New US regulation requires reporting of all crypto transactions over $10,000 to IRS

Tax compliance challenges emerge for crypto miners and persons making transactions in decentralized exchanges.

Share this article

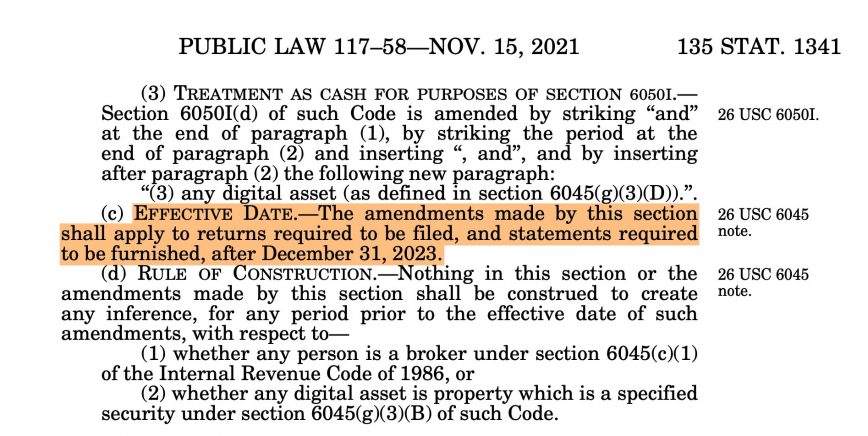

The Infrastructure Investment and Jobs Act, passed by the US Congress in November 2021, introduced a new provision into the Tax Code. Anyone receiving over $10,000 in cryptocurrency in their trade or business must report the transaction to the Internal Revenue Service (IRS) within 15 days.

This new rule, which took effect on January 1, 2024, requires submitting detailed personal information, including the sender’s name, address, Social Security number, transaction amount, and date, among other requirements.

Coin Center, a cryptocurrency advocacy group, filed a lawsuit against the Treasury Department, challenging the 6050I law constitutionality in June 2022, but the legal process is ongoing. As it stands, the law is in force, and all Americans must comply. It’s a self-executing statute requiring no further regulatory action for enforcement.

Jerry Brito, Executive director at Coin Center, stated in his X account that:

“This is the 6050I law that Coin Center challenged in federal court, and our case is in appeals. Unfortunately, for the time being, there is an obligation to comply – but it’s unclear how one can comply. The existing form for “cash” transactions isn’t applicable, and there are many unanswered questions like, What if you receive funds from a block reward or a DEX transaction? Who do you report as the sender?”

People involved in significant cryptocurrency transactions are legally required to report them within 15 days. If they fail to do so, they risk facing felony charges. However, complying with this law can be challenging in practice.

For example, crypto miners or validators who receive block rewards exceeding $10,000 may need help deciding whose information to report. Similarly, those participating in decentralized exchanges might need assistance identifying the other party involved in the transactions.

Also, organizations that receive cryptocurrency donations over $10,000 face particularly complicated issues. If the contributions are anonymous, complying with counterparty reporting requirements becomes impossible.

Moreover, the law’s criteria for evaluating the $10,000 threshold regarding cryptocurrency value still need to be clarified. According to Coin Center, the IRS has yet to offer guidance on these issues, leaving many uncertain.

Where and how to file reports for cryptocurrency transactions remains unresolved. While Form 8300 is the standard for cash transactions, it still needs to be determined whether it applies to cryptocurrencies, now legally classified as cash.

Lawsuits challenging the law’s constitutionality are ongoing, yet the law remains enforceable until a court overturns it.

Share this article