Liquid staking ecosystem longevity relies on token liquidity: Kairos Research

EigenLayer's LRTs face liquidity scrutiny as deposits soar and presence in DeFi grows.

Share this article

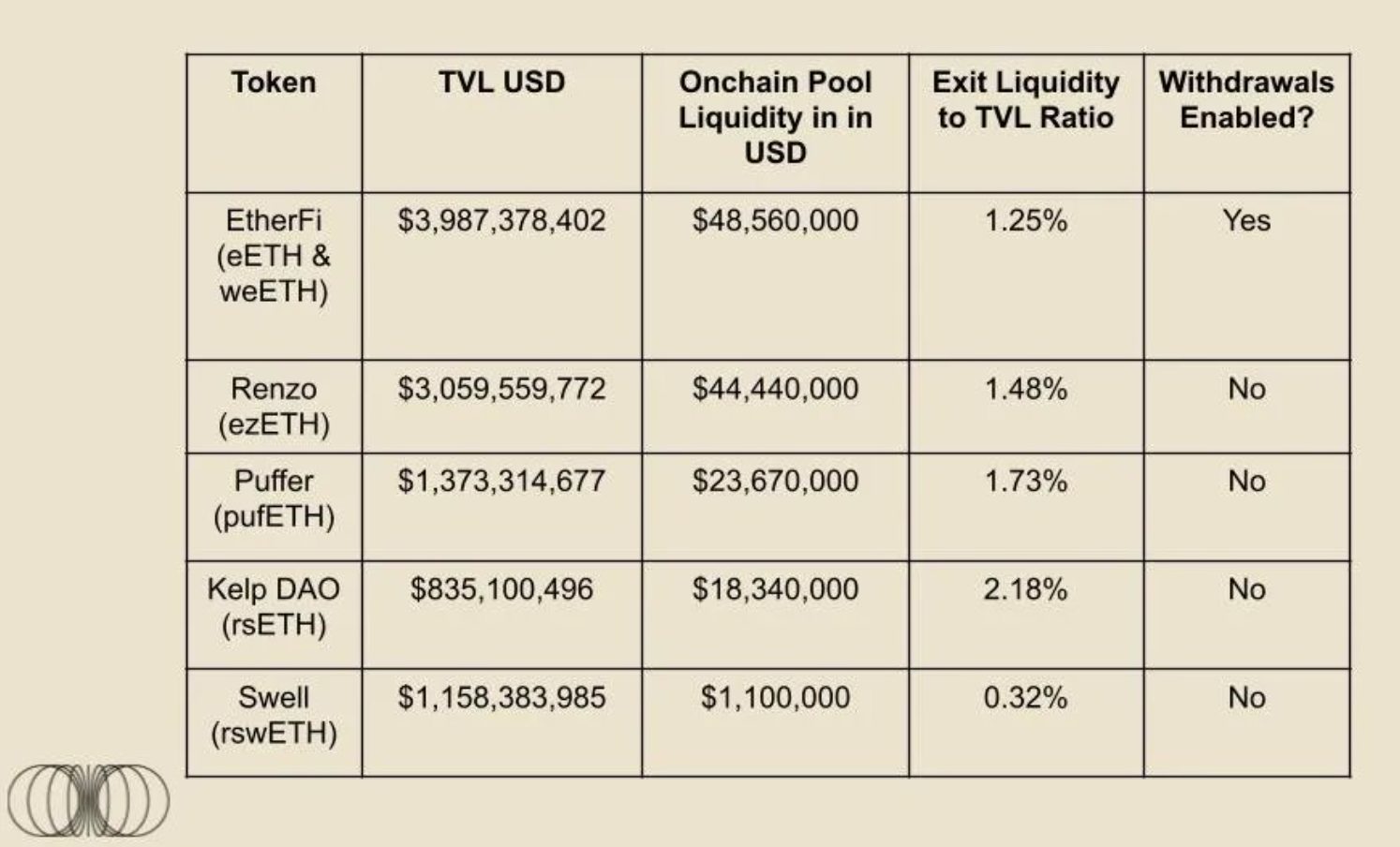

The landscape of liquid restaking tokens (LRTs) depends on how liquid those assets are, according to a report by crypto research firm Kairos Research. After EigenLayer officially enables withdrawals of LRTs, the whole ecosystem will rely on how liquid restaking protocols manage to keep those tokens liquid.

Liquid restaking consists of allocating Ether (ETH) or liquid staking tokens (LSTs) into an infrastructure of shared security, and users receive a proxy token representing the deposited amount to keep operating in the decentralized finance (DeFi) ecosystem. In EigenLayer’s example, decentralized applications might just turn to their security infrastructure with millions of staked ETH instead of creating their own validator set.

The report then explains that the possibility of exchanging LRTs for the underlying asset, which is ETH, plays a major role in this industry, especially after EigenLayer opens up for withdrawals since users might chase alternative yield streams. Yet, it takes seven days to remove staked ETH from EigenLayer, and investors could search for ways to find liquidity quickly.

In this case, if an LRT doesn’t have enough liquidity, its peg with ETH will fluctuate, consequently creating issues for usage.

“Once LRTs become further integrated into the broader DeFi ecosystem, especially lending markets, the peg importance will increase dramatically. When looking at the current money markets for example, LSTs, specifically wstETH/stETH, is the largest collateral asset on Aave, and Spark, with roughly $4.8bn and $2.1bn supplied respectively,” highlighted Kairos’ analysts.

Moreover, an abundance of liquidity makes it harder to shake LRT prices, and the report utilizes a post from Coinbase director Conor Grogan to underscore how Sam Bankman-Fried (SBF) managed to create a significant ‘depeg’ in stETH by selling $75 million into the market. The lack of liquidity created a shock that Grogan labels as the reason behind a daisy chain of events that included the blow-up of hedge fund Three Arrows Capital.

Nonetheless, the report points out that incentives from protocols using EigenLayer’s shared security structure and liquid restaking protocols might play an important role in keeping the LRT ecosystem healthy. “We think token incentives could potentially play an important role here, and we look forward to diving into the different token models following potential airdrop events from other LRT providers.”

Share this article