EigenLayer’s TVL soars 120% in less than 48 hours

Lido leads in EigenLayer's LSTs with almost 54% market share, with 558,000 stETH restaked in the protocol.

Share this article

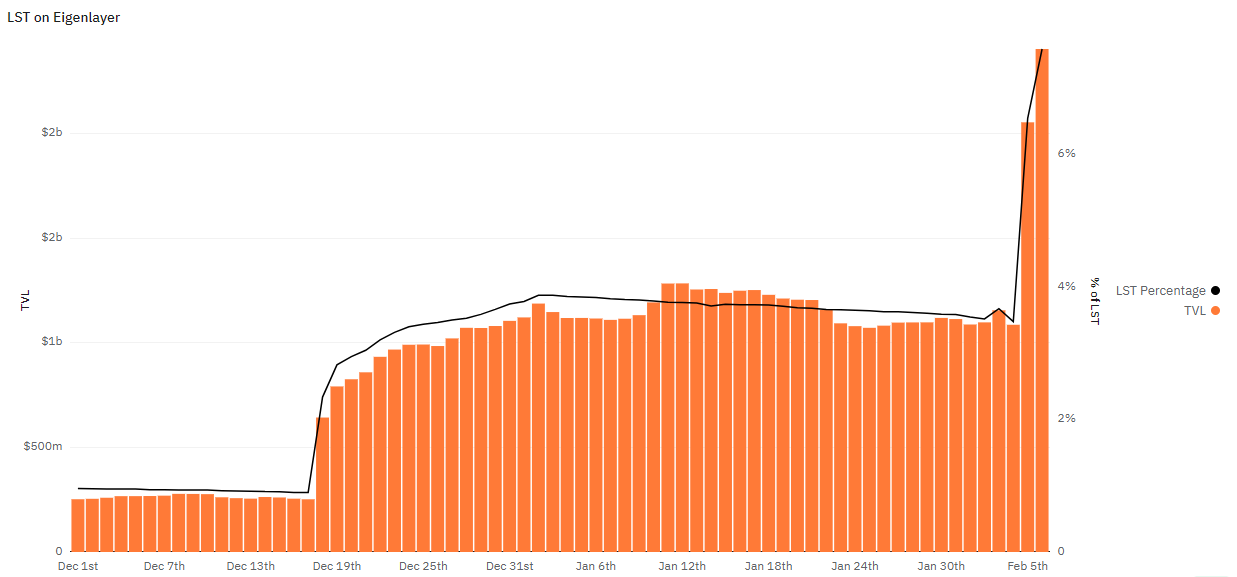

EigenLayer’s total value locked (TVL) sits at over $2.4 billion at the time of writing, with a 120% leap registered since the restaking period reopened on Feb. 5, at 8 pm (UTC). According to a 21co dashboard on the on-chain data platform Dune Analytics, the protocol closed yesterday with almost $1 billion on top of the TVL registered on Feb. 4.

Moreover, a 108% growth in liquid staking tokens (LST) usage to restake on EigenLayer can also be seen, with LST representing 7.6% of all TVL. The number of unique depositors has surpassed 89,000.

Lido’s LST dominates 53.9% of the liquid staking market share on EigenLayer, with over 558,000 stETH restaked in the protocol. The token earned by staking ETH on Lido has experienced significant growth in market share since Feb. 4, when it held 40.2% of the LST pie on EigenLayer.

Swell’s swETH comes in second place, with 17.9% participation and almost 178,000 units restaked in EigenLayer. The swETH lost the most in terms of market share, sliding from 24.3% on Feb. 4 to the current 17.9%.

A significant jump in usage was shown by Binance’s Wrapped Beacon ETH (wBETH), which had 2.4% dominance on Feb. 4, and now represents 6.3% of LST participation on EigenLayer.

The least used LST for restaking is Anker’s ankrETH, with 1,119 tokens allocated at EigenLayer, representing 0.1% of all the liquid staking tokens locked at the protocol.

Share this article