MakerDAO Considers Raising Stability Fees, Again

Interest is now as high as an unsecured line of credit

Anyone got a sense of déja vu? The MakerDAO is considering an increase to stability fees, which are used to control the price of dai stablecoins.

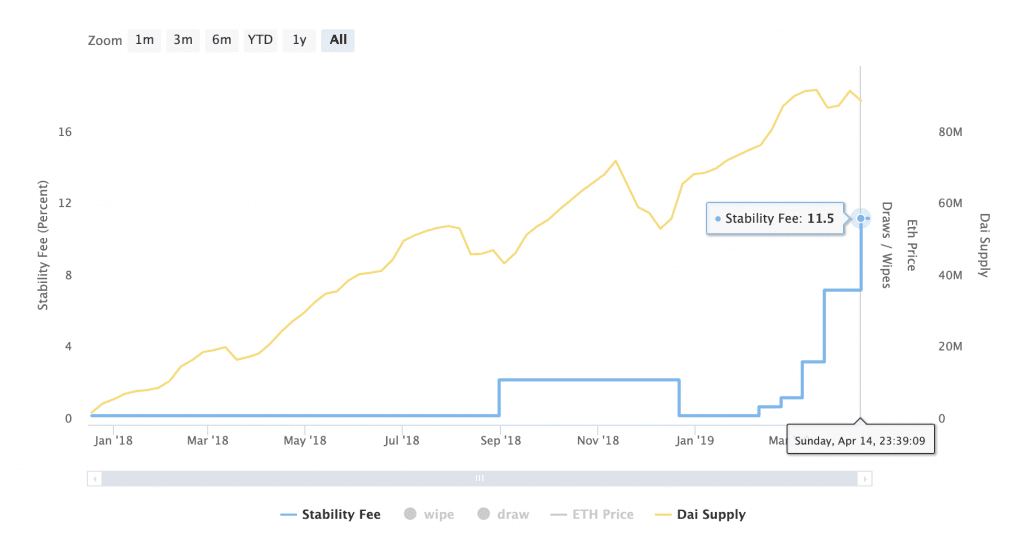

The Maker Foundation Interim Risk Team (MFIRT) placed another vote into the MKR voting system yesterday, to increase the Dai Stability Fee by 3% to 14%. This fee was only 0.5% up until September 2018, and increased to 11.5% just 5 days ago. The historic stability fee is shown below in blue, and the Dai supply in yellow.

Anyone got a sense of déja vu? That’s because we heard this same story earlier this week when MakerDAO implemented the fifth stability fee increase in the last year. The current proposal would be the sixth interest rate hike in the last 12 months.

What is the Stability Fee?

The Stability Fee is a bit like an interest rate on Dai. Users who lock ether into a collateralized debt position (CDP) contract to obtain Dai are charged interest over time, and this interest is known as the “stability fee.” This fee is an annual interest rate, and the loan can be returned at any time. When the loan is returned the CDP owner returns the Dai and pays outstanding interest.

The stability fee is used as a risk parameter, by which stakeholders can influence the price of Dai to maintain its $1 peg. The price of Dai is simply determined by supply and demand: when supply outpaces demand the stable coin falls below its peg, as it has done continuously for the past month.

The lagging demand for Dai is expected, since the cryptocurrency market has been surging recently. In a bear market, investors retreat to stablecoins for security. In a more bullish market, those same investors sell their stablecoins and move value to the riskier crypto assets.

To counteract the decrease in demand, MakerDAO tries to decrease the supply by raising the stability fee. This makes it more expensive to hold a Dai loan, encouraging CDP owners to close their contracts and pay the accrued interest that they owe.

What does this mean for Dai?

The fact that the ecosystem needs to keep increasing its stability fee could mean that the model isn’t working. That could have two reasons:

- CDP owners aren’t paying attention, and have no idea they’re being automatically forced to pay outrageous interest rates.

- CDP owners just don’t care or understand what’s going on.

In the announcement for the latest vote, MFIRT outlined 3 key reasons for another increase:

It’s surprising that this vote is happening so soon after just hiking the rate 3.5% less than a month ago. Some analysts have suggested the system hasn’t been given enough time to recalibrate at the previous rate. Others are in disbelief that a 150% collateralized loan is seeing the same interest rate as an unsecured line of credit.

In any case, it’s clear that these rate increases aren’t working as planned, since Dai is still trading below $1.

Is Dai On Solid Ground?

It might be time to question whether or not MakerDao is moving too quickly, since the team’s main focus over the last few months has been to develop and release Multi-Collateral Dai (MCD) rather than perfecting what makes their product useful: the ability to maintain a $1 peg.

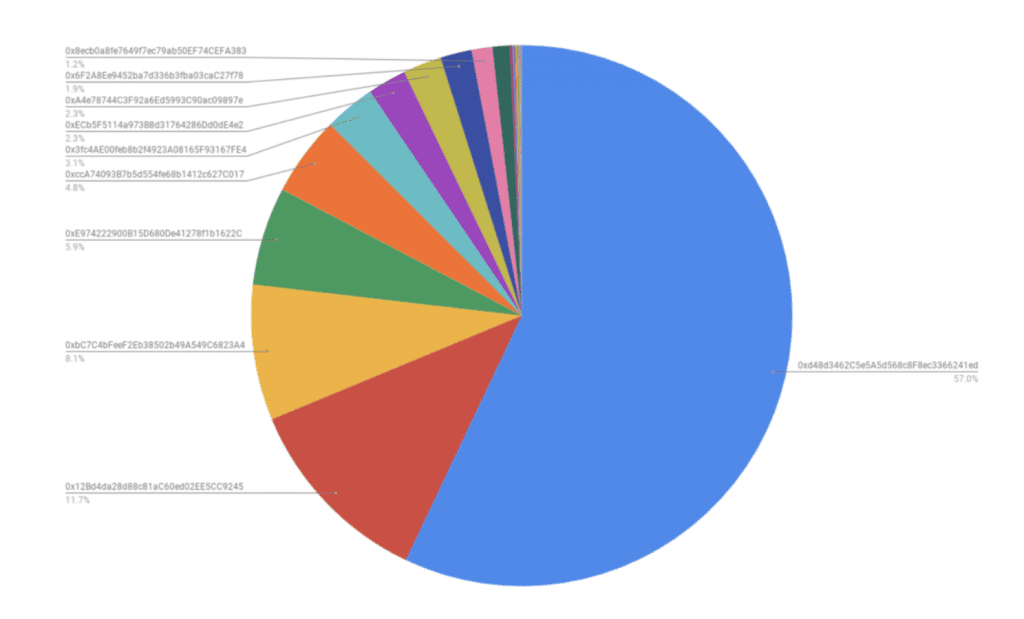

Additionally, MKR is supposed to be a governance token where holders make decisions for the network, and the project is having difficulty encouraging people to vote. In the last vote 96% of the votes came from only 10 different addresses.

For now the Executive Vote will continue until the number of votes surpasses the total number of votes in the previous Executive vote that increased the rate to 11.5%. This is a continuous approval vote, so nothing will happen until the network hits that total.

Meanwhile, the Maker community must face gnawing questions about whether their built-in stability mechanism isn’t quite working as well as they’d hoped.

Maybe sixth time’s the charm?

Earn with Nexo

Earn with Nexo