Solana and Avalanche Enter New Uptrend

Solana and Avalanche are surging in tandem as sentiment in the crypto market improves.

Key Takeaways

- Solana and Avalanche have risen by roughly 20% in the past 36 hours.

- SOL needs to stay above $42 to advance to $52.

- AVAX could trigger an upswing to $28 if it breaks $24.

Share this article

Solana and Avalanche are gaining bullish momentum after slicing through crucial resistance areas.

Solana and Avalanche Overcome Resistance

Solana and Avalanche appear well-positioned for gains as the broader cryptocurrency market enjoys new tailwinds.

Solana’s SOL token has risen by nearly 20% over the past 36 hours. It soared from a low of $38.60 to post a new monthly high of $46.10. The sudden upswing has allowed Solana to overcome a crucial area of resistance, potentially leading to higher highs.

Solana sliced through the middle trendline of a parallel channel that had developed on its four-hour chart. Trading history shows that every time SOL has breached this barrier since June 20, it has advanced toward the channel’s upper boundary. Now, similar price action could push the asset to $49 or even $52.

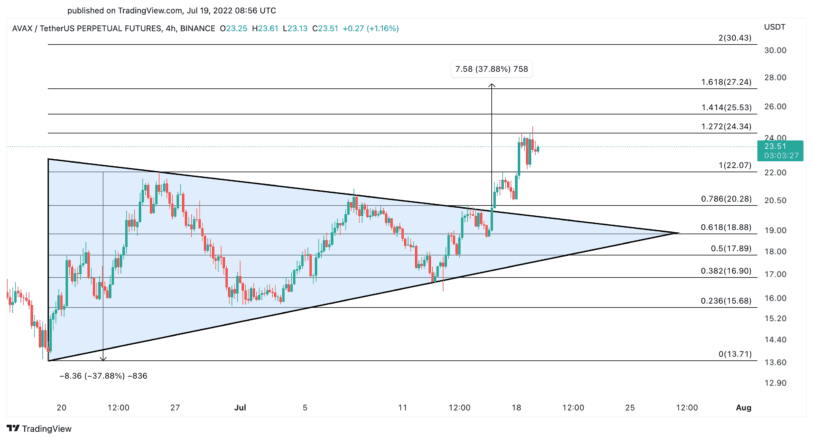

Avalanche has also seen a wave of bullish momentum over the past 36 hours, surging from a low of $20.60 to a high of $24.80. The upward impulse was triggered after AVAX broke out of a symmetrical triangle that had developed on its four-hour chart. With two corrections occurring after the breakout, it appears that the token has collected enough liquidity to advance further.

The height of the triangle’s Y-axis suggests that Avalanche has entered a 38% uptrend toward $28. A sustained four-hour candlestick close above the $24.30 resistance level could further validate the bullish thesis.

Although the odds appear to favor the bulls, the support levels are crucial due to the ongoing uncertainty across crypto and global financial markets.

If Solana fails to keep the channel’s middle trendline at $42 as support, the optimistic outlook may be invalidated. A four-hour candlestick close below this vital level could trigger a spike in profit-taking that sends SOL to $38.50 or $35.20. Similarly, Avalanche needs to avoid dipping below $22 as the downswing could initiate a retracement to $20.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article