Crypto funds register over $5 billion in monthly inflows

Propelled by spot Bitcoin ETFs traded in the US, crypto investment products see growth in assets under management.

Share this article

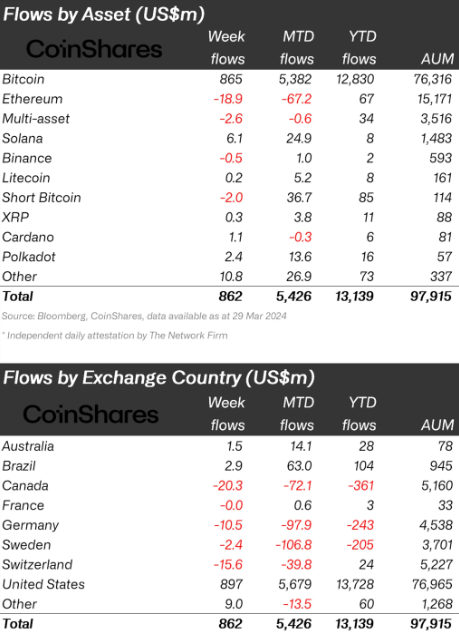

Crypto investment products saw $862 million in weekly inflows in March last week, according to asset management firm CoinShares’ head of research James Butterfill. The movement comes one week after a record of almost $1 billion in outflows was registered by the same products.

Funds with exposure to Bitcoin (BTC), mostly spot exchange-traded funds (ETF) traded in the US, registered $865 million in inflows and dominated the period. Meanwhile, crypto products going short on BTC price showed a $2 million outflow.

Investors showed less appetite for Ethereum (ETH) exposure through funds, with $19 million in outflows seen from these products. ETH funds suffered the largest outflows in March, with over $67 million being moved out by investors.

Solana-related funds saw $6 million in inflows last week, and $25 million last month, with SOL being the altcoin with the most attention in March. Polkadot (DOT) also captured weekly interest, as its $2.4 million in inflows show.

Regionally, the US registered $897 million in inflows last week, and over $5.6 billion in March. Brazil and Australia registered $2.9 million and $1.5 million in weekly inflows, respectively, while the rest of the countries tracked by CoinShares went the opposite way.

Crypto products traded in Canada registered $20 million in weekly outflows, while Switzerland funds shrunk by $15.6 million in assets under management in the same period.

Share this article