DeFi DApps Surge, But Mainly Among Pro Traders

Why is nearly a fifth of the Dai supply locked up in Compound?

Share this article

Decentralized finance may just be taking off, but it hasn’t escaped the notice of savvy traders. The rapid rise of Compound Finance suggests that the lending app has become the focal point for sophisticated trading strategies, which exploit arbitrage opportunities on DeFi dApps across the Ethereum ecosystem.

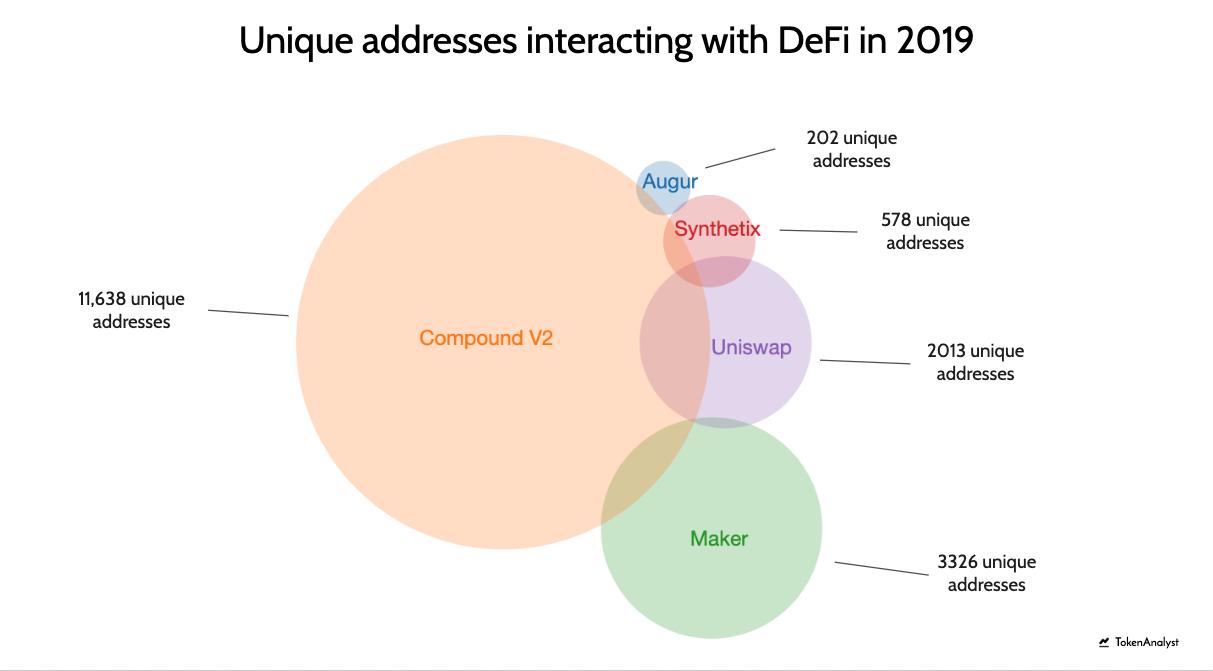

Out of all the unique addresses in the DeFi space, more than half have interacted with Compound this year, according to crypto analytics site TokenAnalyst.

As the graph below shows, more than 11,600 unique addresses have interacted with the Compound smart contract this year. That’s far larger than any other DeFi dApp, including the Maker protocol which has only had 3,300 new addresses. Based on these figures, Compound currently constitutes approximately 65% of the market share among Ethereum-based DeFi apps..

Unique addresses represent the destinations for blockchain payments. Most are associated with single users, who usually generate a new address for each transaction. This is a strong indication of a dApp’s popularity: the more wallets interact with a specific application, the more popular it is with Ethereum users.

The Compound Protocol allows anyone to borrow or earn interest on Ethereum-based assets – such as Ether or Dai – without the need for a counterparty. Lenders supply assets to a liquidity pool, which is lent out to borrowers – interest rates are calculated algorithmically based on supply and demand. The protocol can be accessed through numerous interfaces, including the Coinbase and Huobi Wallets.

Who’s really using DeFi dApps?

Maker is still one of the most popular destinations for cryptoassets. $292M worth of Ether is currently held as collateral in the protocol, meaning Maker accounts for just over half of all value locked in DeFi dApps. $115.5M of assets are stored in Compound smart contracts, at the time of writing.

With the future of altcoins still uncertain, many ETH holders have created Maker CDPs to realize the dollar value of their holdings while ultimately retaining control of their Ether. But contract holders pay a stability fee until they redeem the collateralized Ether, so lending Dai into the Compound liquidity pool might help minimize overheads for longer-term holders.

But as TokenAnalyst’s graph above highlights, some users are also using DeFi for increasingly sophisticated trading strategies.

This includes arbitrage between different dApps, and exploiting price differences between cDai and cUSDC, which are issued to Compound lenders as a form of interest. The most popular onchain destination for large-scale Dai borrowers is the dYdX exchange, hinting “the chief use-case of #Dai borrowing today: trading on margin,” tweeted TokenAnalyst.

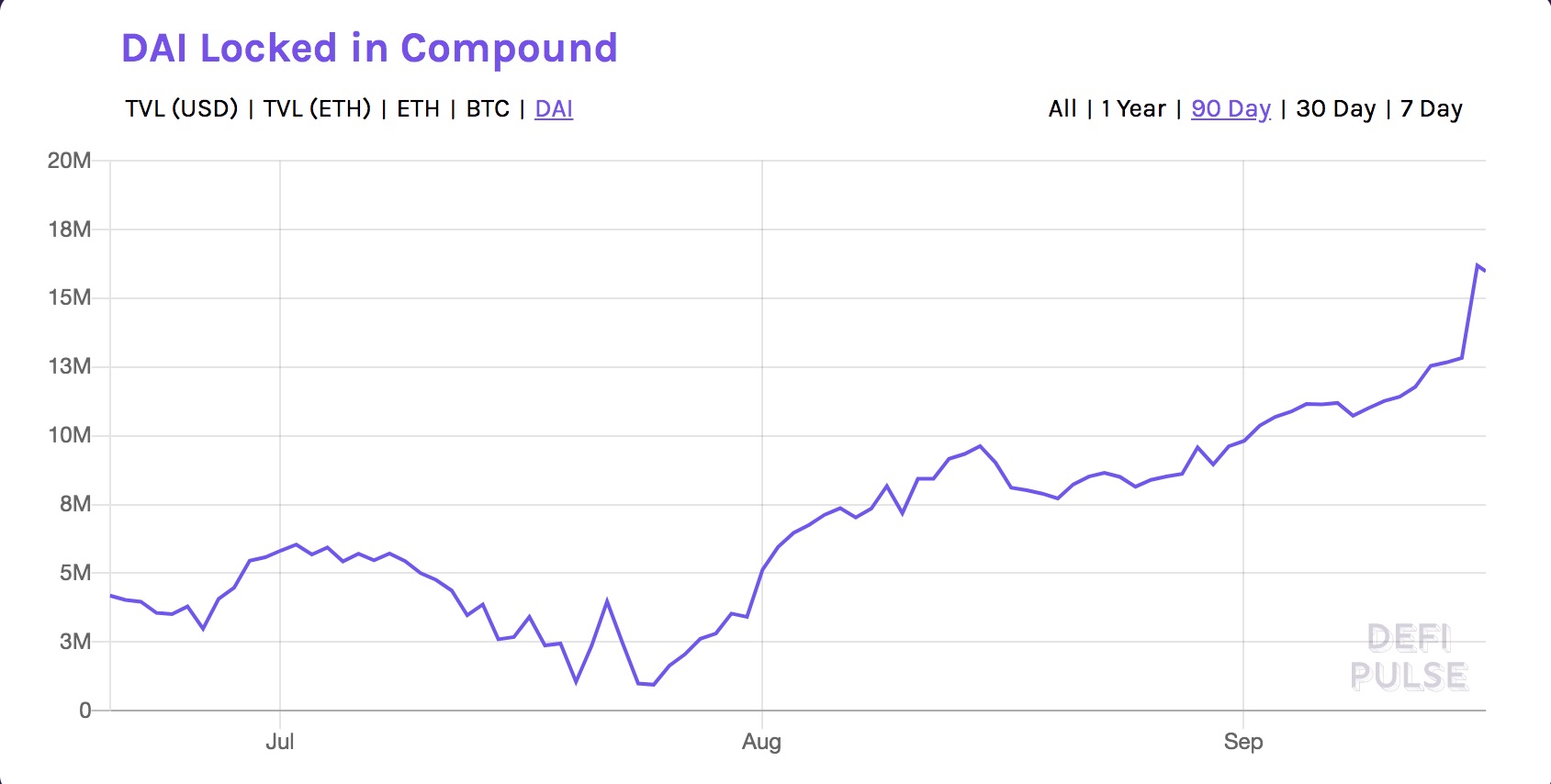

Soon after Compound upgraded to Version Two in June, there was a sharp rise in the amount of Dai held in Compound. From a quarterly low of 995,000 on July 25, there is now more than 16M Dai in Compound: nearly a fifth of all Dai in circulation.

Data from TokenAnalyst indicate that the number of wallets interacting with Compound increased from 1195 at the launch of Version Two, to more than 6,700 in August. Since then, the figure has dropped back to 2,750, suggesting some consolidation among larger token holders.

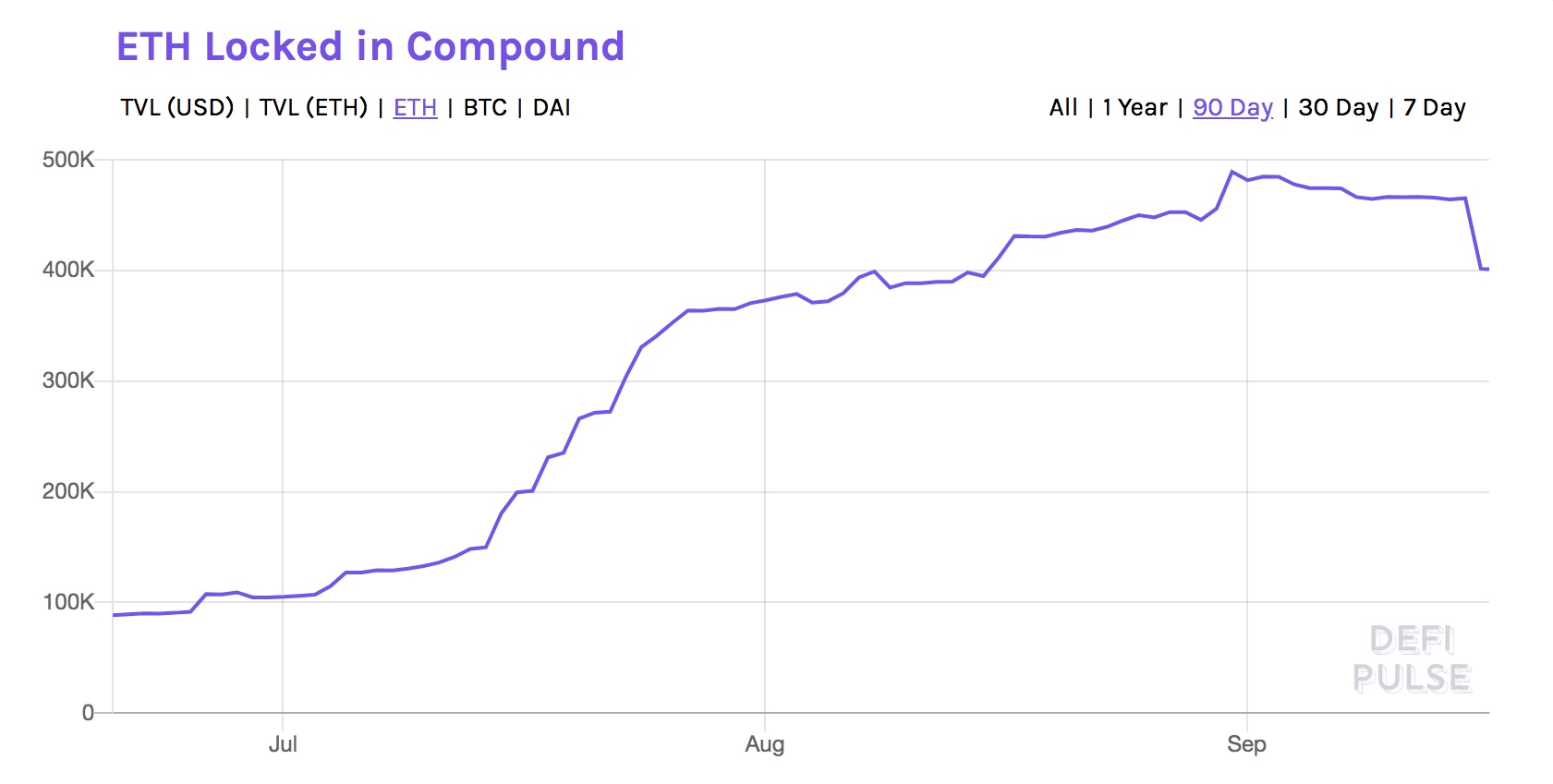

The same is true with Ether. Despite a sharp drop over the weekend, the amount of ETH stored in Compound has more than quadrupled since the end of July.

The sharp rise in Compound deposits indicates a surge in use for DeFi applications, but the biggest use-case so far is trading and arbitrage. Decentralized Finance may still be a nascent space, but the numbers speak for themselves.

Share this article