Crypto funds see over $700 million in weekly inflows, GBTC exits ease

Bitcoin dominated the inflows, and Solana showed a positive result for the week, contrasting Ethereum and Avalanche.

Share this article

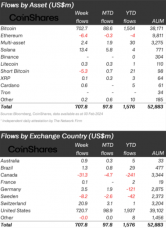

Crypto investment products experienced $708 million in inflows last week, amounting to $1.6 billion in inflows year-to-date, according to a Feb. 5 report by asset management firm CoinShares. Bitcoin (BTC) remains the predominant recipient of investment flows, securing $703 million last week, which accounts for 99% of the total inflows.

In contrast, short-bitcoin products experienced slight outflows of $5.3 million, aligning with a positive shift in price dynamics, while other digital assets showed mixed results. Solana reported inflows of $13 million, overshadowing Ethereum and Avalanche, which faced outflows of $6.4 million and $1.3 million, respectively.

Moreover, total global assets under management have reached $53 billion. Despite declining trading volumes for Exchange-Traded Products (ETPs) to $8.2 billion from the previous week’s $10.6 billion, the figures substantially exceed the 2023 weekly average of $1.5 billion, representing 29% of Bitcoin’s total trading on reputable exchanges.

The United States continues to be at the forefront of these inflows, with a significant $721 million recorded last week. Newly issued Exchange-Traded Funds (ETFs) in the US have been particularly successful, drawing $1.7 billion in inflows, averaging $1.9 billion over the past four weeks, and totaling $7.7 billion in inflows since their launch on Jan. 11.

However, there has been a net outflow from established issuers amounting to $6 billion, though recent data indicates a slowing in these outflows.

In the sector of blockchain equities, a notable outflow of $147 million was observed from a single issuer, yet this was partially offset by $11 million in inflows from other issuers, indicating a diverse investment landscape within the digital asset market.

Share this article