German government moves $895 million in BTC; crypto exec calls dump “overestimated”

Crypto market shows resilience as Germany offloads seized Bitcoin, with analyst downplaying long-term impact.

The German government resumed its Bitcoin (BTC) outflow spree today with roughly 16,039 BTC sent to exchanges and market makers. This amount is equivalent to nearly $895 million. After the movement was reported by on-chain data platform Arkham Intelligence on X, Bitcoin took a quick 3.5% dive in a few minutes before a quick rebound.

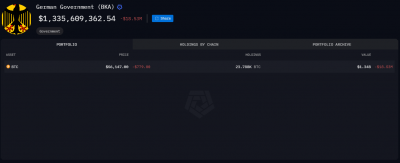

According to a dashboard by Arkham, the German government still holds 23,788 BTC, which translates to over $1.3 billion. The government dump is one of the factors pointed out by investors to be pressuring the Bitcoin price, along with the recent Mt. Gox’s creditors repayment.

Justin Sun, the founder of Tron, even offered to cut a deal with the German government to buy all their BTC holdings. However, it isn’t clear if this was an actual offer or just Sun chasing the spotlight.

Notably, CryptoQuant CEO Ki Young Ju highlighted on X that the government dump is “overestimated.” He explains that $224 billion has flowed in crypto since 2023, and the government-seized Bitcoin stash contributes to only $9 billion. “It’s only 4% of the total cumulative realized value since 2023. Don’t let govt selling FUD ruin your trades.”

Nevertheless, Bitcoin’s “overhang supply”, as Mt. Gox and government holdings are called, still leaves investors fearing an upcoming dump. This puts the market in a tough spot, as BTC tries to reclaim its major price level of $60,600, as underscored by trader Rekt Capital.