Nexo Offers to Buy Out SALT

Share this article

Rumors are swirling after an offer to buy out the first platform for decentralized lending. Nexo, a European-based company for cryptocurrency-collateralized lending, has sent a “letter of intent” to buy out SALT Lending, a similar service in New Zealand, the United Kingdom and several states.

The letter–which Nexo also shared on social media—appears to be an offer for the purchase of SALT’s “remaining qualifying assets,” including outstanding loan debts and their cryptocurrency collateral. If accepted, Nexo can offer a funding capacity of “up to US $2,000,000” for customer of SALT’s outstanding loan applicants, and will honor SALT’s remaining obligations on its own platform.

The offer also says that Nexo will “consider” accepting SALT tokens as collateral or payment for SALT’s outstanding loans.

The letter was circulated widely on Nexo’s LinkedIn and Twitter platforms, where it was spun as “lending a helping hand” to an apparently-ailing competitor. Within the SALT community, including unofficial Telegram groups, the offer was widely dismissed as a publicity stunt.

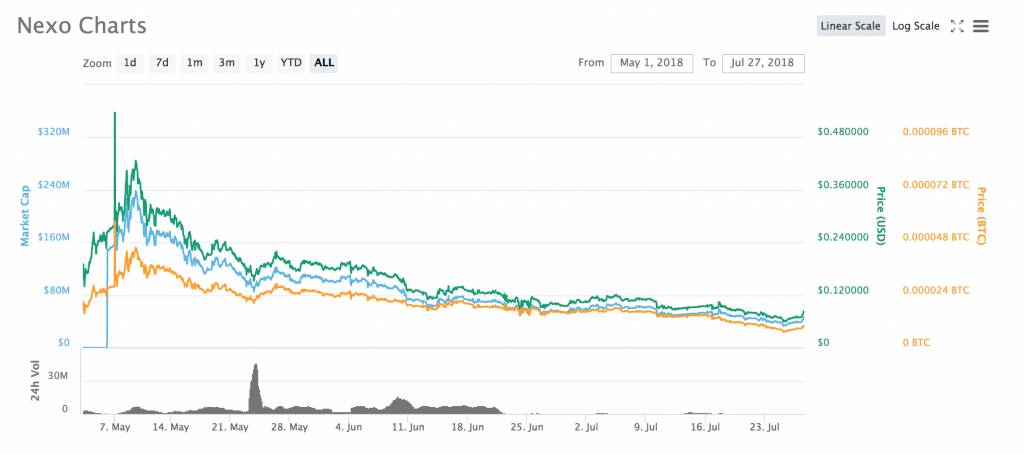

Both companies share the model of using cryptocurrency as collateral for cash loans—an innovative business model that allowed SALT to issue one of the most profitable initial coin offerings of 2017. However, that model lost its appeal in 2018, when cryptocurrency prices began to sink.

SALT’s company leadership also made several stumbles. In an apparent effort to justify SALT as a utility token, the company decided to make loans repayable in SALT at retail prices. Since the market price for SALT was significantly lower on exchanges, that policy created a lucrative arbitrage opportunity for SALT’s borrowers, and that opportunity widened as the token’s value continued to sink.

Expectations fell even lower due to the team’s poor communications with their investors. Although the company has ditched SALT repayments, it also limited its community engagements and turned to heavy moderation in its Telegram groups. The two official subreddits, Saltlending and Salttrader, show few signs of life.

It’s not clear how seriously Nexo meant for the offer to be taken, but the letter put a megaphone to rumors that SALT Lending may be on its last legs. Last week, SALT’s CEO and founder, Shawn Owen, abruptly stepped down without explanation and was replaced with an “interim” president and CEO.

Crypto Briefing’s phone calls and email messages to SALT’s Denver offices were not returned at the time of writing.

The author is not invested in either SALT or Nexo, but does own other cryptocurrencies.

Share this article