Crypto Volumes Surge as Bitcoin Takes a Beating

Volumes soaring across the sector as investors flee crypto market volatility.

Share this article

Crypto trading volumes have soared this week as investors flock to stablecoins and Bitcoin tests $6,000 amid global turmoil caused by coronavirus concerns and oil price declines.

Crypto Markets Tumble

Markets traditional and otherwise have been taking a beating this week.

The primary causes have shifted between concerns of the spread of coronavirus, the breakdown of oil talks between Saudia Arabia and Russia, and the inability of governments to ward off a potential global economic meltdown.

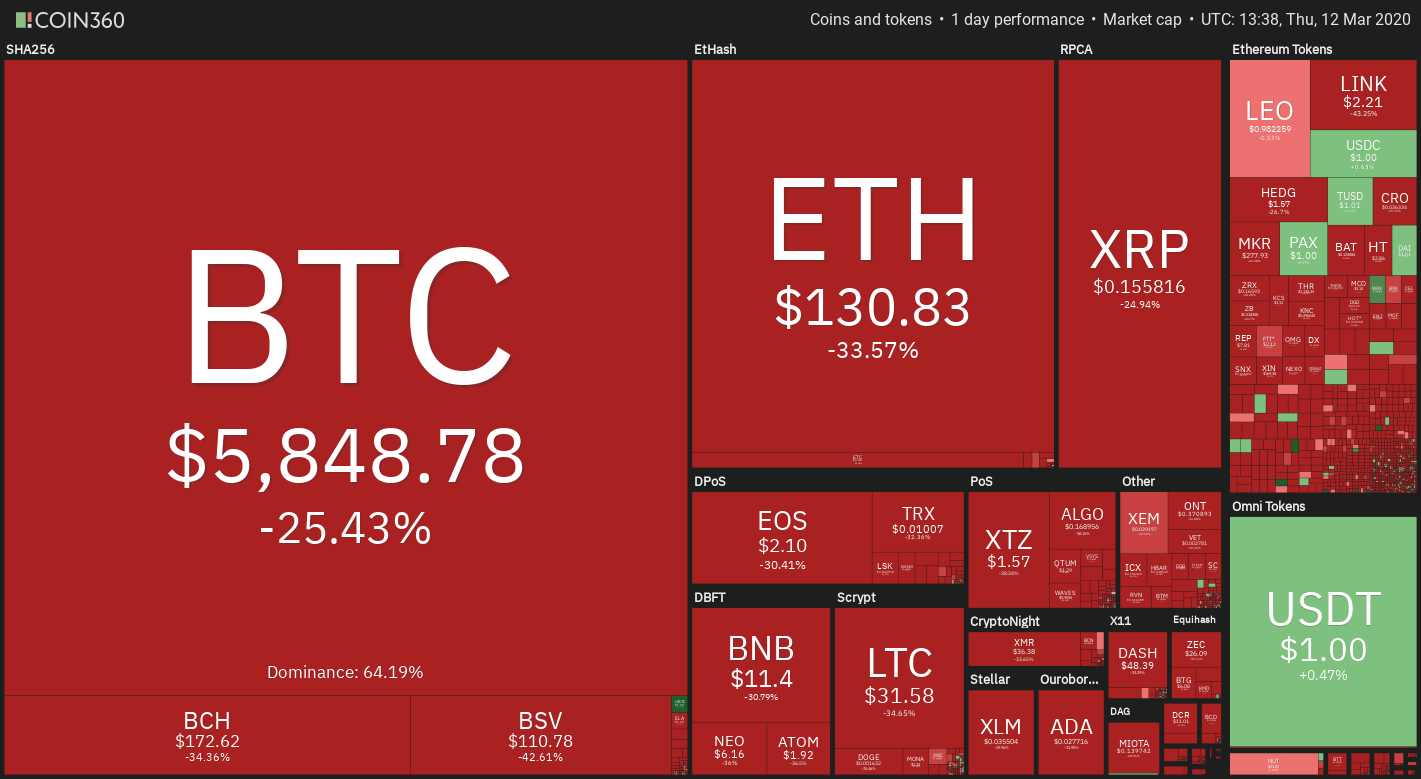

Coin360’s heatmap paints a particularly dramatic picture of a crypto market drenched in red.

The top crypto, Bitcoin, has lost a quarter of its value and Ether is down by a third.

According to CoinMarketCap, of the top 100 coins by market cap, only the stablecoins are safe. Most cryptos are trending downward to the tune of double-digit losses for last the 24 hours.

Trading Volumes Soar

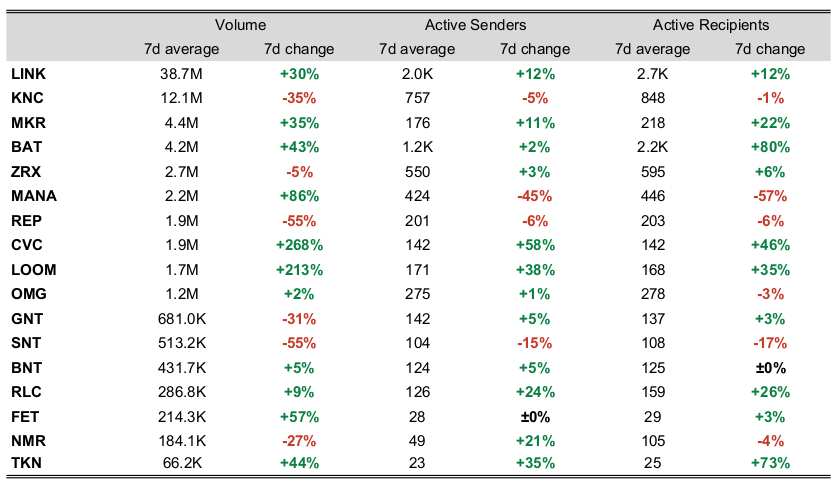

According to data from Token Analyst, the major cryptocurrencies saw significant rises in trading volumes this week.

Around $70 million worth of BTC and $19 million worth of ETH left exchanges for the week as prices declined. Those volumes also hit many other crypto projects.

Civic (CVC) and Loom Network (LOOM) were most severely impacted, with weekly volumes of more than 200% higher for both coins.

At press time, both are down for the day by almost 40%. When non-stablecoin cryptocurrencies are leaving exchanges, it indicates heavy seller pressure.

Rising Volumes Signaling a Flight to Safety

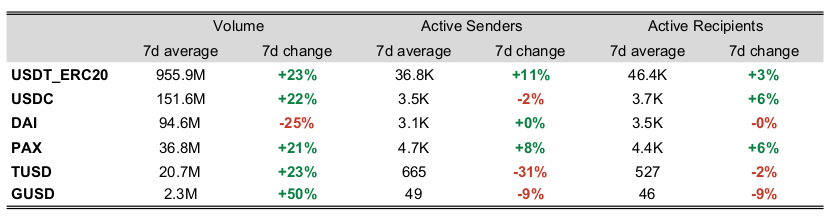

Stablecoins benefited from the flight to the relative safety of fiat-backed or represented coins.

Most stablecoins saw on-chain activity surge this week. Tether volume is up by 24% and USDC by 22%, according to Token Analyst.

Interestingly, with stablecoin trading volumes rising so acutely, it could be inferred that investors were not cashing out of crypto for the long term, but sitting on the sidelines until prices showed signs of recovery.

Gold has not seen evidence of major price growth, according to FXStreet, with sentiment toward the precious metal deteriorating “despite rising speculations that the Federal Reserve could reduce the FFTR by another 50 bps at the March 17-18 meeting.”

Bitcoin may have lost the safe-haven asset argument in light of the broader market sell-off, but gold has fared little better.

Share this article