Nearly half of major airdrop tokens peak within two weeks: CoinGecko

Market conditions play an important role in airdropped token prices, and the current bullish sentiment might suggest a shift in market dynamics this year.

Share this article

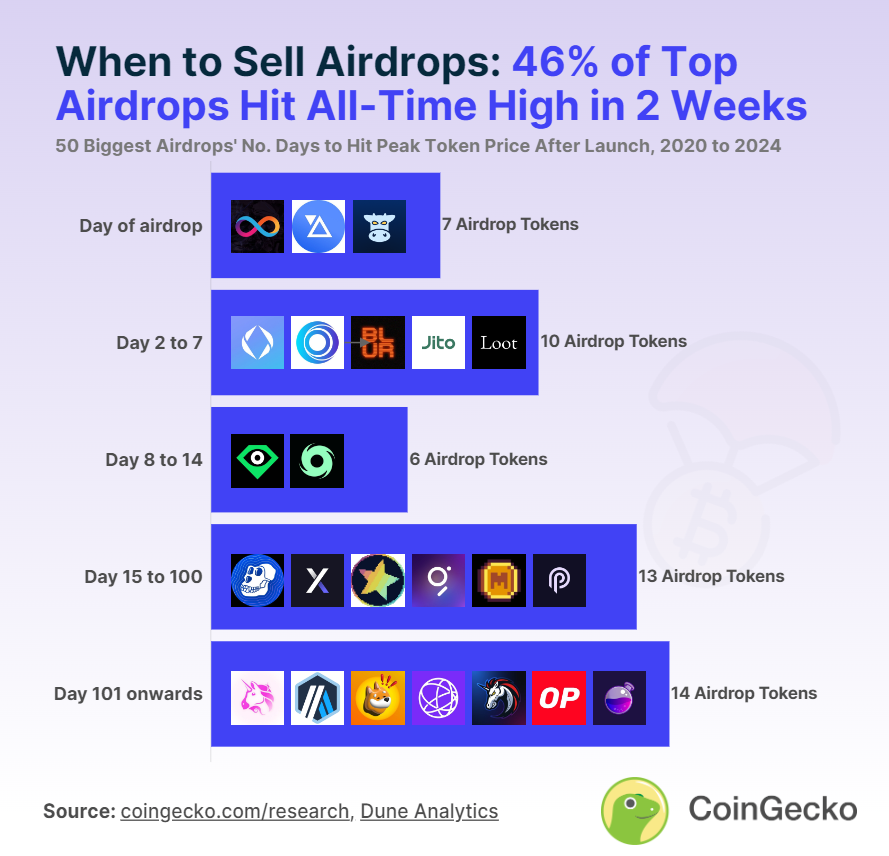

Nearly half of the largest crypto airdrops have seen their peak values within the first two weeks of distribution, a Feb. 23 CoinGecko report shows. Specifically, 23 of the top 50 tokens distributed through airdrops, representing 46%, reached their highest prices during this period, highlighting a potential strategy for recipients to maximize profits by selling shortly after receiving the tokens.

Key examples of short-term price peaks include Ethereum Name Service, which surged by 73% on the second day of trading, and X2Y2, with a 121% increase in the same timeframe. Other notable airdrops such as Blur, LooksRare, and ArbDoge AI also saw significant returns within the first 14 days.

The trend suggests an initial spike in interest following the airdrop, leading to a temporary price surge. However, not all airdrops follow this pattern. Some, like Solana aggregator Jupiter, experienced a decline immediately after the airdrop, indicating a quick sell-off by recipients.

The other 27 tokens analyzed in the report reached their peak values beyond the two-week mark, with some taking as long as 581 days. Long-term market conditions and project developments can also play an important role in the valuation of airdropped tokens.

Going over market conditions, the report identified that 19 of the 50 tokens airdropped hit their all-time highs during the 2021 bull market, with some tokens like Uniswap showing returns significantly higher than their short-term peaks.

2022 was notable for NFT-related airdrops, with tokens such as ApeCoin and LooksRare achieving new highs despite an overall bearish market, showing the varied impact of market trends on different types of tokens.

Looking ahead, the approval of spot Bitcoin ETFs in the US has contributed to a bullish sentiment in 2023 and 2024. Airdrops during this period show a mixed pattern, with some tokens peaking shortly after distribution and others benefiting from a more extended holding period, indicating a shift in market dynamics that may influence future airdrop strategies.

Share this article