Faith in Fiat Falters, As Bitcoin Gains Believers

Is the death of fiat a legacy of quantitative easing?

Share this article

As quantitative easing dampens faith in fiat, cryptocurrencies will only become more attractive. That’s one of the most startling assertions from Mark Mobius, founding partner of Mobius Capital Partners, who is in India this week to promote his new book, “Invest for Good.”

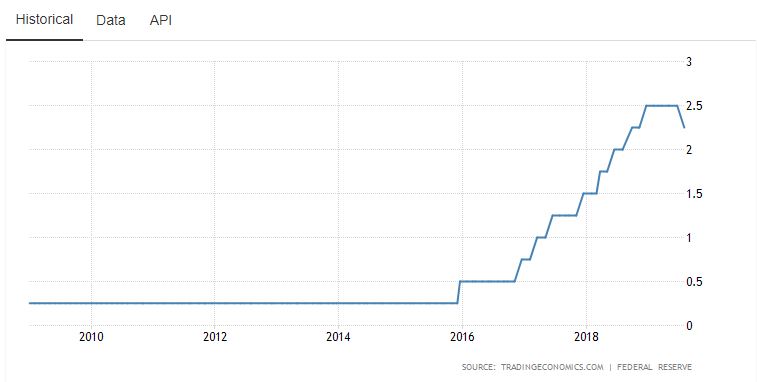

The global economy has been propped up since the end of the Great Recession by historically low interest rates. The U.S. Fed Fund Rate sat at a mere 0.25 percent for more than half of the past decade, a rate which many observers felt was too low for too long.

Ben Bernanke’s Hanky Panky

With interest rates around the world historically low and falling, two concerns are rearing their heads: first, that central banks lack sufficient leverage as growth falters; second, investors are struggling to identify money-making targets. Faith in the global political-economic system risks becoming undermined.

FED Chairman Jerome Powell was right to resist Trump’s demands for a slash in interest rates. This is especially true given that U.S. consumers, at least for now, have remained robust despite recession and trade war fears. As the chief economist for Surveys of Consumers reported in August:

Yet, with global markets reeling from Sino-U.S. trade tensions, even Powell seems to have relented in his stance.

Stock Market Bubble Seems to Have Popped

One result of low interest rate regimes is frothiness in risk-on asset classes, with investors anticipating strength in fundamental growth drivers like consumer demand and corporate expansion. The post-financial crisis period of rising stock markets and exuberant money managers speaks directly to the impact of rates which have been too low for too long.

To bet with the FED this time appears risky. U.S. markets have demonstrated that they may already have grazed the medium-term top. Profit margins over the past decade have been historically and unsustainably high as companies sought to get more out of less. Bridgewater Associates labeled this phenomenon Peak Profit Margins.

Mobius fears that falling interest rates will drive irrational investment decisions and ultimately a crash. The antidote? Gold and cryptocurrencies. As the investor told the Reuters Global Markets Forum:

Never Bet Against The FED (Until You Should Bet Against The FED)

Forbes found that $100,000 invested into 3-month treasury bills in July 2009 would have been nominally worth $105,076 ten years later. In real terms, adjusted for inflation, that amount is actually $86,480, representing a real loss of around 13 percent.

As we appear to be entering a second phase of real negative interest rates, combined with little obvious equity upside, faith in fiat could dwindle, as alternative asset classes like cryptocurrencies become more attractive for both speculation and capital preservation. When an asset class represents both those things, we know we are in uncharted waters.

Share this article