MiCA could propel euro-backed stablecoins in the Eurozone: Kaiko report

Euro stablecoin trading volume hits record highs amid regulatory shifts.

Share this article

Impending Markets in Crypto Assets (MiCA) regulations are poised to transform the stablecoin landscape favorably to euro-backed stablecoins, as reported by Kaiko Research. Binance has announced restrictions on stablecoins that fall short of the new MiCA standards, while Kraken is assessing its stablecoin offerings to ensure compliance with the European Union’s criteria, which may result in the delisting of certain stablecoins for EU customers.

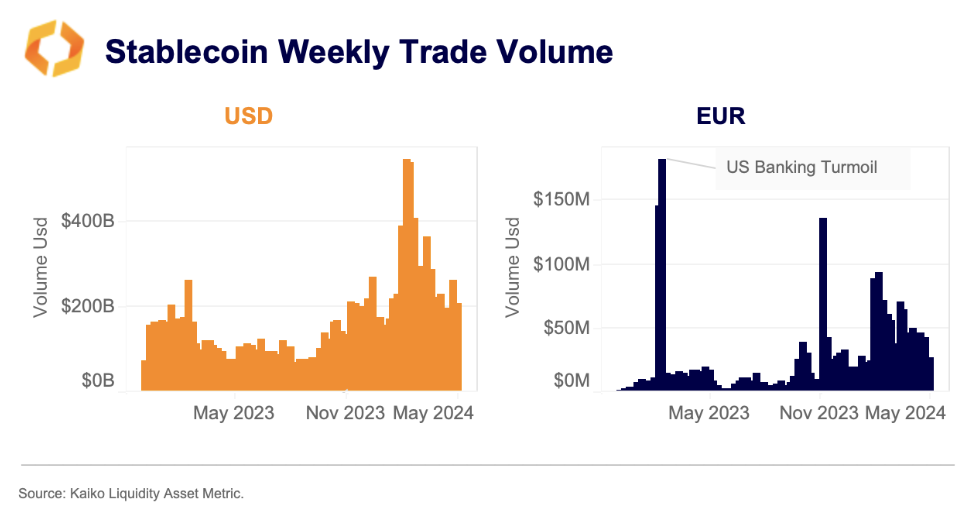

Despite Europe’s slower adoption rate compared to the US and APAC regions, euro-backed stablecoins have seen a surge in trading volume since the year’s start. This uptick indicates a growing demand within European markets. Notably, the combined weekly volume of prominent euro stablecoins, including Tether’s EURT, Stasis EURS, and Circle’s EURCV, has surpassed $40 million since March, marking a record duration of sustained high volume.

AEUR, introduced by Binance in December, has quickly dominated the euro stablecoin sector, accounting for over half of the total volume. While USD-backed stablecoins remain the market’s giants, with a staggering $270 billion in average weekly volume in 2024, euro-backed stablecoins have carved out a 1.1% transaction share, a significant rise from virtually none in 2020.

Trading pairs of USDT against the euro are now some of the most traded instruments, outpacing even EUR-denominated Bitcoin trading on Binance and Kraken. This trend highlights these platforms’ role as key fiat gateways for European traders.

The specific stablecoins to be deemed unauthorized remain undisclosed. However, Kraken’s review of Tether’s USDT, the world’s largest stablecoin, is particularly noteworthy given its past regulatory challenges. Despite its primary trade volume occurring during US market hours, USDT remains a vital asset for European traders.

While over-the-counter (OTC) trading will likely maintain USDT-EUR liquidity, the shift towards regulated alternatives such as USDC could become a preferred option for many traders, suggests the report.

Share this article