DeFi Blue Chip Curve Finance Breaks Out Targeting $7

Curve looks ready to post significant gains as it breaks out of a bull flag.

Key Takeaways

- Curve Finance's CRV token is up more than 38% in the past three days.

- The DeFi token has broken through significant resistance.

- Further buying pressure could push CRV to $7.

Share this article

Curve Finance appears to be catching up to the growing bullish momentum the DeFi market sector has experienced over the past few weeks. The lack of significant resistance barriers ahead suggests that CRV has more room to ascend.

Curve Finance’s CRV Enters Rally

Curve Finance appears to have gained the strength to post higher highs after overcoming a significant resistance level.

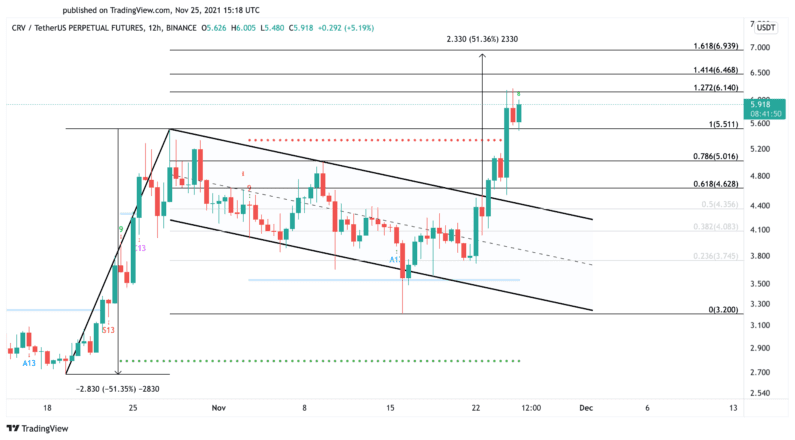

The DeFi staple’s CRV token has risen by nearly 38% over the past three days, shrugging off the recent uncertainty in the cryptocurrency market. The sudden bullish impulse has pushed CRV beyond the upper trendline of a bull flag that developed on its 12-hour chart.

The bullish continuation pattern anticipates that CRV could advance another 10%. If buy orders continue to pile up, CRV could gain further bullish momentum to print a 12-hour candlestick close above the $6.14 resistance level and march toward $7.

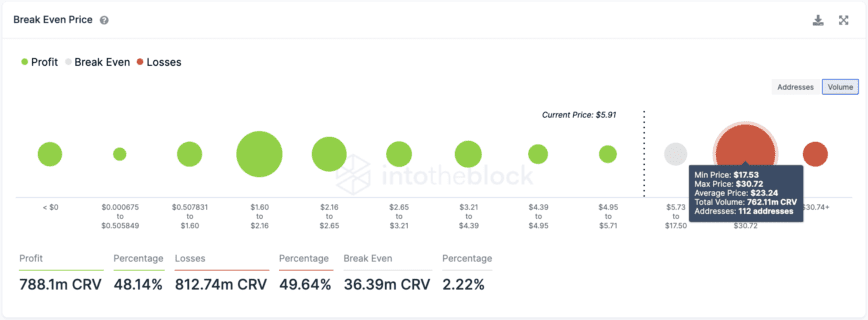

Transaction history shows that the most significant concentration of tokens was acquired at a higher price. Roughly 112 addresses obtained 762 million CRV between $17.53 and $30.72 based on IntoTheBlock’s Break Even Price model. Therefore, the asset has room to rise before these token holders may attempt to break even on their long positions.

It is worth noting that that the $5.50 support level is currently acting as a strong foothold. As long as CRV continues to trade above this price point, the odds will favor the bulls. Still, any signs of weakness at $5.50 may result in a correction to $5 or $4.60 before the uptrend resumes.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.

Share this article