Earn Market-Leading Rates on Your Crypto with the Invictus Yield Vault

By utilizing the Yield Vault, qualifying lenders can loan Invictus Alpha a minimum of $25,000 of their crypto for a fixed yield.

Share this article

Many long-term crypto HODLers unknowingly forgo the opportunity to earn additional yield on their crypto, which would result in significant compounding returns over time.

Introducing Invictus Yield Vault

The Invictus Yield Vault was established to provide long-term crypto holders the opportunity to earn market-leading fixed interest rates on a range of their crypto assets. By utilizing the Yield Vault, qualifying lenders can loan Invictus Alpha a minimum of $25,000 of their crypto for a fixed yield. Loan periods vary from 3- to 18-months, and in return lenders earn fixed interest rates that are compounded monthly and paid in-kind. The loaned crypto is used as collateral by Invictus Alpha to fund market-neutral, yield-generating arbitrage trading strategies. These arbitrage trading strategies eliminate capital drawdown risks by hedging against any crypto price movements—ensuring that all crypto lent to the Yield Vault by lenders is safe.

The Yield Vault’s market-leading rates remain fixed for the loan’s tenure. Our competitors rarely explain why their rates change—sometimes citing poor market conditions and tiered systems as covers for variable rates. This means that our competitors’ investors are exposed to significant reinvestment rate risk, potentially hampering their annual percentage yield (APY). Wouldn’t you want the comfort of knowing that your interest rate is fixed regardless of what is happening in the market? Unlike many competitors, the Invictus Yield Vault rates remain high and steady.

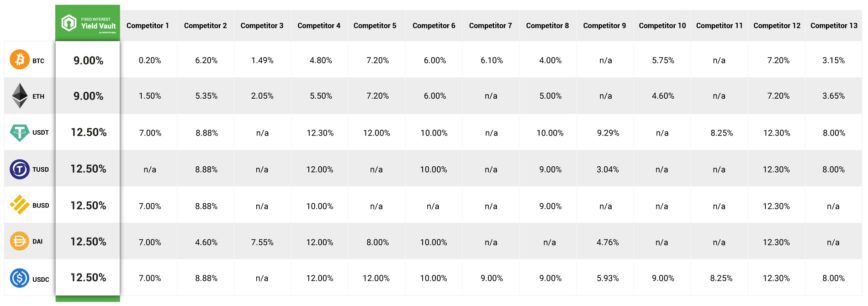

Below is a comparison of some of the other major players’ rates in the market. Each APY is for a 12-month $25,000 loan, paid in-kind.

The most prominent feature of the Invictus Yield Vault is the attractive rates, and there is a good reason for it. A major selling point of the Vault—which we believe may be decisive—is Invictus Alpha’s vertical integration with the product, meaning all returns are generated in-house. Many of our competitors outsource yield generation to third parties, with each middleman taking a cut along the way and ultimately compounding counterparty and credit risks onto their lenders. Invictus Alpha has no middle-man. It maintains clear oversight over loaned capital and deploys your crypto following predefined market-neutral strategies.

Furthermore, many competitors regularly refer to yield as a ‘reward.’ Embedded in their Terms and Conditions, you agree to let them use your assets in any way they deem fit—to sell, loan, rehypothecate, use as collateral, offer to third parties, and so on. The Invictus Yield Vault does not share this substantial and unnecessary risk. It is inconsistent with the Invictus ethos of transparency, and it constitutes a key point of differentiation from Invictus and its competitors.

Lenders interested in the Invictus Yield vault can find additional information on the interest rates offered or easily reach out to our Yield Vault Team via the Invictus Capital website.

Share this article