Crypto landscape signals turbulence and dissatisfaction: IntoTheBlock

Bitcoin ETFs' waning capital inflow adds to crypto market woes.

Share this article

The current crypto landscape signals turbulence and dissatisfaction from investors, according to IntoTheBlock’s “On-chain Insights” newsletter. The price drop registered by Bitcoin (BTC), the subdued impact of new Hong Kong ETFs, and the EIGEN token launch initial fiasco are the main reasons.

The crypto rally this year hit a rough patch as Bitcoin’s value seesawed between $57,000 and $59,000 following the Federal Reserve’s decision to maintain interest rates. Despite persistent inflation, rates remained unchanged at two-decade highs, between 5.25% and 5.5%.

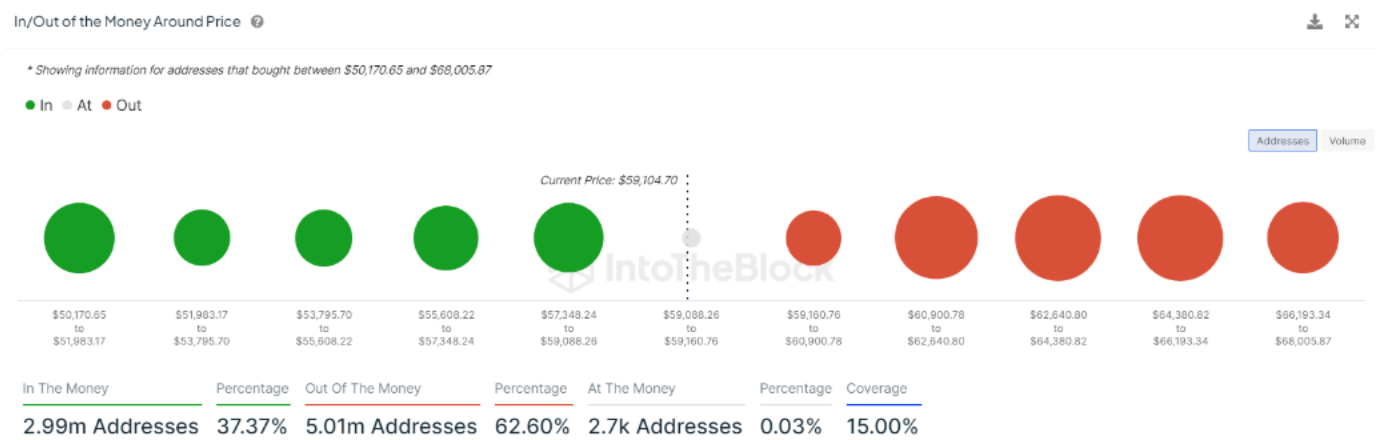

Moreover, Bitcoin’s value concluded April with a loss exceeding 12%, marking its first monthly decline since August 2023. IntoTheBlock’s “In/Out of the Money Around Price” indicator shows that only 37.4% of holders within the +/-15% price bracket are currently in profit, highlighting the market’s volatility.

The introduction of US Bitcoin spot ETFs earlier this year initially spurred market growth, with BTC reaching new highs. However, the influx of new capital into these ETFs has waned, contributing to the market’s downward pressure.

In contrast, Hong Kong’s recent launch of six new products holding BTC and Ethereum (ETH) had a less significant impact, with a combined trading volume of approximately $12.7 million on their debut day, compared to the $4.6 billion of the US spot ETFs.

Furthermore, the Eigen Foundation’s announcement of the EIGEN token airdrop has also stirred the crypto community. With 15% of the initial 1.67 billion EIGEN tokens earmarked for community distribution, early users with accumulated “points” are set to receive the first 5% through the airdrop.

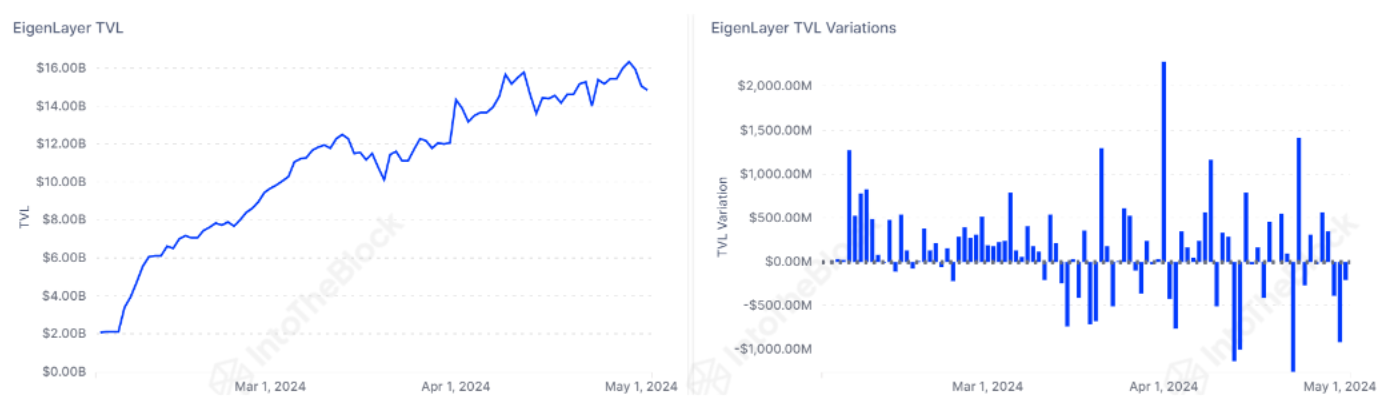

Yet, the airdrop details have led to over 12,412 withdrawal requests, fueled by disappointment over restrictive policies and the token’s initial non-transferability. The full effect of these withdrawals will emerge after EigenLayer’s seven-day processing period.

The crypto community backlash was so significant that Eigen Foundation reassessed the ‘stakedrop’ distribution to add more tokens to users, as the entity informed on May 2.

In summary, the crypto market is experiencing volatility with Bitcoin’s price drop and . , with restrictive conditions leading to a surge in withdrawal requests. These events underscore a period of turbulence and dissatisfaction in the crypto market.

Share this article