Crypto Money Grabs and Scams: No Product, No Funding

It's looking a lot like 2017. Founders with half-baked ideas are raising millions; investors are willing to let their money ride on projects without products. Things have got to change.

Share this article

Once again, founders are raising at ludicrous valuations with business plans that make scribbles on the back of a napkin look like blueprints for the Whitehouse. With the return of the bull market comes the opportunists and scammers.

Investors are partially responsible as well. Speculators are throwing money into half-baked projects with little due diligence. One morning, you look at Blockfolio and see your portfolio lost 50% of its value. You hodl on strong, but tomorrow it loses 50% again. Would you sell or risk being the last one standing when the music stops? It’s clear how this story ends—another multi-year hangover once the bubble pops.

Market Cycles and Incentives

These ebbs and flows are part of a market cycle that continues to repeat itself. Every few years, people will lose faith in cryptocurrency and sell everything they own. Projects and founders empty their treasuries to keep the lights on. Crypto Twitter and Reddit turn into ghost towns. What would the market need to do to maintain healthy and sustainable progress?

The reality is that projects need to fundraise to execute their visions. Investors want to take on the early risk for part of the upside.

ICOs Come to the Forefront

Come 2017, the initial coin offering, or ICO, violated this dynamic. Billions of dollars poured into speculative projects, both good and bad. A few projects that survive with big raises include EOS and Tezos, which raised $4.1 billion and $232 million. Other tokens weren’t so lucky.

Dragon Coin raised $320 million to open up a floating casino that was never built. Hyundai DAC raised $258 million with dubious connections to the South Korean automobile company. Like hundreds of other initial coin offerings, the money disappeared, and the projects had little to show for it.

It’s not surprising. Why would founders actually execute when they could become a multi-millionaire just from marketing a farfetched whitepaper? There is no accountability, and the incentives are misaligned between investor and founder.

Even with the staggering amount of fraud, some honest projects from 2017 found product-market fit. Chainlink, Cosmos, Maker, Kyber, and other cryptocurrencies were able to rise from the rest. Like Synthetix and Ren, others ground it out and pivoted away from their original concepts, later finding tremendous success.

Equitable Token Distributions

I have yet to see a truly equitable and fair distribution of tokens until yEarn launched. Founder Andre Cronje cares less about making a profit than to see his technology used and adopted. Many brilliant and passionate builders in the blockchain industry also share his disposition, but he is an extreme example.

I don’t expect every founder to follow Andre’s lead. Most founders have bills to pay and are willing to take on early risk in order to reap profits later. And if it does work out then, yes, they should get a payday. They should have some upside. I’m ok with that. More than ok, I insist on it. If I can’t identify where and how a founding team can reap profits, then I become concerned.

The beauty of a well-designed crypto-economic system is that it leverages various holders’ profit-seeking interests to create a sustainable ecosystem. What we see today is not sustainable. Teams forking successful projects, making zero improvements, and raising millions against it with the promise of an extravagant roadmap leading to world domination. These projects are just a few degrees away from an outright Ponzi.

Where were these founders during the 2018/2019 bear market? Why come out now with all these brilliant ideas with no product or traction to support their vision? Why do they need $5 million to build a proof of concept? They had two years to innovate and build like the rest of us. What were they doing for the past two years if they are so passionate about the crypto and DeFi space as they claim?

Thinking About Risk

Token distributions should address risk. And founders should take on the most risk. Founders need to de-risk a project well enough before they should even consider raising a dollar of investor money.

But how much derisking is enough? This is the trickiest part and quite subjective. This is also what makes it so easy for founders to lure in thousands of unsuspecting newbie investors looking to be part of the next Bitcoin.

For me personally, as an entrepreneur for the past 20 years, I won’t raise money until I at least have product-market fit. This means that there must be some signs that the product I have envisioned is or will be used and can bring value to users. I tend to be a bit old school, and I religiously refer back to the book Lean Startup by Eric Ries, the Silicon Valley startup bible. This means usage, users, or revenue. Revenue is less important in the early days, but there must be some metric to measure a product’s success, or at the least, its potential success.

Now, as an investor, if I want to take on even more risk, then I may invest in an early prototype or proof of concept. This is also known as an MVP (minimum viable product). If you are a founder, built a product, and need funds to move on to the next stage: audits, marketing, hiring, servers, then that is fine but at least give investors the ability to imagine what usage might look like by showing them a product.

This also shows that the founder has skin in the game and has already taken his own time (or capital) to build something. The stages of a successful product are: Idea -> Product -> Usage -> Scale. If founders want to reap profits, they should be prepared to take on the risk.

Money Grabs, Scams, and Delusions

To me, anything less than a product is a “money grab.” If you are trying to raise money based on an idea and have a product launching somewhere on your 3-year roadmap, that is a money grab. If you forked another project, tweaked some variables, and changed the interface, that is a money grab.

For me, forking a successful project is perfectly fine if you have added a significant innovation to it. There’s no point in reinventing the wheel if you are just painting the wheel and adding a tire, but that isn’t a significant innovation in my eyes. Crypto investors are responsible for not investing in money grabs—all it does is take attention and resources away from legitimate projects. You are doing yourself and crypto a significant disservice by doing so.

Now a money grab is very different from a “scam.” The main differentiator lies in the founding team’s intent. Money grab founders actually have the intent to see the project through and usually believe they can achieve their goals. A scam project has no intent on doing anything, or they already know their project likely won’t succeed. They plan on taking investors’ money and either disappearing or slowly fading away.

But what if I ask you to invest in my project and I truly believe I can create a colony on mars yet my background as a preschool teacher gives you no indication that I have the ability to do so. Is that a scam project or a money grab.? It is neither. These are called “delusional” projects, and we see them all the time.

Run as fast as you can when teams sound delusional. An easy spot-check is seeing if their past accomplishments line up to anything remotely close to their future claims. I believe entrepreneurs need to be given a chance, but Elon Musk did not create SpaceX by trolling Reddit for two years and then coming out and asking the public for investment dollars. I believe investors have a responsibility to avoid scams and delusional projects as well. It’s better for their wallets, too.

Crypto Still Has Immense Potential

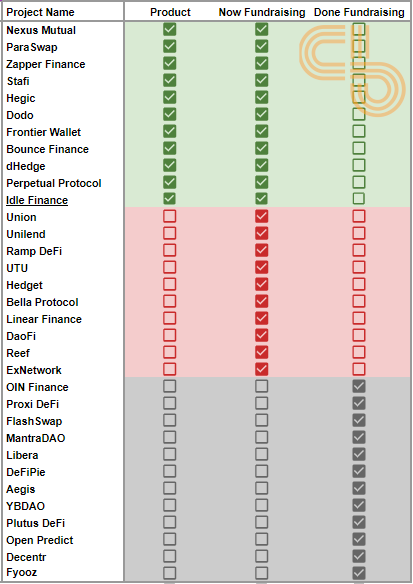

The one thing that gives me hope about the crypto markets today is that while money grabs and scams are plentiful, there are still some really exciting projects being built and run by experienced and dedicated teams. Products that have been de-risked; some have users and are getting real traction.

These projects will lay the foundation for an alternative financial system free of government intervention and rent-seekers. These are the founders who will help shape the new world economy. These are the projects that we will be covering. These are the projects that I will be investing in. These are the projects that you should be investing in.

Here is what you can do to help crypto and blockchain evolve into something better than what it is today. If you see a project fundraising with no product, tag it with #noproductnofunding. If someone tells you about a project that has no product, simply reply with #noproductnofunding.

Disclosure: The author of this article owns BTC, ETH, LINK, SNX, and yEarn

Share this article