IOTA Digital Asset Report And Evaluation (DARE) By Crypto Briefing

Share this article

Our IOTA Digital Asset Report and Evaluation examines the blockchain that isn’t a blockchain – a DAG that uses a completely different consensus mechanism to compete within the rapidly-developing Internet of Things (IoT) industry. It’s one of the most ambitious platforms in the space, and although there are many who marvel at the technology, the pace of adoption and leadership structure have occasionally offered cause for concern.

Introduction To IOTA

IOTA is often described as a block-less blockchain. It is built on Tangle technology, which utilizes a directed acyclic graph (DAG) to achieve a zero-transaction-fee, parallelized confirmation model.

IOTA was designed with an IoT future in mind and focuses on alleviating scalability and cost issues that have plagued traditional blockchain architecture.

However, despite being conceived back in 2015, it has enjoyed limited progress towards adoption. Growth has been stalled by the slow development of the IoT market as well as questions regarding technological viability.

IOTA has been at the center of multiple controversies, yet the underlying concept and infrastructure development continue to hold promise.

IOTA Market Opportunity

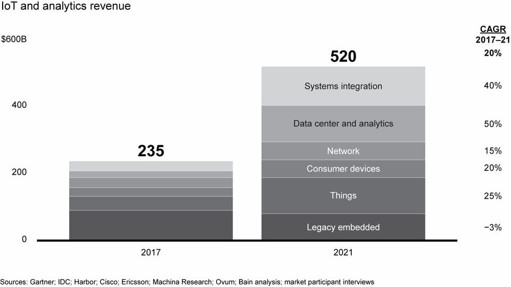

Bain expects the IoT market to more than double in size from $235 billion in 2017 to $520 billion in 2021. IOTA has been designed and is continuously being improved upon to answer the needs of this particular niche.

The growing demand for smart ecosystems and automation will drive the demand for IOTA’s product if it is able to deliver on its promises of speed, security, scalability and ability to execute microtransactions.

However, IOTA is far from the only player in the blockchain-IoT space. There are a number of smaller projects like IoTeX and IoT Chain, as well as, blue chip companies involved.

IBM invested $200 billion in the Global Watson IoT Headquarters in Munich back in 2016, and now offers IoT services that utilize Watson and Hyperledger.

Also, Streamr, a second-layer project designed for handling real-time IoT data utilizes the Ethereum as its first blockchain integration, making the Ethereum network itself a competitor.

While IOTA’s approach was at one-point novel, it needs to start producing tangible deliverables and achieving real adoption in order to stay commercially relevant.

IOTA Underlying Technology

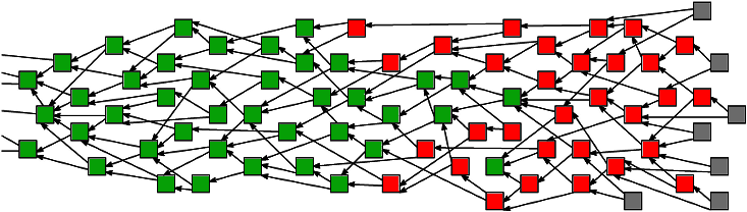

The core of the IOTA Network is the Tangle, which is an implantation of directed acyclic graphs. Unlike blockchain, where every block is linearly linked, Tangle has a tree structure, growing endlessly from the genesis node, which gives it its high throughput property.

In order to submit a transaction into the network, one must first approve two previous transactions, or “tips” and do some PoW. This “pay it forward” approach gives IOTA its feeless property. As tips are referenced by new transactions, they form branches. The tree-like structure allows for partitioning and rejoining of branches, enabling offline transactions, which results in n quicker transactions through Flash Channels.

Tangle utilizes eventual consensus, and references the heaviest branch as the valid one. Tips are selected using MCMC-based algorithms to ensure that branch weight is properly accounted for during the randomized selection. Users are allowed to use different tip selection algorithms at their own risk.

While transactions can be processed relatively quickly, time to finality is a different question. IOTA allows users to individually set the confirmation confidence level, meaning that merchants could, for example, process transactions when 51 out of 100 tips reference them.

Yet, that is not a guarantee of validity, and it is not entirely clear how real-life conflict resolution would happen if a transaction is proven invalid after the fact.

To facilitate consensus and prevent malicious agents from endangering the network, IOTA employs a Coordinator. The Coordinator issues zero-value transaction at 2-minute intervals. All transactions directly or indirectly referenced by the Coordinator milestone transaction are considered confirmed.

Additionally, IOTA utilizes Snapshots. As per IOTA’s FAQ: “This is essentially a ‘pruning’ of the ledger – it removes all events and addresses on the ledger which do not have a positive balance. At the end of this pruning we are left with a basic ledger, comprising a list of all addresses that contain IOTA, and their respective balances.” In a February report on IOTA, Konfid.io drew attention to its inability to retrace transactions back to the genesis, and how this posed, at the very minimum, an ethical dilemma. It is unclear if this was a bug or a feature of the network.

In another May publication of the IOTA report, Konfid.io pointed out the unsuitability of the PoW protocol with IoT devices because of the computational demand. While this is likely an issue that can be resolved, it highlights the magnitude of challenges that are facing IOTA in order to achieve real adoption.

IOTA is also different from other DLT projects in that it uses ternary instead of binary logic. The project utilizes ternary arithmetic because of its potential efficiency benefits and better fit for IoT processes. One of the products of the team’s work in the ternary realm was the Curl hash. However, after security concerns were raised over its use, IOTA switched to Keccak (SHA-3) for cryptographic signing.

IOTA seems to be invested in the ternary thesis on the hardware level as well with the Jinn project. On one hand, it is nice to see a comprehensive approach; on the other hand, they have a lot invested in a technology that is yet to show mass adoption.

There are a number of implementations for IOTA covering the major programming languages; however, the network is not able to natively support smart contracts. That is why several additional layers are needed. The quorum consensus layer, Qubic, uses Abra, which is an “Intermediate trinary-based functional programming language used to describe a qubic’s behavior”. Qubic is meant to enable the creation of a qApp ecosystem and help with the adoption of the network.

Update #1

August 2018 was a busy month for IOTA with several key releases focused on usability. The IOTA Hub was introduced to simplify integration for service providers. Also, the beta version of the Trinity desktop wallet was released. These two projects were developed to address user-friendliness aspects of IOTA and, in so doing, improve adoption.

The beta version of the JavaScript library was also unveiled.

Over the last months, progress was made on Qubic, although, given the lack of dates, it’s hard to forecast specific milestones.

Perhaps of more consequence was the unveiling of MicroHash, a smart contract based on Qubic Lite and TOQEN layers. The lack of smart contracts has been one of the biggest critiques of the IOTA network, however, it remains to be seen if the multi-layer structure proves competitive, and how it will change with the release of Qubic.

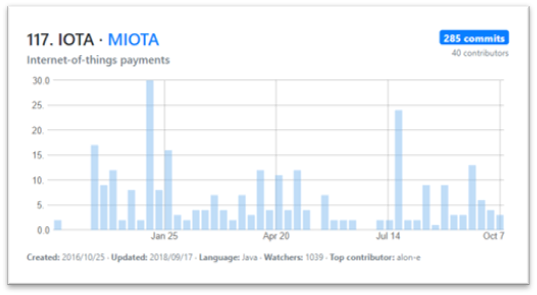

IOTA is continuing to work on some of its major issues including economic incentives, cryptography and efficiency. The GitHub activity has remained relatively quiet, but steady.

The IOTA project is showing progress but given how its development time and the increased level of competition in the IoT space, it may not be enough.

Nevertheless, the lack of specificity on milestones and progress is frustrating.

It would also help to see how and when IOTA plans to address specific issues like confirmation time. As it currently stands, the confirmation time can be several minutes and longer, which is likely too long for many of the targeted IoT use cases.

The IOTA Ecosystem Structure

The classical IOTA system is a no-hierarchy, user-driven offering. Unlike many of its competitors IOTA does not separate participants into actors and validators. This implementation of the DAG utilizes a “pay if forward” protocol, with no distinction among actors.

To submit a new transaction, one must first verify two previous transactions. This is the basis of the Tangle structure. Since IOTA has been designed for an IoT ecosystem, it expects both machine and human users as well as machine-to-machine interactions.

Due to security concerns, IOTA has implemented a Coordinator. It is controlled by the IOTA Foundation and its job is to issue zero-value transactions at two-minute intervals to facilitate consensus in the network.

The IOTA community is also working on an application layer for its network, called Qubic. Qubic will add oracles to the system and will use a quorum-based consensus protocol. While the Tangle layer of IOTA is feeless, Qubic introduces rewards and Proof-of-Resource (PoR) in order to incentivize Oracles to process data and disincentivize malicious actors.

Qubic is currently in development, so in the meantime, Qubic Lite (QLite) has been released to allow for experimentation with qApps. QLite utilizes a third layer TOQEN, which is essentially a blockchain surrogate. A smart contract can be introduced to run as a fourth layer protocol:

- 1st Layer – IOTA (Tangle), this is the data layer;

- 2nd Layer – Qlite, this is the quorum consensus layer;

- 3rd Layer – TOQEN, infrastructure for smart contracts with TQN token;

- 4th Layer – MircoHash, smart contract.

IOTA has a number of wallets available for its MIOTA currency. However, most of them have been received as less than user friendly. In response, IOTA has cooperated with its community to develop the Trinity wallet, which has been in Beta since May 2018.

Additionally, there is hardware development underway, which in fact began prior to the founding of IOTA. Jinn is a trinary microprocessor being developed to optimize IoT processes. IOTA is a software child of Jinn and should enjoy a performance boost should the secret project come to fruition.

IOTA also set up a Data Marketplace to encourage cooperation around its platform, which has garnered interest from major players. This, however, resulted in some communication issues regarding companies participating in the pilot vs establishing an actual partnership with IOTA.

The IOTA Foundation controls the development, research, funding, and operations of the Ecosystem. The project has faced a lot of criticism for incorporating centralization principles, which the team has defended as both necessary and temporary.

There is a sense even at this stage, the IOTA project is highly exploratory with the overall architecture becoming more and more cumbersome in order to meet market demand. Considering the current low level of adoption it merits the question if such development is sustainable and ultimately worthwhile.

Update #1

The IOTA Foundation tries to facilitate network adoption through strategic partnerships and project funding. Both efforts have yielded some results. In August, IOTA announced the first six Ecosystem Development Fund grantees. The most ambitious of the group, was probably NavIndo, an indoor mapping project.

On the partnership front, there has been some positive news a well, the biggest being Volkswagen’s expected use of IOTA in its products and the Fujitsu proof-of-concept publication. A similarly positive development was the signing of an MOU with SinoPac, which had been utilizing Tangle for its iCertificates project. This builds on the early news of a deal with the city of Taipei to develop digital citizen cards with Tangle technology.

However, there was also disappointment, when Sirin Labs decided to go with Ethereum instead of IOTA for its Finney phone.

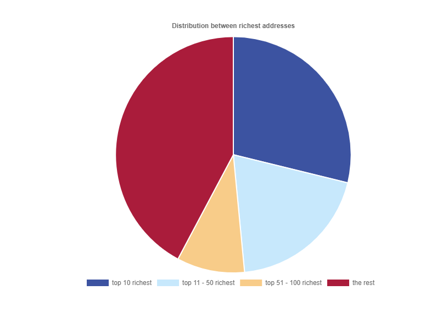

User adoption has grown, but at a slower pace than in 2017, as the number of non-zero-balance addresses increased from 260,629 in January 2018 to 376,045. The distribution of wealth on the network is still very centralized with the top 100 addresses controlling nearly 58% of the coin supply.

Overall, the ecosystem has grown, but it still lacks general adoption use cases.

The project needs a big win in terms of implementation in order relieve the angst around its future prospects.

IOTA Token Economy

MIOTA is the native currency of IOTA and its primary purpose is to serve as a payment vehicle. In addition, with the development of the TOQEN layer, the ecosystem has introduced a TQN token. TOQEN acts as an add-on blockchain. As such, the IOTA ecosystem incorporates both a straight payment and a reward/staking protocol.

Currency – MIOTA is traded on some of the biggest exchanges in the market, including Binance and Bitfinex. However, the currency was originally designed for the IoT economy and intended for person-machine and machine-machine transactions. As there are currently few implemented use cases, MIOTA is mostly being used for speculative purposes.

There is no mining involved with IOTA, as all of the MIOTA were already present in the genesis transaction. IOTA typically trades as MIOTA, which stands for one million units of IOTA. Since IoT ecosystems imply microtransactions, it is important that the IOTA currency is divisible.

Staking – Oracle operators need to provide a stake based on a PoR protocol. While the nature of the protocol is hybrid and allows flexibility, it also associates a weight with the stake, which determines the voting power of Oracles.

Rewards – Oracles are rewarded with TQN tokens for processing data. The rewards are offered at the discretion of qubic owners. The TQN tokens can be acquired for MIOTA via gateways and also converted back to MIOTA. A TOQEN wallet has already been released.

It is unclear if this structured will be maintained when the main Qubit development is completed. However, it appears that in the meantime there was no way to introduce smart contracts into the ecosystem without a secondary token. If this spurs adoption, the additional complexity might be overlooked, but as of now, that is a big if.

Update #1

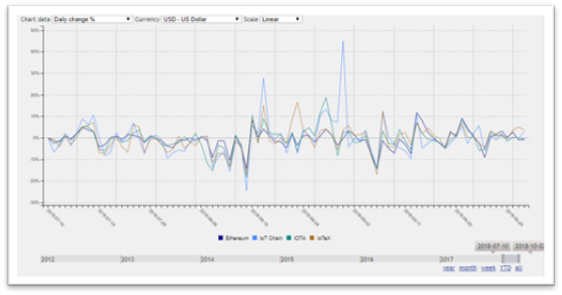

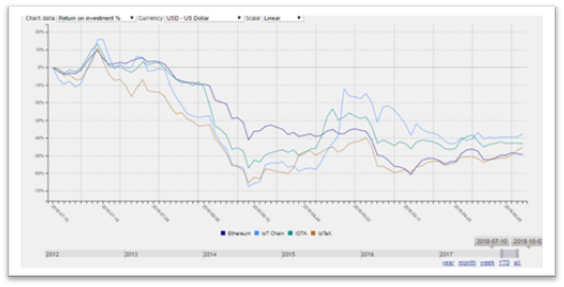

Cryptocurrencies have been stuck in the bear market for most of 2018, which has significantly impacted MIOTA. However, while its daily market cap swings appear to be less violent, its returns appear in line with its competitors. Here, Ethereum is included as a competitor due to the development of the Streamr layer.

Ethereum / IoT Chain / IOTA / IoTeX price (above) and ROI (below).

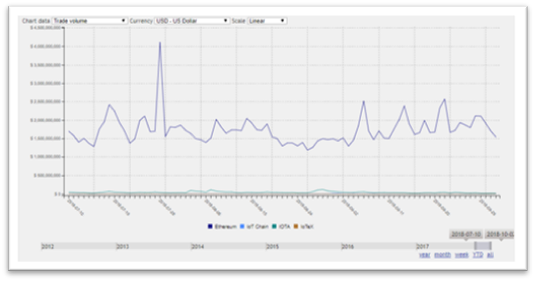

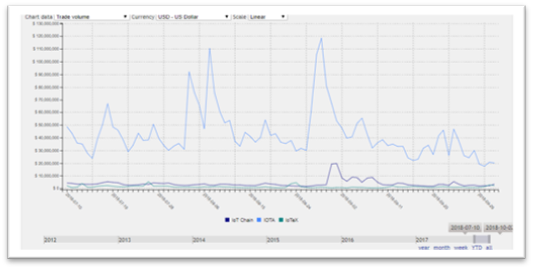

While MIOTA’s daily volume is far below that of Ethereum, it is encouraging to see it confidently surpass its smaller competitors.

Ethereum / IoT Chain / IOTA / IoTeX volume (above) and without Ethereum (below)

However, it is important to note that IOTA’s stiffest competition might come from outside the cryptocurrency club, as IBM makes a play in the space. With a world know brand, a vast pool of resources and partners and a market cap above $130 billion, it could prove to be the biggest obstacle to IOTA quest for IoT dominance.

IOTA Core Team

Sergey Ivancheglo– Co-Founder & Member of the Board of Directors – Sergey has 20+ years of experience in software development and has been involved with DLT since 2011. He is credited with creating Nxt and co-founding Jinn.

Serguei Popov– Co-Founder & Member of the Board of Directors – Sergey is a Professor of Mathematics who specializes in probability theory and stochastic processes. He collaborated on the Nxt project and authored the Tangle white paper, among other DLT focused publications.

David Sønstebø– Co-Founder & Co-Chair of the Board of Directors – David was involved with the Jinn project and later joined IOTA. There is not much public information available about him, even though he is one of the most public faces of the network.

Dominik Schiener– Co-Founder & Co-Chair of the Board of Directors – Dominik has some entrepreneurial and crypto experience, specifically, from the Bithaus GmbH exchange project. In 2016, he won the Shanghai Blockchain Hackathon for his CargoChain project.

Ralf Rottmann– Member of the Board of Directors – Ralf has the most business experience of the IOTA board members. He has founded a number of companies, including grandcentrix GmbH and is on the Advisory Council for the Digital Economy of North Rhine-Westphalia.

The IOTA team also includes 3 supervisory board members, 9 executives, 37 staff members and 12 advisors.

While the team has an eclectic mix of youth and experience, their level of maturity and composure has been repeatedly called into question over PR issues.

Update #1

There could be some internal strife between IOTA’s founders. Leaked emails revealed discord around the inclusion of Sergey Ivancheglo and Serguei Popov on the Board of Directors of the IOTA Foundation, as well as, general trust issues.

Both co-founders were eventually nominated to the Board, and IOTA released a formal statement regarding the leaked emails, but the situation looks bad.

First of all, this is not the first time the project’s management team has been brought into the spotlight for the wrong reasons.

Second, it raises questions about the governance set-up and transparency of the project, with the reasons for the two co-founders not being on the board appearing murky.

The leak also raises numerous other issues, and it is a serious concern that so many years into working together, the founders have not been able to, at the very minimum, maintain a consistent public appearance.

The apparent lack of chemistry within the IOTA leadership poses questions about the long-term stability of the project.

Final Thoughts And Verdict

IOTA is initiated with a C+ grade.

IOTA represents a daring attempt at challenging the status quo. While promising to solve a lot of the problems troubling existing blockchain solutions with its DAG implementation, the team introduces a variety of risks.

From the controversy regarding the Curl to its choice of using ternary arithmetic, IOTA seems to compound risks without anything commercially tangible to hang its hat on. Its focus on IoT technology shows vision, but at the same time, presents a challenge of finding adoption for a developing technology in a just-past-nascent-stage industry.

While IOTA may still prove to be a worthwhile endeavor, at the moment, there is just too much up in the air for it to be considered a top project.

Update #1

IOTA maintains a C+ grade.

Overall, IOTA has made progress in both development and community building.

However, their efforts have yet to bear serious results on the adoption front. The Qubic project, as well as, partnerships with major players are promising, but without forecastable milestones it is difficult to judge their commercial value.

The technology and adoption risks are compounded by persistent PR and management issues. These concerns make it difficult to rate the project highly.

For now, the IOTA grade remains a C+.

Share this article