Microstrategy, Square Become Repeat Bitcoin Buyers

Institutional investors continue adding Bitcoin to their balance sheets despite its erratic price behavior.

Key Takeaways

- MicroStrategy has purchased roughly $1 billion of Bitcoin (19,500 BTC), following its own previous purchases.

- The move comes after Square Inc. revealed its own purchase of an additional $170 million worth of Bitcoin.

- The mounting upward pressure behind Bitcoin may soon be reflected on prices despite an impending supply barrier.

Share this article

While over-leveraged traders are getting crushed by Bitcoin’s volatility, it seems that institutional investors are taking advantage of every downswing to add more BTC to their holdings.

MicroStrategy Buys the Bitcoin Dip

MicroStrategy announced on Feb. 24 that it had purchased 19,452 BTC for roughly $1 billion in cash at an average price of $52,765 per token. This brings its total balance sheet to 90,531 BTC, with those funds acquired at an average of $23,985 per coin.

MicroStrategy CEO Michael Saylor commented on the purchase. “The company now holds over 90,000 Bitcoins, reaffirming our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, can serve as a dependable store of value,” Saylor says.

He added that the firm will continue to to “[acquire] Bitcoin with excess cash” and raise capital to purchase Bitcoin.

The purchase comes after Square Inc. published its annual earnings report, revealing a $170 million Bitcoin purchase at an average price of $51,235. The financial services firm now owns 8,807 BTC, bought at an average price of $25,000 per token.

Stiff Resistance Ahead

Because such significant purchases by institutional investors tend to be carried out as over-the-counter trades, the impact on Bitcoin prices could be delayed. But if buying pressure continues to mount, Bitcoin may be able to recover promptly after the correction and march towards new all-time highs.

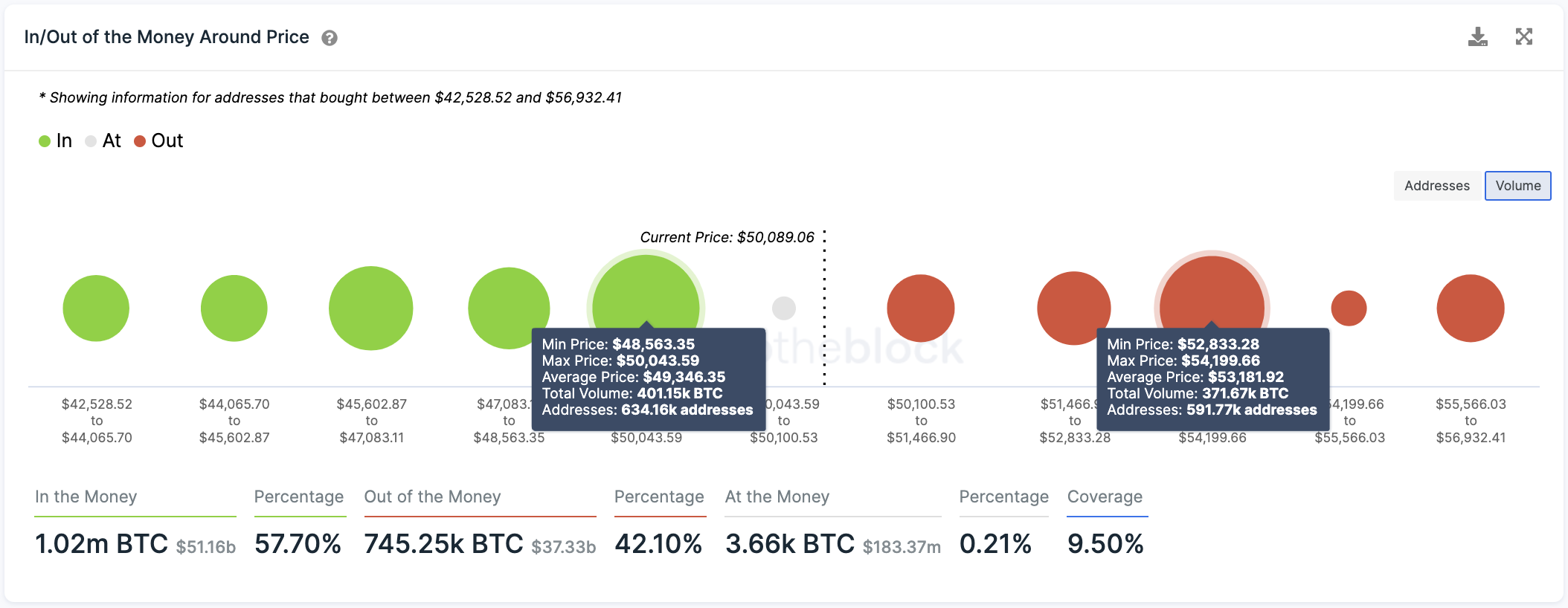

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model reveals that Bitcoin must slice through a stiff supply barrier. Indeed, nearly 600,000 addresses have previously purchased approximately 370,000 BTC at prices between $52,800 and $54,200.

Such a significant interest area may have the ability to absorb some of the buying pressure seen recently. Holders who have been underwater may try to break even on their positions, slowing down the uptrend. But if Bitcoin can break through this hurdle, it would likely resume its parabolic advance.

The IOMAP cohorts also show that Bitcoin sits on top of stable support. More than 600,000 addresses bought roughly 400,000 BTC between $48.500 and $50,000. This crucial demand barrier must continue to hold to avoid a steeper decline towards $40,000.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

Share this article