Crypto Market Plunges And Soars With Revealing Synchronicity

Share this article

It’s been a rocky week for Bitcoin. After a sudden crash last Thursday, Bitcoin’s market capitalization fell by around 3 percent, where it languished until a sudden jump of over 7 percent yesterday. Prices have since slipped somewhat, although maintaining a daily gain of around 5 percent.

You can take every word in the preceding paragraph, cross out each mention of “Bitcoin” and replace it with XRP, ETH, or any other top-ten coin with very little loss of accuracy. With the obvious exception of Tether, most of the leading cryptocurrencies have been marching in lock-step, with only a few percentage points’ difference in their short-term movements. At the time of writing, one has to go past the top twenty cryptocurrencies by market cap to find one that doesn’t follow the trend.

Besides making a joke out of our efforts at “diversification,” this tendency is a strong indication that bear season is still far from over.

Cryptos Still Heavily Correlated

Most crypto hodlers put a great deal of thought and research into their investments, which makes it a bit frustrating when the market moves in unison: no matter how well you research and scrutinize your investment, the gains (or losses) tend to be about the same.

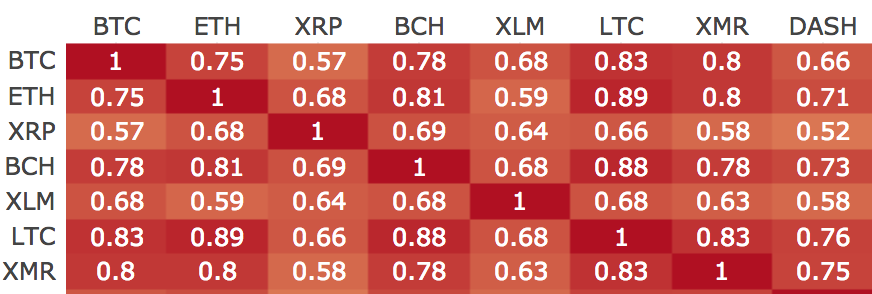

At present, almost all of the leading cryptocurrencies show strong correlations with Bitcoin prices—most of them with coefficients between 0.6 and 0.9, reflecting strong links between Bitcoin and altcoin prices. Tellingly, the altcoin with the weakest Bitcoin correlation is Bitcoin Cash—suggesting that the fork coin is finally starting to decouple from BTC. That would please BCH investors, if it weren’t for the fact that the decoupling seems to be in the wrong direction.

Why is the market still tracking BTC?

There are two big reasons why Bitcoin is still leading the market, which should be a red light for anyone hoping to lead the races.

The first, and simplest, reason is that most cryptocurrencies are still priced in satoshis. Although exceptions to the rule are growing in number–EOS and TRX both have fiat pairings, and many tokens are priced in Ethereum– Bitcoin is still the leading medium of exchange for cryptocurrency markets, which means a change in Bitcoin’s dollar value will be reflected proportionately among the altcoins.

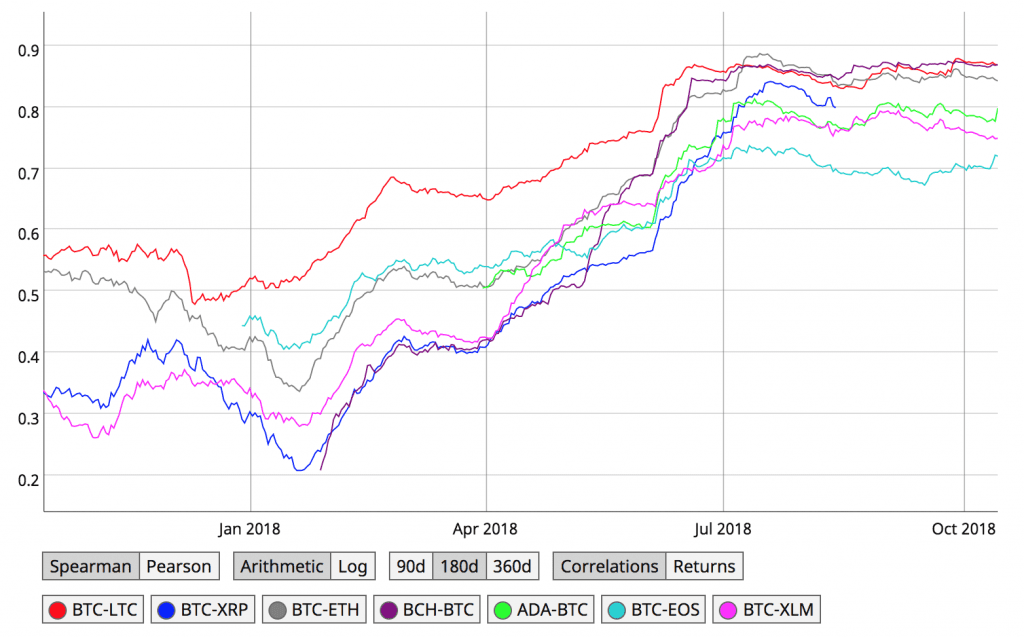

But there’s another factor at work as well: Bitcoin is where frightened investors bury their treasure. It might not be the fastest or the most scalable crypto around, but as the first and oldest blockchain currency, it’s also the least likely to go belly-up. Here’s how Bitcoin-altcoin correlations have changed over the past year:

High Bitcoin values represent an opportunity for flush investors to put their money into higher-risk projects, like initial coin offerings, STO’s or other altcoin endeavors, which can then rise or fall from their own merits. But when markets are doubtful–as they have been for the past eight months, and especially for the past week–cautious investors move from alts to Bitcoin, or even further into fiat.

The fact that crypto prices are continuing to move in unison may indicate another six weeks of bear season–or at least until the alts stop hiding in Bitcoin’s shadow. The paradox is that most new coins are supposed to improve on the Bitcoin formula, in order to eventually replace it. Ironically, before any cryptocurrency can do that, they’ll need a Bitcoin-led bull run first.

The author is invested in Bitcoin, Ethereum and several other assets mentioned in this article.

Share this article