Massive Supply Barrier Is Keeping Cardano Prices From Breaking Out

Cardano is poised for further losses as multiple technical indexes are flashing sell signals while support continues to lose strength.

Key Takeaways

- The TD setup presented a sell signal on ADA's 3-day chart, suggesting that there is more room to go down.

- If the 50-twelve-hour moving average fails to hold, Cardano could drop to $0.09.

- On the flip side, turning the $0.11 resistance into support may invalidate the bearish outlook.

Share this article

Greed among crypto investors has triggered a market-wide correction, liquidating more than 34,000 traders in the past 24 hours. And unfortunately for ADA holders, Cardano looks no different.

Cardano Prepares for Another Leg Down

Many cryptocurrencies, including Cardano, took a major hit after the new weekly trading session began.

Since today’s open, ADA dropped more than 5%, trading at $0.107 to a low of $0.101.

Despite the significant losses incurred, the TD sequential indicators estimate that ADA has more room to go down.

This technical index presented a sell signal in the form of a green nine candlestick on the 3-day chart. The bearish formation estimates a one to four 3-day candlesticks correction before the uptrend resumes.

If validated, ADA may drop towards the setup trendline at $0.09.

The 50-twelve-hour moving average on the 12-hour chart can be used as confirmation for the bearish outlook. This trend-following indicator has been able to act as stiff support, keeping falling prices at bay since Sept. 25.

Therefore, only a 12-hour candlestick close below this hurdle will add credence to the TD setup’s forecast.

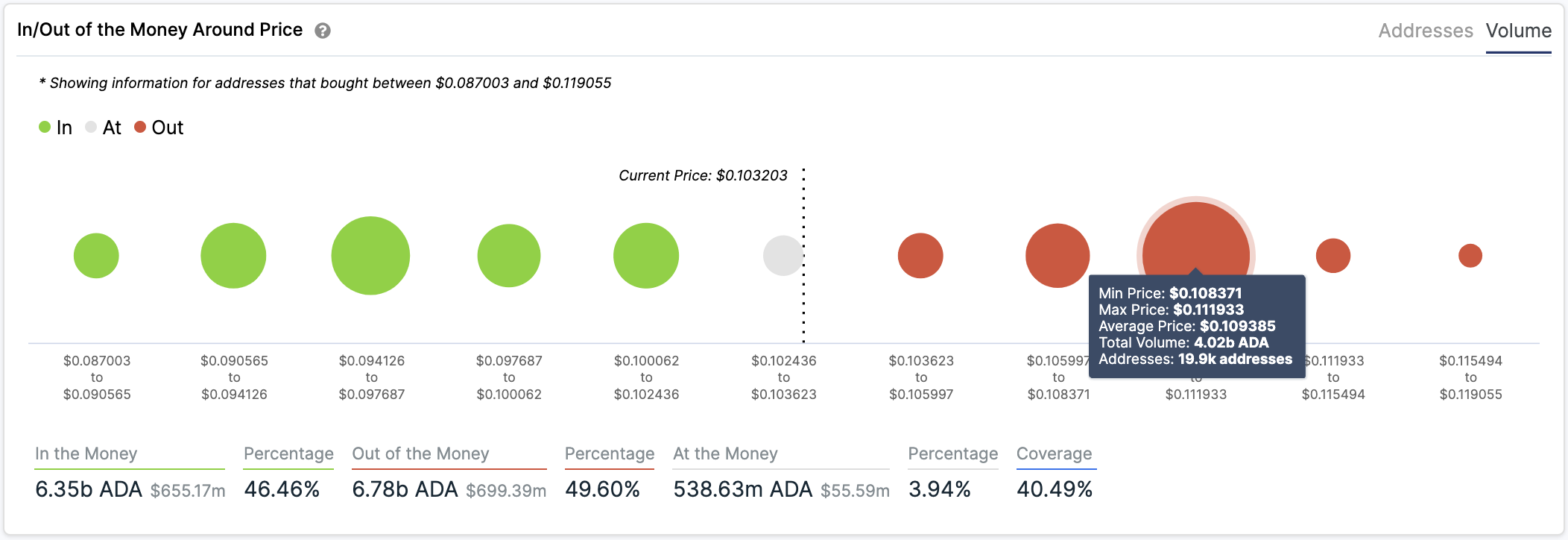

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that moving past the $0.103 support level could be catastrophic.

Based on this on-chain metric, the next critical area of interest is the setup trendline hovering around $0.09. Here, roughly 28,000 addresses had previously purchased more than 1.3 billion ADA.

Conversely, investors must pay close attention to the $0.11 resistance barrier.

Turning this critical barrier into support may have the strength to jeopardize the bearish outlook and lead to further gains. Doing so won’t be easy, as nearly 20,000 addresses hold more than four billion ADA around this price level.

Share this article