How Diversifying A Crypto Portfolio Increases Investor Risk

Share this article

A common question coming from cryptocurrency investors and traders is: how should I allocate my portfolio? Common portfolio management wisdom in traditional finance tells us to diversify holdings, but is diversification possible in cryptocurrencies? To answer this question we need to analyze several underlying assumptions and variables.

What is the purpose of diversification?

There are two main types of risks in investing:

- Undiversifiable Risk

- Diversifiable Risk

Undiversifiable risk (i.e. market risk or systematic risk) cannot be remedied, and is a fundamental risk that investors open themselves up to whenever they invest. It’s the underlying assumption that whenever one invests $1 in anything there is a chance that things like inflation rates, political instability, war or currency exchange rates could tarnish an investment – and an individual can’t change that.

Diversifiable risk, however, is unsystematic; meaning that is is specific to industries, markets, countries and economies – this risk can be reduced by diversifying a portfolio.

For example, an investor investing all of their money in oil stocks exposes themselves to the inherent risks of the entire oil industry. If the world demand for oil suddenly plummeted due to the mass adoption of electric vehicles then that investor’s portfolio would fall with the underlying demand for oil.

Consider the same scenario, and assume that the investor invested half of his portfolio in aluminum stocks. If demand for electric, lightweight vehicles skyrockets then demand for aluminum to build vehicles also rises. Therefore, the investor’s portfolio would fall with the decreased demand for oil, but rise with the increased demand for aluminum; making him market neutral (in a very, very simplified example).

Diversification optimizes an investor’s risk/return profile, meaning that they can have a greater expected return on their investment for a lower risk profile.

The Capital Asset Pricing Model (CAPM) describes the relationship between systematic risk and expected return for assets and is typically used for pricing risky securities. Its theory is that investors need to be compensated to take on additional risk and in the time value of their money, meaning that more risk should mean higher return. This is for individual assets typically, but sets the stage for portfolio management.

Conventional wisdom in equities argues that an investor can achieve optimal diversification with 15-20 stocks, and diversification benefits are maxed out at 30 equities on a logarithmic curve.

The impact of diversification is strongest in assets that have weak correlation with one another. Correlation between assets measures their relationship between each other, and analysis can be done between two or infinite assets. Correlation is measured from -1 to 1, where a correlation coefficient of -1 indicates negative correlation (one asset moves up while the other moves down) and +1 indicates positive correlation (assets move up and down in direct tandem). (I will argue that cryptocurrency fits this paradigm, later.) Correlation values close to zero indicate no trend.

Diversification is the only free lunch in investing because one gets a benefit of reduced risk at zero cost, because the expected return can remain the same. If any two assets are less than 100% correlated and each have an expected return of 7% per annum – a portfolio would have a better risk return profile including both of these assets rather than one asset individually. Diversification is not binary, and diversification benefits are just better when the assets are less and less correlated.

If the goal of portfolio optimization is to build a portfolio that optimizes the risk/return profile, and properly optimizing that profile requires (or should require) investing in negatively (or non-positively) correlated assets, we can assume that diversification is favourable when assets have negative correlation with one another. Therefore, investing in two assets that have a correlation coefficient of +1 exposes an investor to unwanted undiversifiable risk, and it can be argued that they should just choose one of those assets to invest in, because it would give them a better risk/return profile.

Further, we can establish that investing in assets that have close to 100% correlation can help diversify a portfolio a small amount, but not nearly as significantly as negatively correlated assets.

Can you diversify in cryptocurrencies?

The short answer is not really. It’s investing in a very niche, highly correlated market where there are few, if any, opportunities to invest in assets below a certain threshold of correlation. Investing in low market cap altcoins is analogous to taking a levered position in Bitcoin; it’s not any sort of hedge or diversification strategy.

Expanding a portfolio into highly correlated coins can actually do the opposite of diversification – the investors are purchasing BTC/ETH (because they are so highly correlated) and exposing themselves to additional risk such as illiquidity, price manipulation, hacks and operational overhead.

They’re taking on additional risk while keeping the same expected return since the assets are so highly correlated.

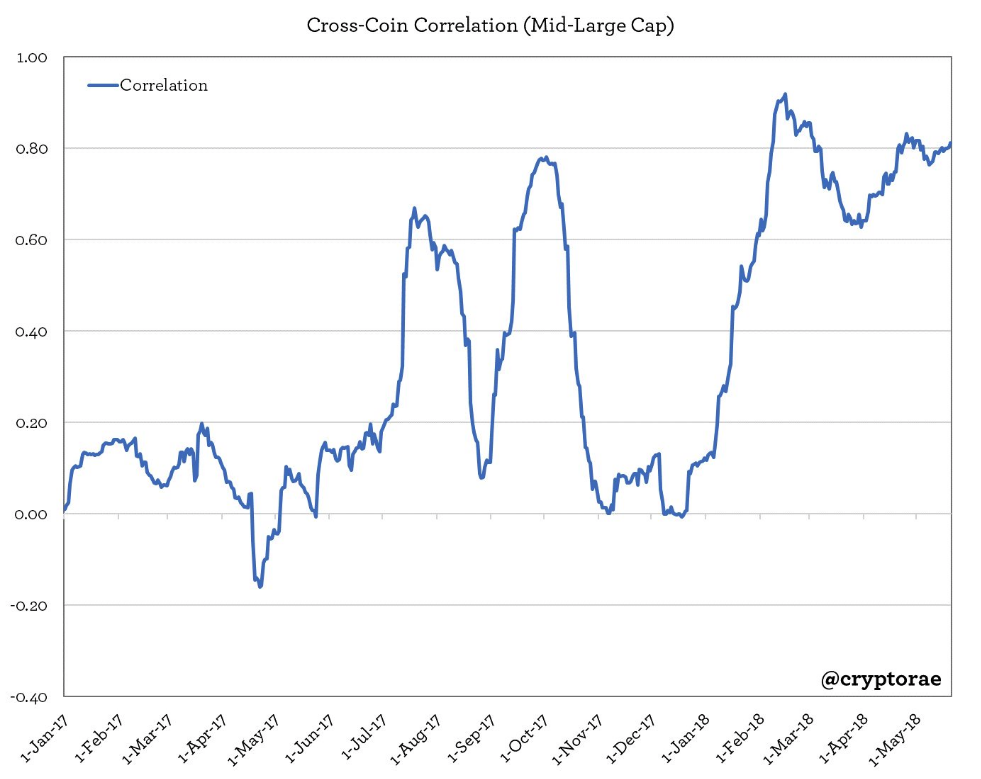

Cross-coin correlation (CCC) measures the degree that a set of coins move in the same direction. This can be calculated by averaging the correlation of every coin pair in a set of coins, which can give a picture of how a market behaves over time. See the cross-correlation for 25 mid-to-large market capitalization coins below:

Data by CryptoRae

There are two major takeaways from this graph:

- Correlations are very high right now at +0.81

- Correlations have been above +0.65 since early February

In a high correlation environment, investing in more coins does not reduce your risk substantially because the coins are highly correlated with one another; therefore an investor should have a more concentrated portfolio. The only way to “diversify” or “hedge” in this market would be to invest in fiat in my opinion. Negatively correlated assets are very hard to find, and they’re more of a unicorn (an unexpected and rare beast) in cryptocurrencies than they are in equities.

Keep in mind the CCC in more bullish market conditions, such as in December 2017, showed little correlation between assets, in which case diversifying would have a larger impact. Correlation however is calculated using historical data.

Diversification is most important in bear market conditions (or when assets are falling) because that’s when an investor depends on negative correlation between assets; and correlations in crypto have historically increased during sell-offs. Therefore, it would be unwise to base correlation expectations on favourable market conditions.

For example, let’s assume that asset A and asset B are negatively correlated and an investor has a position in both. If asset A’s price plummets then it is expected that asset B will rise proportionally – this is when the investor depends on negative correlation to keep himself in a more risk neutral position. If asset B falls with asset A in a bear market, and shows that they are in fact not negatively correlated, then the “diversification” actually added more risk for the investor – and failed to provide mitigation when needed most.

In cryptocurrencies we’ve seen high correlations in sharp sell-offs or bear markets.

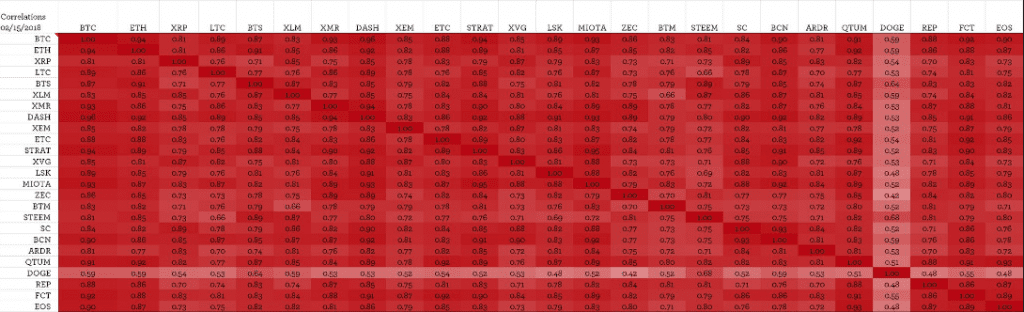

See individual cross-coin correlations below. This is a heat map where red cells indicate +1 correlation coefficients, and blue cells indicate -1 correlation coefficients. I don’t see much blue, which means all coins are highly correlated with one another as of mid-February.

Investing in 50 coins in this type of environment is not diversification – it’s like walking into a casino and putting $20 in 50 different slot machines and thinking your odds of winning the jackpot are higher than putting $1000 in one machine.

In cryptocurrencies specifically, according to Ari Paul, we need to think about diversification along 3 axes, but diversification benefits are still abysmal in these market conditions in my opinion.

- Idiosyncratic Risk: Microeconomic risk that is company specific. This has no correlation with market risk and can be mitigated or eliminated with diversification. An example would be if a project team suddenly went dark and abandoned their project with their ICO funding.

- Market Regimes: Regime risks where certain categories fall in and out of favour. Bitcoin, altcoins, privacy coins, dApp platforms, DEX’s and DAG’s can all be considered regimes. These regimes run the risk of falling out of favour or facing regulatory pressure.

- Protocol Risk: What protocol does the asset run on? For example, 50 ERC20 tokens are vulnerable to ethereum bugs.

Is there any way to apply this analysis to a crypto portfolio?

In a period of high CCC it is wise to hold a concentrated portfolio. With all the talk about diversification being important, it is also important to note that investing in bad projects is not diversification either, and in crypto there are (in my opinion) few projects that are worth investing in for the long term. Therefore, I believe that a more concentrated portfolio of 4-7 assets makes most sense.

Investing in more than one project diversifies idiosyncratic risk immediately, investing in different regimes reduces market regime risk, and ensuring protocol investments are balanced between platforms reduces protocol risks.

Good practice in portfolio allocation would be to create a list of projects and to categorize them based on their maturity, regime, and protocol and to balance one’s portfolio in a concentrated manner upon those variables.

Better practice would be to include crypto as a portion of the entire investment portfolio (including debt, equity, real estate, ETF’s, etc.) and then apply the above practices for a crypto portfolio – that is the only way to truly diversify investments.

Disclaimer: This is not investment advice. The author is invested in some cryptocurrencies. Data is from CryptoRae.

Share this article