How Will Bitcoin Fit in the Great Monetary Expansion?

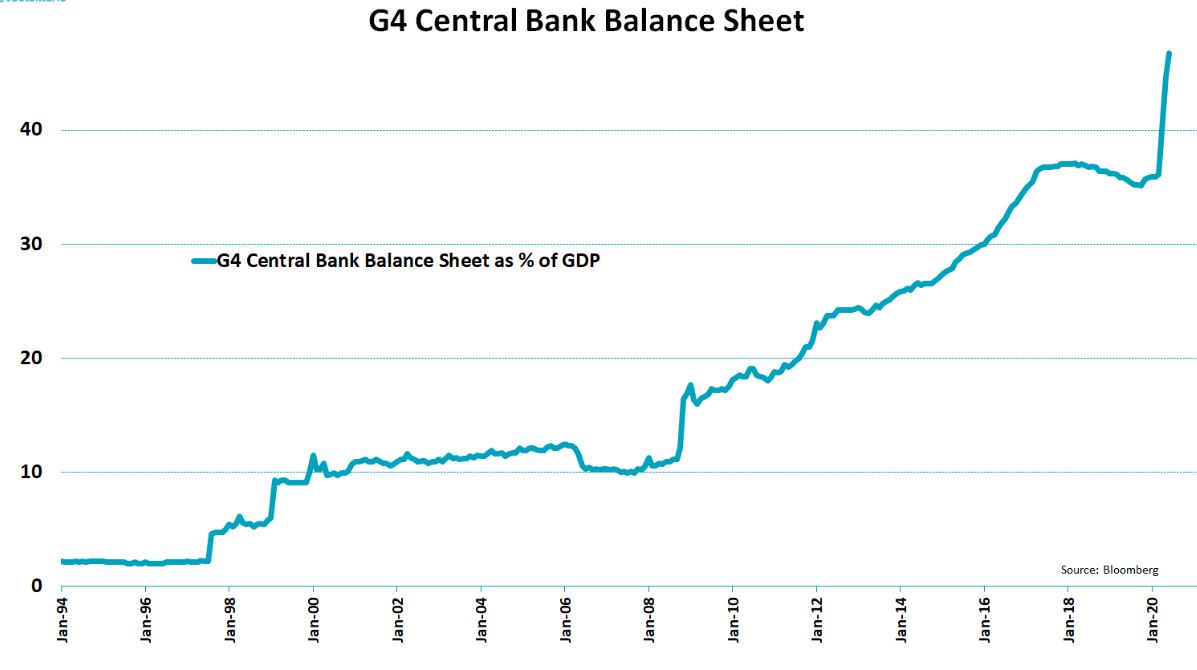

The central banks of the U.S., EU, Japan, and England now hold almost half their regions’ annual GDP on their balance sheets.

The great monetary expansion is underway, with the G4 central banks now holding nearly 50% of GDP on their balance sheets. What role will Bitcoin play?

Central Banks See Unprecedented Expansion

The G4 central banks’ balance sheets now hold over 46% of GDP on their balance sheets.

The U.S. Federal Reserve, Bank of Japan, European Central Bank, and Bank of England balance sheets as a percentage of GDP rose from around 35% to 46.7% since the beginning of the year.

Jeroen Blokland, the head of Multi Asset at Robeco Asset Management, pointed out the dramatic growth in balance sheet balances across the G4, signaling a dramatic pronouncement of central bank involvement in their respective economies.

For reference, the response to the Great Recession took central bank balance sheets from around 11% to 18% of GDP in each region.

That number continued to climb throughout the jobless recovery but has since skyrocketed in the wake of the pandemic.

The U.S., the EU, and Japan represent about half of the total global output, according to Bloomberg. With nearly half of that on the books at central banks, it means the equivalent of almost a quarter of annual global GDP is now on central bank books in four of the most significant economies in the world.

The moves are a response to the ongoing recessions resulting from COVID-19 shutdowns. As Tom Orlik, chief economist at Bloomberg Economics, said in April:

“The extremity of the virus crisis is forcing central banks to push the limits of the possible. We expect the ECB to expand its fire fighting Pandemic Emergency Purchase Programme. Ahead of the game in terms of the size and scope of stimulus, the Fed won’t add additional support, but will confirm it has space to do more.”

Bitcoin’s Potential to Shore up Household Finances

With global interest rates hovering around zero and monetary expansion set in place for the foreseeable future, monetary debasement is a real threat.

And as Tuur Demeester argues, that causes a transfer of wealth from the poor to the rich:

Monetary debasement significantly contributes to the wealth transfer from poor to rich. The rich have access to the money before it loses its purchasing power (via borrowing), and thus harvest wealth from the poor. As the money cheapened in the 90s, the wealth gap grew in tandem: pic.twitter.com/T9HxIHLP2k

— Tuur Demeester (@TuurDemeester) January 3, 2020

The wealthy have first and early access to cheap money, raising asset prices that then become increasingly out of reach for the working class.

Holding Bitcoin and other digital assets may be the only avenue for low-income households to protect their net worth in a cascading spiral of monetary debasement that is likely to follow the global expansion of money supply.