EOS Whales Accumulate in Preparation for a Major Price Movement

Now that the hype around Bitcoin's halving is over, on-chain metrics reveal that large investors have been adding massive amounts of EOS to their bags.

Key Takeaways

- EOS' social engagement metrics are through the roof.

- Meanwhile, the number of addresses with 100,000 to 10,000,000 EOS has been increasing rapidly.

- This unusual on-chain activity suggests that EOS is poised for volatility, but it may not be in the direction that most expect.

Share this article

Large investors appear to have been accumulating EOS over the past few months suggesting that a major price movement could be underway.

Unusual On-Chain Activity

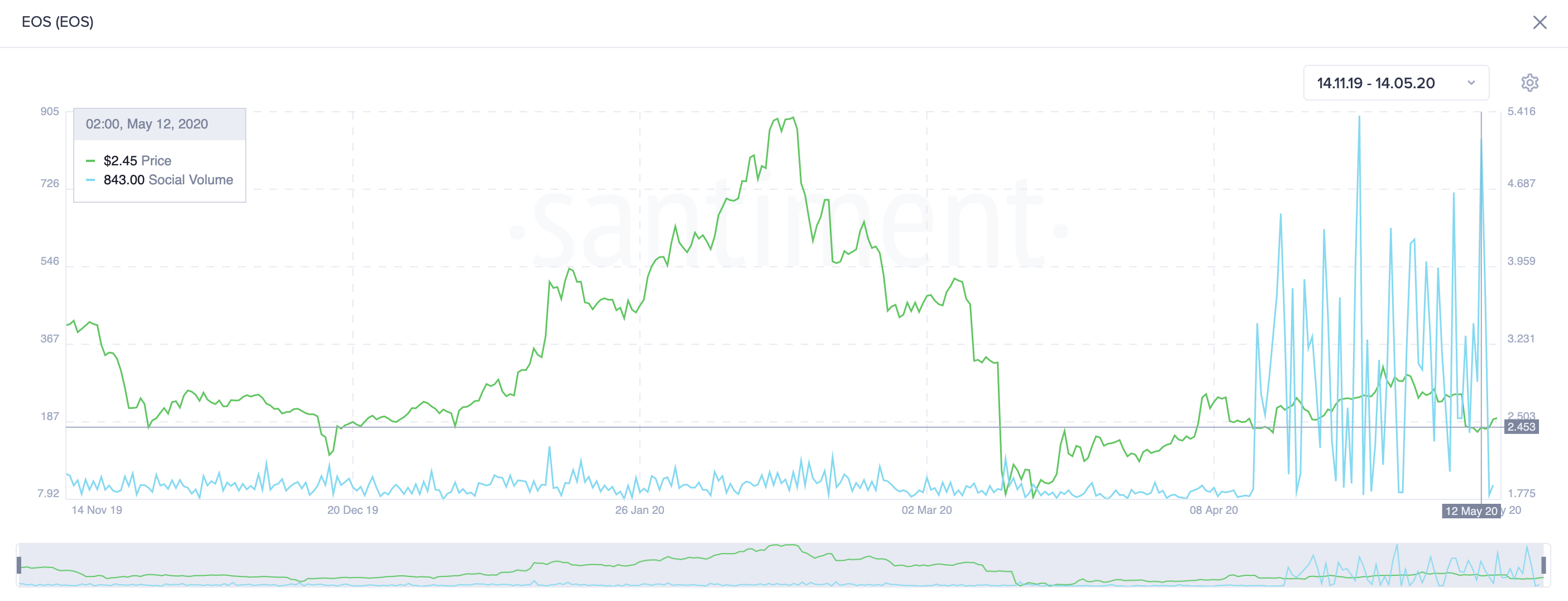

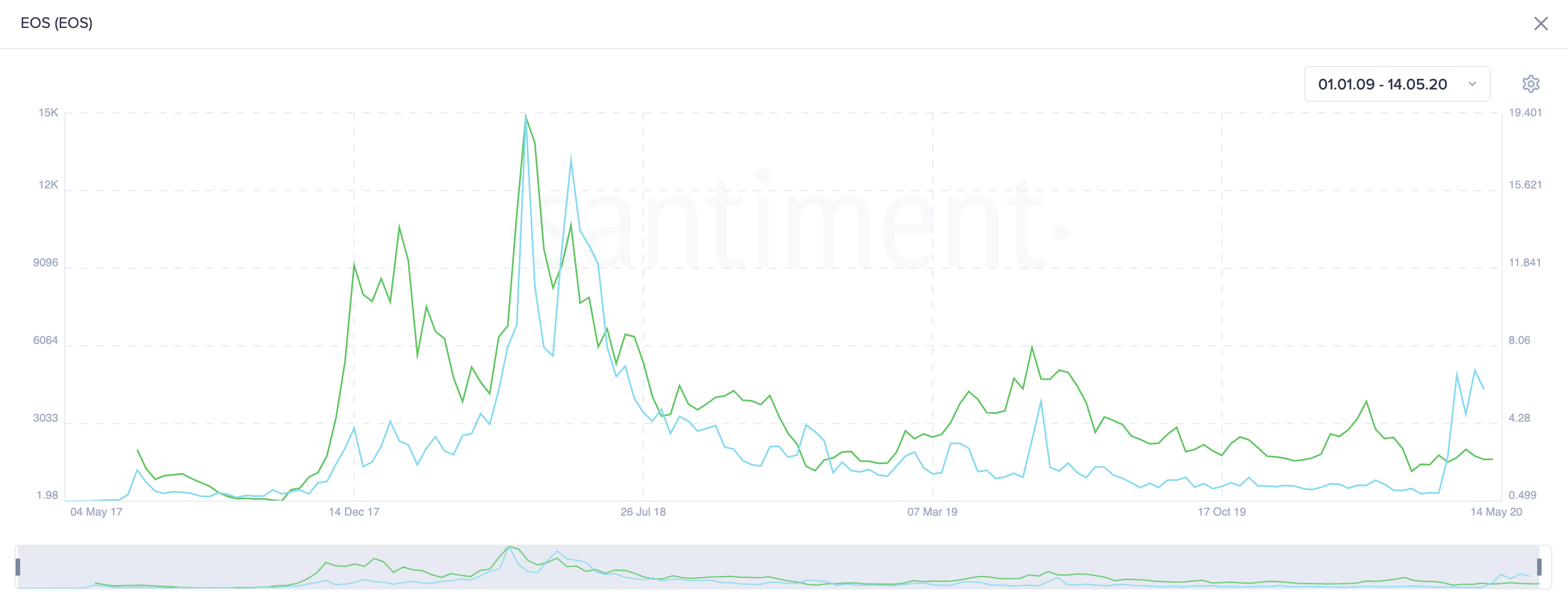

Data from Santiment reveals that since mid-April, EOS’ social activity has been experiencing a series of spikes reaching levels not seen in more than a year.

Throughout the first quarter of 2020, the number of EOS mentions across more than 1,000 crypto social media channels hovered at an average value of 50.

But on Apr. 13, social engagement metrics skyrocketed to a score of 416.

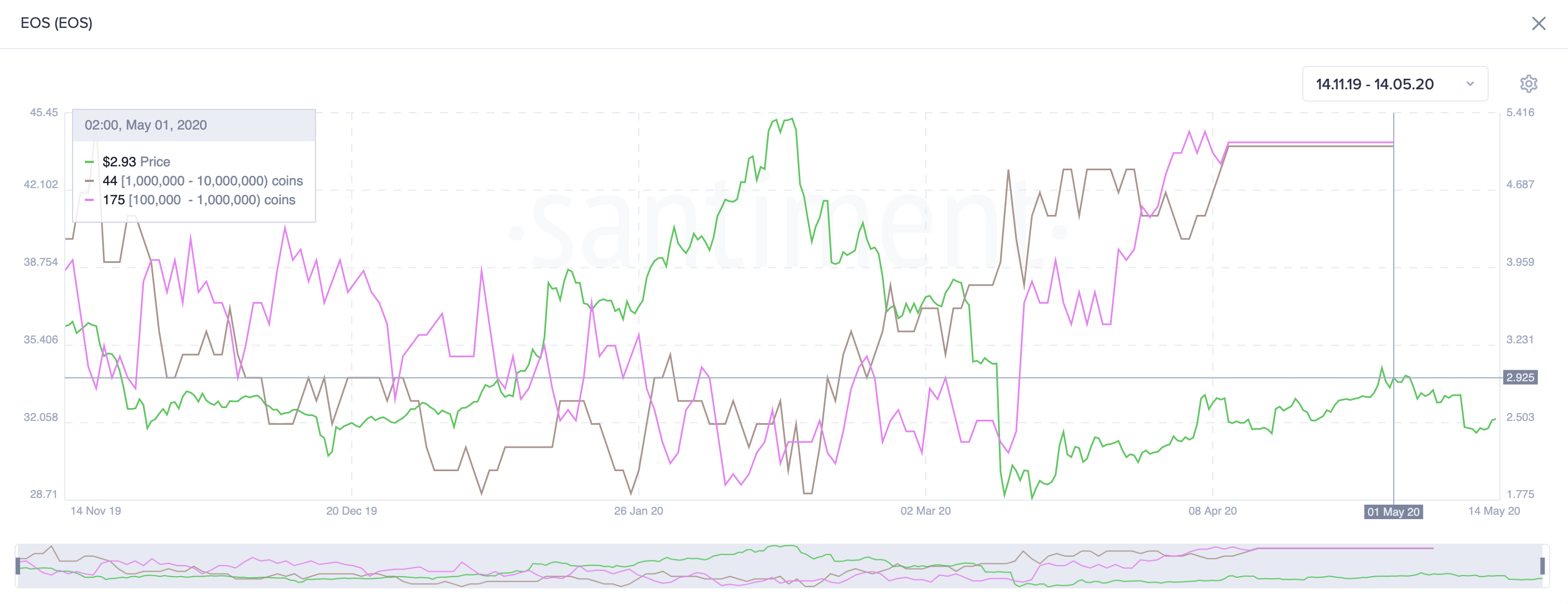

At roughly the same time, big players started to heavily accumulate this altcoin.

The number of addresses with 100,000 to 1,000,000 EOS, which can be considered as “baby whales,” doubled since mid-February.

Meanwhile, the number of “big whales” holding 1,000,000 to 10,000,000 EOS has increased by a whopping 22% within the same timespan.

This type of behavior indicates that EOS may be preparing to push its price further up before they can find a reasonable level to dump their holdings on unaware investors.

While the optimal price level for them to do so cannot be determined, a look at the technicals may help paint a better picture.

EOS May Be Poised for an Upward Advance

EOS is one of the few top cryptocurrencies by market cap that has not been able to fully recover from the losses incurred during March’s market meltdown.

This cryptocurrency is still down 18% since Black Thursday.

The slow upward price action may not be encouraging to some investors, but others see it as an ideal entrance as the coin could continue growing.

This coincides with the forecast presented by the TD sequential indicator on EOS’ 1-day chart.

The TD setup recently provided a buy signal in the form of a red nine candlestick. The bullish formation estimates a one to four candlesticks upswing or the beginning of a new upward countdown.

Since the current candlestick is a green one candle, a succeeding green two candle trading above the close of the current one could serve as confirmation of the optimistic outlook.

If this were to happen, a further increase in the buying pressure behind EOS could see it surge towards the 61.8% or even the 50% Fibonacci retracement levels.

These resistance barriers sit at $3 and $3.5, respectively.

Nonetheless, a spike in supply could invalidate the optimistic view and push EOS back down to the 78.6% Fibonacci retracement level.

Breaking below this area of support could trigger a steeper decline that sees this cryptocurrency moving back to Black Thursday’s low of $1.4.

Moving Forward

The cryptocurrency market seems overwhelmingly bullish now that Bitcoin added another halving to the history books.

Since then, BTC is up more than 21%, indicating that this could have been the catalyst for a new bull market. This may also indicate why so many investors are turning to altcoins like EOS.

But as Bitcoin reaches a multi-year resistance trendline, prominent figures within the industry such as Tone Vays maintain that it could trigger a steep correction that affects all assets in the crypto market.

If BTC retraces, it is likely the rest of the market would follow. If one considers such a bearish premise, then EOS’ social volume shows that high chatter and price are inversely correlated. It could even be a justification for leaving any long positions in this altcoin.

Indeed whales might actually be preparing to dump their holdings sooner than anticipated.

Therefore, the 78.6% Fibonacci retracement level that sits at $2.3 plays an important role in EOS’ trend.

Staying above this support level will add credence to the bullish outlook while breaking below it may signal the beginning of a steep decline.

Market participants have often talked about the pump before the halving and the dump after it.

For this reason, it is very important to remain cautious about the market’s price action over the next few days to avoid getting caught on the wrong side of the trend.

Share this article