Grayscale unveils staking-focused yield fund for qualified investors

The fund’s returns are based on staking rewards paid quarterly and are only available for investors with over $1 million in AUM.

Share this article

Asset manager Grayscale announced on Mar. 29 the “Grayscale Dynamic Income Fund” (GDIF), its new staking-focused fund for qualified investors. According to the firm’s X post, the fund “seeks to optimize income in the form of staking rewards associated with proof-of-stake digital assets.”

The GDIF official page explains how Grayscale allocates investors’ funds to different proof-of-stake tokens, stakes them, and cashes the rewards weekly. The earnings are distributed to investors quarterly, as does the rebalancing of the fund’s portfolio.

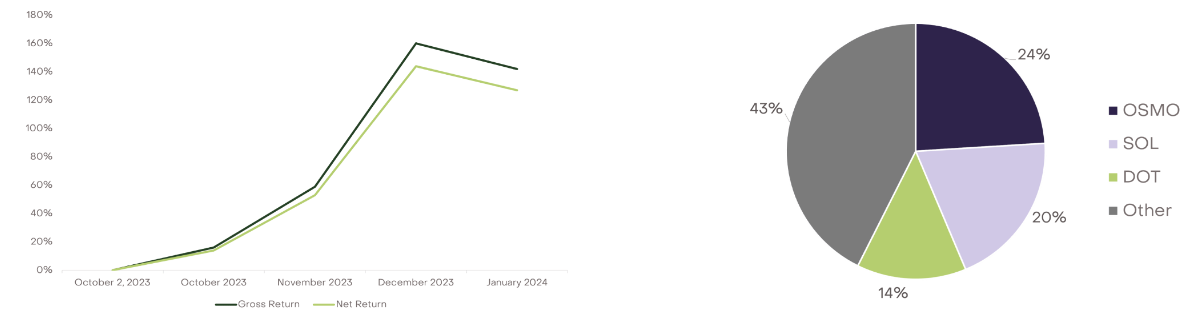

OSMO, the native token of Cosmos-based appchain Osmosis, represents 24% of the GDIF portfolio and its staking offers an average yield at a 12.7% annual percentage rate (APR). Solana (SOL) and Polkadot (DOT) are also two significant assets in the funds’ composition, with 20% and 14% shares respectively.

Moreover, Grayscale states that the fund showed a net return of over 140% from October 2023 to January, which means fees and expenses were already deducted. However, the fund is restricted to investors with assets under management of $1,1 million or a net worth of $2,2 million.

Share this article