A new record: crypto products hit $2.9 billion in weekly inflows

Bitcoin dominates with 97% of 2023's inflows.

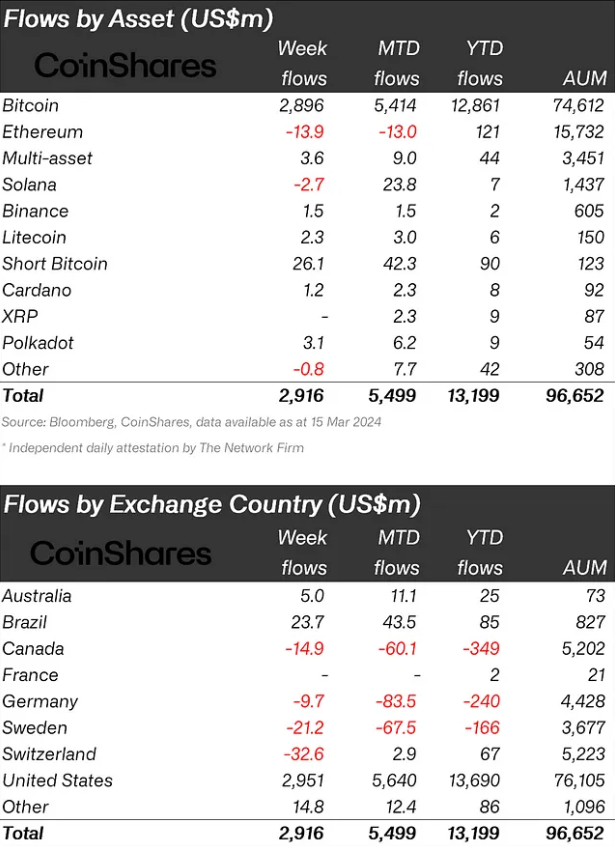

Crypto investment products have set a new record with weekly inflows reaching $2.9 billion, surpassing the previous week’s high of $2.7 billion, according to the latest weekly inflow report by asset management firm CoinShares. This surge has propelled the year-to-date inflows to $13.2 billion, eclipsing the total inflows of $10.6 billion for the entire year of 2021.

Despite the overall success, smart contracting platforms like Ethereum, Solana, and Polygon experienced outflows, with Ethereum seeing $14 million, Solana $2.7 million, and Polygon $6.8 million leaving their ecosystems through funds.

The trading volume for the week remained steady at $43 billion, maintaining the previous week’s levels and accounting for nearly half of the global bitcoin trading volume. Notably, global exchange-traded products (ETPs) reached a milestone, breaking the $100 billion mark for the first time, although a price correction later in the week caused the value to settle at $97 billion.

Regionally, the US led with inflows of $2.95 billion, complemented by smaller amounts entering markets in Australia, Brazil, and Hong Kong, which saw inflows of $5 million, $24 million, and $15 million, respectively. In contrast, Canada, Germany, Sweden, and Switzerland experienced combined outflows of $78 million. The year has started on a shaky note, with $685 million in outflows recorded so far.

Bitcoin continued to assert its dominance in the market, with inflows of $2.86 billion last week, now representing 97% of all inflows for the year. Meanwhile, short Bitcoin positions attracted their largest inflows in a year, totaling $26 million, marking the fifth consecutive week of inflows.

Blockchain equities also reversed a six-week trend of outflows by attracting $19 million in inflows, signaling renewed investor interest in the sector.