ETH balances in centralized exchanges fall to lowest level in three months

ETH price remains stable post-ETF approval, surprising derivative traders.

Share this article

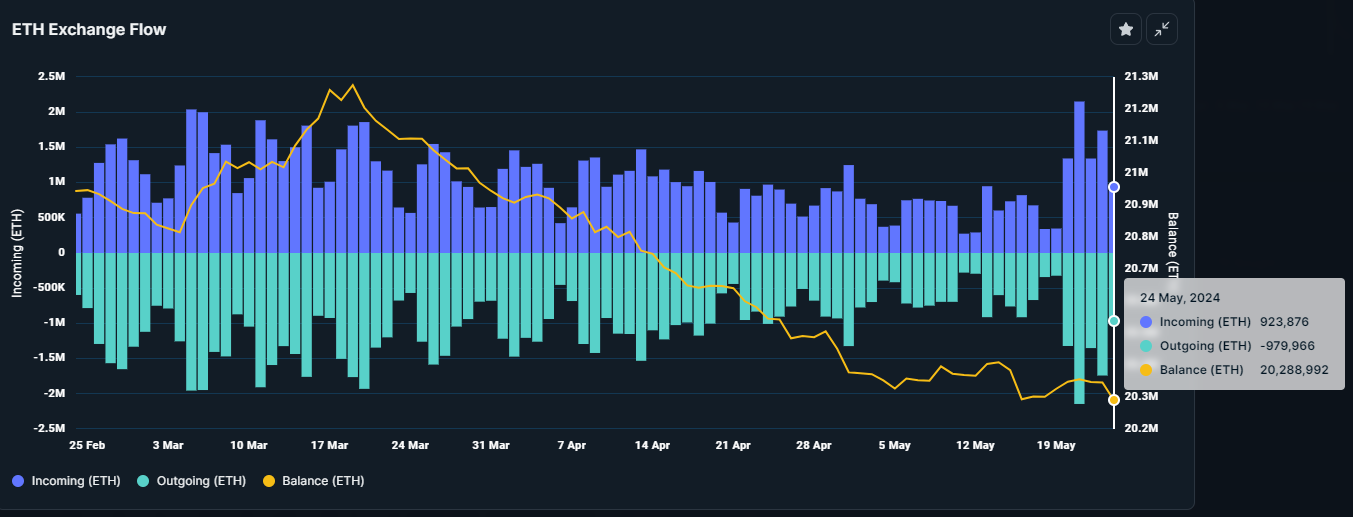

Ethereum (ETH) investors withdrew 56,089 from crypto exchanges in the last 24 hours, according to on-chain analysis platform Nansen. Moreover, the amount of ETH held in centralized exchanges hit the lowest level in the last three months, totaling 20,288,992 ETH.

Crypto outflows from centralized exchanges are seen as a bullish indicator, as the movement suggests investors are expecting price growth with no intention of selling it in the short term.

Despite the spot Ethereum exchange-traded funds (ETFs) approval in the US yesterday, the ETH price didn’t react accordingly, with a meager 0.3% upside in 24 hours. This caught derivatives traders off guard, as over $80 million in ETH long positions were liquidated in the last 24 hours.

However, this scenario was already considered by industry experts, as reported by Crypto Briefing. The ETF approval was likely priced in, and it will take a few days until the market reacts positively, as it happened with Bitcoin (BTC) after its ETFs were approved in the US. The news was met with a sell-off, and it took almost a month before the price started going up.

Even so, on-chain data platform IntoTheBlock shows that 91% of ETH investors are profiting from their positions, while just 6% of them are with their holdings underwater.

Furthermore, the major development for Ethereum didn’t impact its decentralized finance (DeFi) metrics, as the total value locked (TVL) suffered a daily 4.6% pullback. Nevertheless, Ethereum still dominates almost 70% of all DeFi’s TVL.

Share this article