How to know the right time to invest in cryptocurrencies

Share this article

In the volatile world of cryptocurrencies, timing your investment is crucial. Understanding market cycles, conducting thorough research, monitoring market sentiment, staying informed about the global regulatory environment, diversifying investments across different cryptocurrencies, and setting clear goals and limits are essential for making informed decisions.

Market cycles consist of four phases: accumulation, expansion, peak, and contraction. Identifying which phase the market is in can be key to determining the right time to invest. Researching the technology, the team behind the crypto project, and its historical performance is essential before diving into the cryptocurrency market. Market sentiment plays a crucial role in the valuation of cryptocurrencies, and tools like sentiment analysis on social media and the Fear and Greed Index can provide valuable insights into the current mood of the market.

Regulatory climate is another critical factor in the crypto market. Positive regulatory news can boost market confidence, while negative news can lead to declines in value. Diversification is a key strategy in investing, as spreading investments across different cryptocurrencies can help mitigate risk. Long-term investments can weather short-term market fluctuations, while short-term investments might offer quick gains but come with higher risks.

Risk management is essential in cryptocurrency markets, as investing only what you can afford to lose and setting clear goals and limits for your investments are essential. Candlestick patterns are a tool used in technical analysis to predict future market movements based on past price actions. Learning to read these patterns can provide valuable insights into market sentiment and potential price movements.

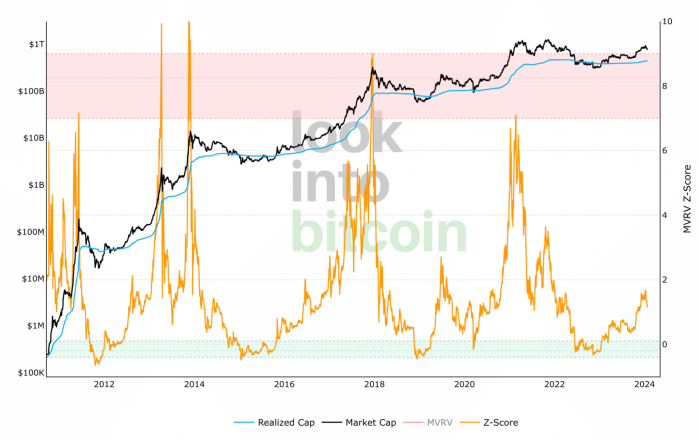

The MRZV Score (Market Value to Realized Value Z-Score) is an advanced metric in cryptocurrency analysis that offers investors a deeper understanding of market valuation dynamics. It measures how overvalued or undervalued a cryptocurrency is at any given time. The MRZV Score should be used in conjunction with other indicators and market analyses to make informed decisions.

The Fear and Greed Index is a popular tool used to gauge the general sentiment of the cryptocurrency market. It takes into account various sources including volatility, market momentum and volume, social media sentiment, surveys, dominance, and trends. The index scores sentiment on a scale from 0 to 100, with scores closer to 0 indicating “Extreme Fear” and scores near 100 indicating “Extreme Greed.”

It is best to use the index as a contrarian indicator in investment strategies. When the index reads extreme fear, it might be a good time to consider buying, as the market could be undervalued, and when it reads extreme greed, it might be time to sell or be cautious, as the market could be in for a correction.

In conclusion, the decision of when to invest in cryptocurrencies is multi-faceted and requires a blend of market understanding, research, sentiment analysis, technical tools, diversification, an investment horizon, and robust risk management.

About Morpher

Morpher is a trading platform on the Ethereum blockchain that fixes trading and investing. Morpher empowers its users to trade unlimited assets with zero fees and infinite liquidity. Morpher’s fractional trading capabilities make the financial markets accessible. Trade stocks in pre-market, weekends, holidays, and everything in between.

Share this article