Only a Black Swan Event Will Keep Bitcoin from Reaching $15,000

Bitcoin continues leading the newest bullish cycle in the cryptocurrency market.

Key Takeaways

- Bitcoin just hit new yearly highs after a week-long consolidation period.

- A further spike in demand could see BTC rise towards the next psychological resistance around June 2019’s high of nearly $13,900.

- On-chain data shows little to no resistance above this price hurdle, suggesting that a new bull market has begun.

Share this article

Bitcoin stole the crypto spotlight after slicing through a crucial resistance barrier that had been preventing it from advance further since Oct. 21.

Data reveals that if buying pressure continues to increase, prices could rise beyond $15,000.

Rising to New Yearly Highs

Bitcoin entered a consolidation period after breaking out of an ascending parallel channel on Oct. 21.

Throughout the week, prices have been contained between the $12,800 support and the $13,300 resistance level. The dormant price action forced the Bollinger bands to squeeze on BTC’s 4-hour chart, signaling that volatility was underway.

Today, a spike in the buying pressure behind the pioneer cryptocurrency allowed it to move past the overhead resistance. The sudden upswing can be considered part of the breakout that the Bollinger bands forecasted.

A further increase in demand could see Bitcoin rise towards the next psychological resistance represented by June 2019’s high of nearly $13,900.

Little to No Resistance Ahead of Bitcoin

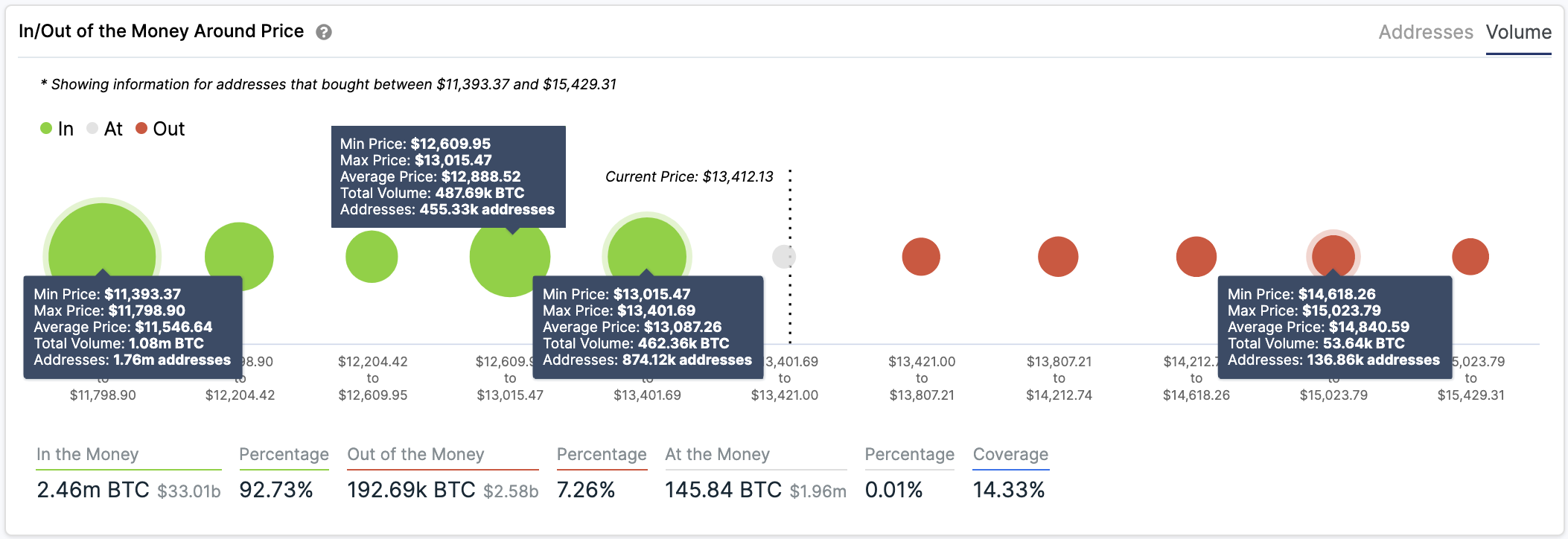

While many market participants consider June 2019’s high as a critical area of interest, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model suggests otherwise. Based on this on-chain metric, Bitcoin could run all the way up to $15,000 before it finds any resistance.

Here, approximately 140,000 addresses had previously purchased nearly 54,000 BTC.

When considering the massive supply barriers that lie underneath the flagship cryptocurrency, the overhead resistance seems insignificant.

Therefore, those who are looking to profit from the recent breakout must be aware that Bitcoin could be about to “teleport upwards into a full-on, FOMO induced, bull run” as on-chain analyst Willy Woo recently stated.

Regardless, the unpredictability of the cryptocurrency market makes it impossible to disregard the bearish outlook. If sell orders were to pile up, triggering a sudden downswing, the range between $12,600 and $13,400 might keep falling prices at bay.

More than 1.3 million addresses are holding over 950,000 BTC around this price level.

Share this article