Ethereum Breaches $4,000, Marking the Presence of Whales

Ethereum appears to be leading the top cryptocurrencies by market cap as it breaks past $4,000.

Key Takeaways

- Ethereum is back above $4,000 after breaking out of a consolidation pattern.

- The bullish impulse coincides with an increase in the number of large Ether transactions.

- The network activity suggests that whales may be positioning themselves for higher highs.

Share this article

Ethereum is making headlines again, after surging by more than 18% within the past four days to test the psychological $4,000 level.

Ethereum Breaks $4,000

The second-largest cryptocurrency by market cap has resumed its uptrend after consolidating for more than three weeks.

Ether made a series of higher lows throughout the stagnation period, while the $3,350 resistance level prevented it from advancing further. Such market behavior led to the formation of an ascending triangle on ETH’s daily chart.

A sudden spike in buying pressure allowed Ethereum to break out of its consolidation pattern on Aug. 31 and rise by more than 18% over the past four days to reach a target of $4,000.

The Fibonacci retracement indicator, measured from the May 12 high of $4,372 to the Jun. 22 low of $1,700, suggests that further buying pressure has more room to push the asset up. Further buying at around the current price levels could see ETH retest its all-time high.

Whales Are Back

The presence of whales and institutional players on the network suggests Ethereum could even target $5,000 if buying orders continue piling up.

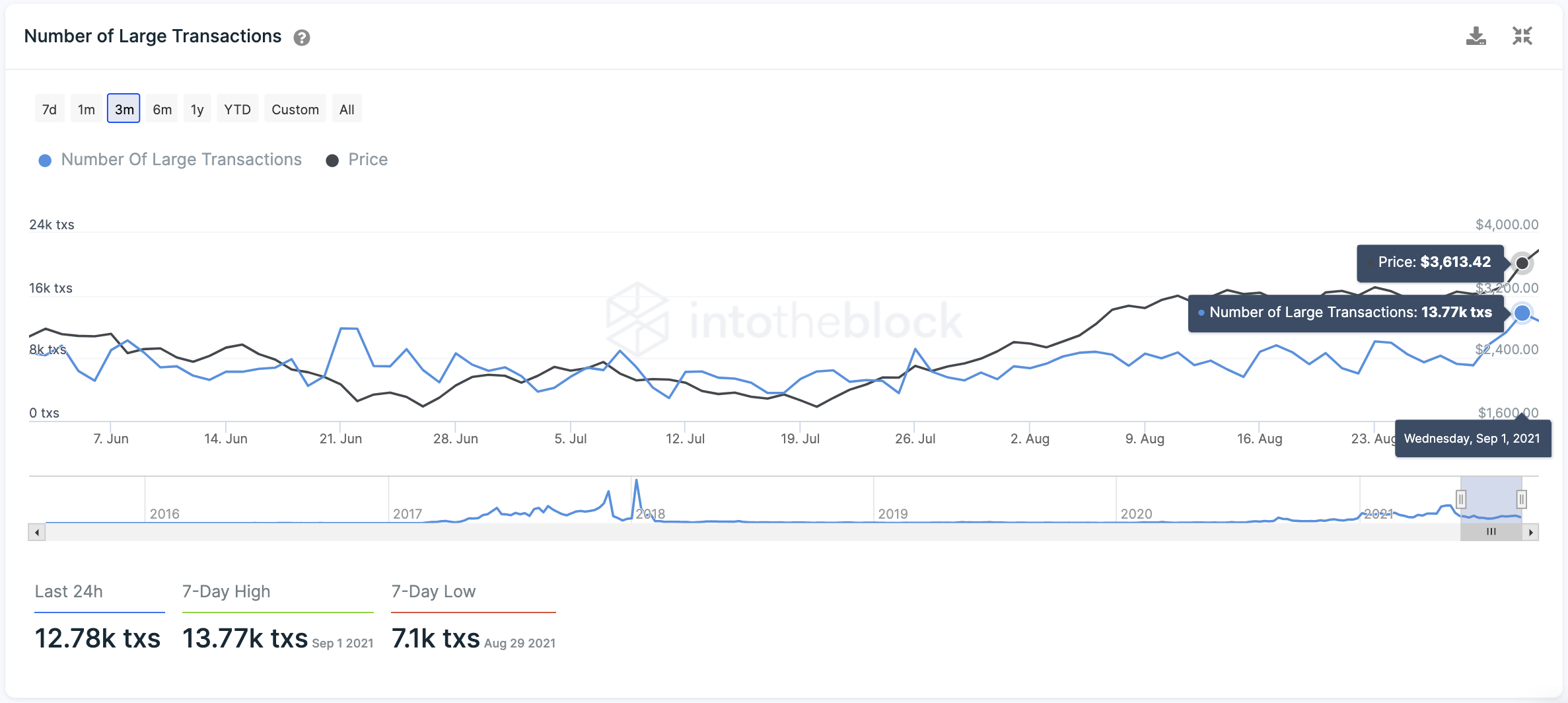

The number of large Ether transactions with a value of $100,000 or greater continues to rise. Roughly 13,770 large transactions were recorded on Sep. 1, and this on-chain metric appears to be trending higher.

Since whales disproportionately impact prices because of their enormous holdings, they can coordinate buying and selling activity to pump or dump tokens. Such is the case that over the past few years, each time the number of large Ether transactions starts to increase, prices tend to follow.

As long as Ethereum can keep its momentum and prices hold above $3,800, further gains can be expected.

Share this article