Q2 looks favorable for crypto performance: Coinbase report

Bitcoin halving and prospect of ETF approvals position crypto for gains in Q2.

Share this article

The crypto market is holding steady despite recent liquidity issues stemming from US holidays and corporate rebalancing at month’s and quarter’s end, according to a Coinbase report. Speculation around the Bitcoin halving and potential spot Bitcoin exchange-traded funds (ETF) approvals in the US may support performance in the second quarter.

“Moreover, we think speculators playing the short MicroStrategy (MSTR) vs long Bitcoin trade may be contributing to some of the recent market volatility,” the report says.

The report also suggests headwinds from earlier this month are fading, and positive catalysts likely won’t materialize until mid-April. The upcoming Bitcoin halving, estimated to occur between April 16-20, is seen as a key event.

“But on the demand side, the 90-day review period that many wirehouses employ when conducting due diligence on new financial offerings – like spot Bitcoin ETFs – could conclude as early as April 10,” the report said.

Wealth management platforms both within and outside major financial conglomerates are gatekeepers to significant capital that could flow into US spot bitcoin ETFs over the medium term, it added.

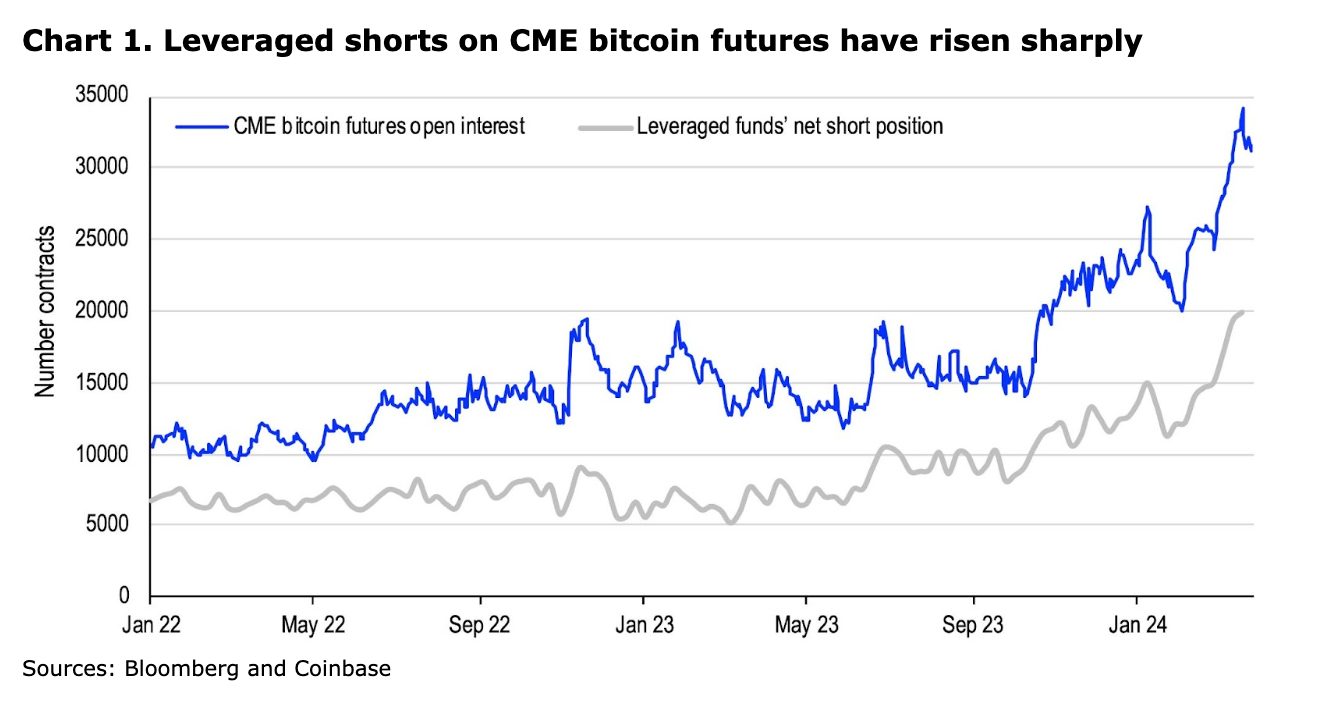

Institutional interest also appears elevated based on a record high of 19,917 leveraged short positions in CME Bitcoin futures as of Mar. 19, suggesting ongoing basis trading activity.

On-chain derivatives on the rise

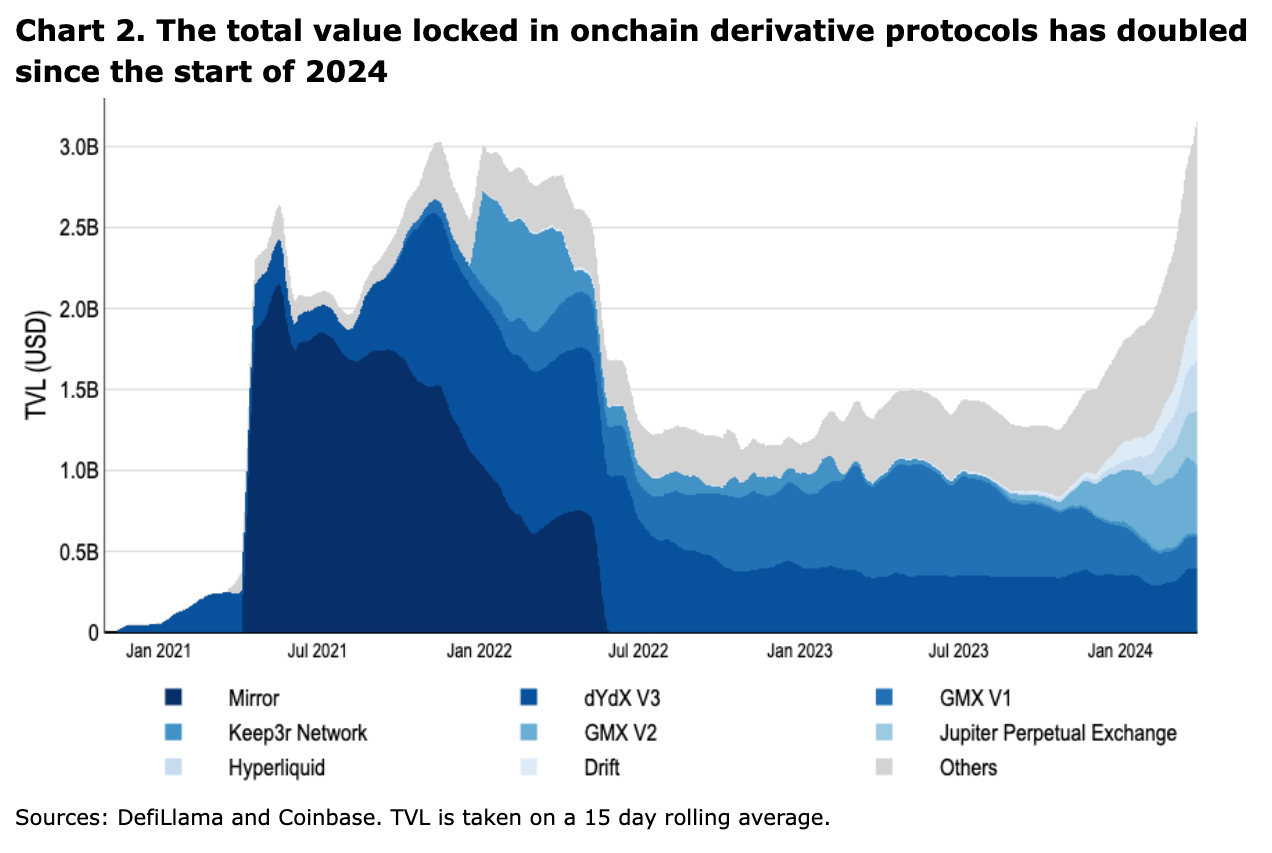

Coinbase’s report also points out that the on-chain derivatives sector surged to new heights, achieving an all-time high in Total Value Locked (TVL) of $3.4 billion. This milestone is particularly significant as it comes at a time when the broader decentralized finance (DeFi) ecosystem is still grappling with a slowdown, with TVL across the board remaining about 50% below its previous cycle highs.

The increased availability of high throughput and low-cost blockspace has paved the way for innovative on-chain products, the report adds, such as Central Limit Order Books (CLOBs). This development has allowed for the rapid creation and cancellation of orders, facilitating liquid exchanges through more traditional market-making strategies. Decentralized exchanges such as dYdX and GMX were mentioned as good examples of these changes.

Share this article