How A Crypto Lending Business That 'Hates The Banks' Avoids Exploiting Its Customers

80 percent of profits returned to depositors.

Share this article

Readers of a certain age will remember a time when banks could increase your wealth, as well as store it. If you’re old enough to remember when Pokemon was just a card game, you might also remember a wise grandparent or uncle telling you to put your allowance in a high-interest savings account, where it could compound at four or even five percent per year. Back then, a meager allowance could become a decent bankroll by the time you reached adulthood.

That advice has gone the way of the bell-bottom, and a decent savings account is about as common as a pre-release Raichu card. My own bank recently offered a magnanimous certificate of deposit paying 2%, provided I deposit $10,000 and leave it untouched. For a deposit of $25,000, they would give me all of 2.15%—which at least would keep ahead of inflation.

There may be several reasons why banking interest seems to have almost disappeared, but Alex Mashinsky believes that he has identified the most salient one.

“They’re stealing your money, basically,” he told Crypto Briefing.

“They’re Stealing Your Money”

Mashinsky is the co-founder of the Celsius Network, a blockchain based lending platform that deals in over a dozen cryptocurrencies. Asked how he became involved in the business of finance, Mashinsky did not mince his words. “I hate the banks,” he said.

For Mashinsky, the disappearance of savings interest is not so much a question of hard times as it is one of voracious monopoly capital, wringing out every penny of profits.

“When you make a deposit at JPMorgan or Citi, they pay you one percent then they turn around and lend me your money on my credit card and charge me 25 percent,” Mashinsky explained to Crypto Briefing in New York. “So they keep 95% of what they make from it. And they can get away with it, because they have a license and we can’t get around them. They’re just sitting in the middle [being] toll collectors.”

That puts a serious dent in the retirement plans of most Americans, not to mention the rest of the world. “You can’t retire when you make 1% on your savings,” Mashinsky says. “The Fed is screwing all Americans so the banks can put more profit on their balance sheets.”

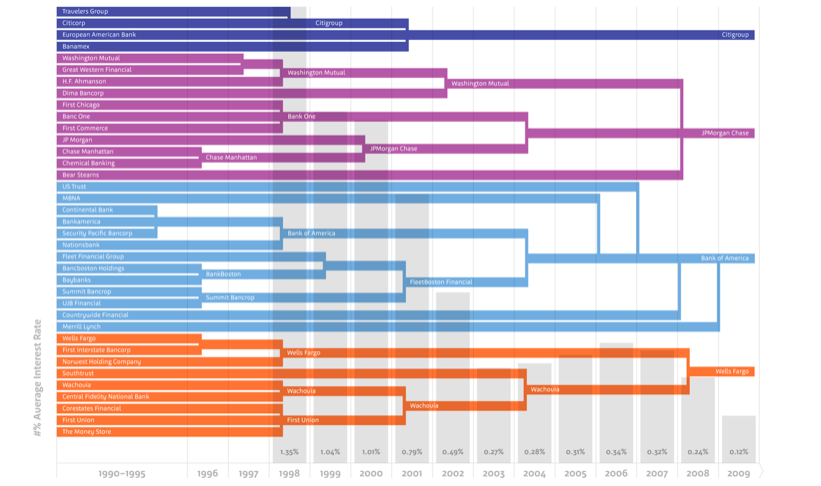

Mashinsky is used to preaching to the choir, but at least he has a good sermon. One of the slides in his keynote presentation is a chart showing the number of hundred-billion dollar banks, compared with the average interest rate. As the banking giants absorbed and devoured each other over the course of a decade, the average interest rate steadily ticked downwards.

The Costco Of Lending

That’s what led Mashinsky to launch the Celsius Network, an alternative lending platform which offers interest at unheard-of rates. The platform has recently reached 200 million AUM, thanks in part to the latest surge in market prices.

“We look like Costco,” Mashinsky said. “You walk in, you don’t have to worry about the cost of the orange juice. you know that Costco did the best job they could to bring it to you.” At present, Celsius offers six percent on Dash deposits, 6.10% on Bitcoin deposits, and 8.10% on stablecoins—meaning you can make money on crypto without worrying about volatility.

Here’s how Celsius brings big-box rates to small-time depositors. When members make a deposit, Celsius pools their cryptocurrencies and lends them out to hedge funds and other institutional traders, who borrow Bitcoin and other assets for arbitrage and market making throughout the cryptosphere.

“We didn’t invent a new business,” Mashinsky explained. “We took all the games that hedge funds and institutions are doing on traditional Wall Street and we applied it to crypto.”

This may make the Celsius team itself sound like a wunch of bankers, but Mashinsky insists that his lending model has nothing in common with the banking system. Celsius does not use leverage, thereby protecting users from the risks of fractional reserves. “Celsius always has more on deposit than it lends out so we can cover any withdrawal at all times,” Mashinsky explained.

Also unlike banks, Celsius is fully transparent in how depositors’ funds are used. Anyone can verify the size of the network’s loans against its deposits, Mashinsky explains, and this data will later be encoded on a blockchain to make verification truly trustless.

That could help advance Celsius’ goal of providing the best deals. At present the company delivers more than 80 percent of their loan interest to depositors and that figure is likely to increase. “If we can deliver 7 percent returns,” Mashinsky said, “then people have a chance for retirement, to pay for their kids’ weddings.“

Share this article

Trending News