Pre-token platforms give early market access but still lack liquidity: Keyrock

Pre-token markets offer early access but face liquidity challenges.

Despite the innovative approaches, pre-token markets face challenges such as price discovery inefficiency due to low volume compared to markets after the token generation event (TGE), according to the “Can markets be efficient before they even exist?” report by Keyrock.

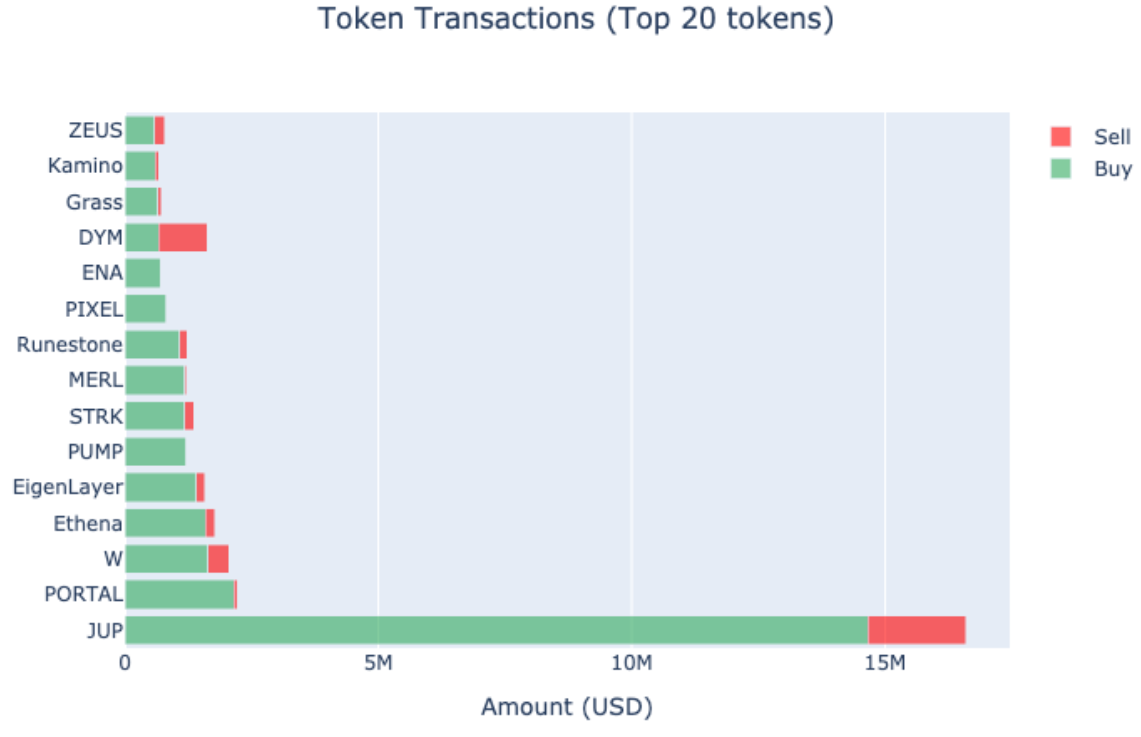

The report highlights that the volume disparity can be as high as 1,000 times, mentioning tokens like Wormhole’s W and Jupiter’s JUP as examples. Moreover, the majority of trades on the points trading platform Whales Markets involve small amounts, with an average transaction size of $870, suggesting that most traders are not large-scale investors.

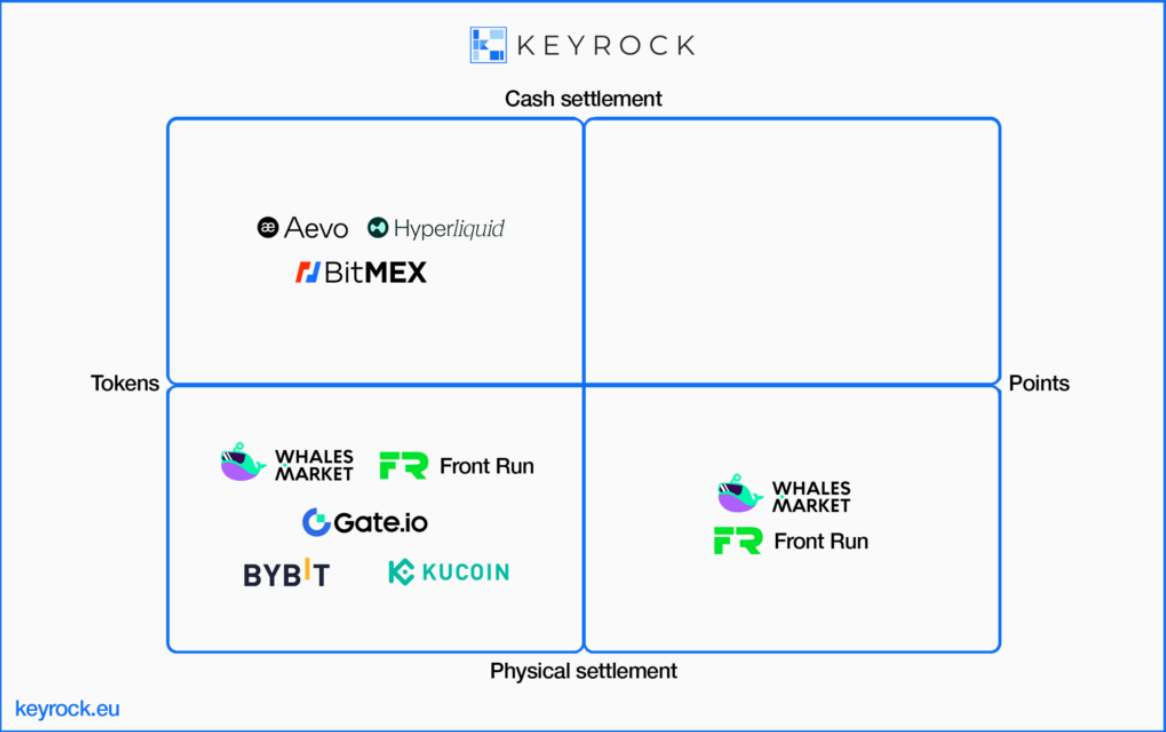

Keyrock points out that pre-token and point markets are emerging as innovative financial instruments, offering traders early access to token futures before their official TGE. These markets are divided into two distinct categories: perpetual futures derivatives markets, which are cash-settled, and peer-to-peer over-the-counter (OTC) markets, allowing for the trading of token futures prior to TGE with physical delivery.

Platforms like Hyperliquid and Whales Market have developed unique mechanisms for these trades. Hyperliquid’s Hyperps are settled on-chain with an off-chain order book, while Whales Market enables trading of both points and futures with a settlement date coinciding with the TGE.

AEVO, another decentralized platform, allows users to trade perpetual contracts at a token’s future price, with all trades being collateralized using USD Coin (USDC) stablecoin and a maximum leverage of 2x. Front Run, an on-chain OTC order book DEX, facilitates futures trading of points, airdrop allocations, and pre-tokens.

Centralized exchanges (CEXs) such as Kucoin, Bybit, Bitmex, and Gate.io have also entered the pre-token trading space. Bybit, Gate.io, and Kucoin offer futures trading with physical delivery post-TGE, while Bitmex provides perpetual contracts trading collateralized with USDT.

The mechanisms behind these platforms vary, with AEVO using a time-weighted average price (TWAP) to set market prices and Hyperliquid using an 8-hour exponentially weighted moving average for pricing. Whales Market ensures seller collateral to guarantee token delivery at TGE, mitigating delivery risk.

However, despite pre-token trading platforms like AEVO, Front Run, Hyperliquid, and Whales Market offering early access to token markets and have reached significant volumes, the illiquid nature of pre-token markets and the potential inefficiencies cannot be overlooked.

Earn with Nexo

Earn with Nexo