertheless, Bitcoin remained the primary focus of investors looking to get crypto exposure through funds, with inflows totaling $663 million. Meanwhile, short Bitcoin investment products saw outflows for the third consecutive week, amounting to $9.5 million, hinting at a slight retreat among bearish investors.

Ethereum faced outflows for the fourth week in a row, totaling $22.5 million. Conversely, other altcoins such as Litecoin, Solana, and Filecoin continued to attract inflows, with $4.4 million, $4 million, and $1.4 million, respectively.

In the US, investment sentiment continued to be strong with an additional $648 million in inflows. Brazil, Hong Kong, and Germany also reported inflows of $10 million, $9 million, and $9.6 million, respectively. In contrast, Switzerland and Canada experienced outflows of $27 million and $7.3 million.

Share this article