‘Solana ascent to a top 3 blockchain by market cap seems inevitable,’ says Zeta Markets’ CEO

Tristan Frizza explains that even after the Dencun upgrade, Ethereum layer-2 blockchains won’t offer lower gas fees than Solana does.

Share this article

Solana (SOL) jumped almost 13% in the last seven days, and Tristan Frizza, CEO and Founder of Zeta Markets, believes that SOL’s rally “has just begun.” The approval of spot Bitcoin exchange-traded funds in the US, the halving, and Ethereum’s Dencun upgrade are boosting increased institutional interest, renewed optimism, and broader adoption, heralding the dawn of a new cycle, and that’s when SOL might shine.

“With Bitcoin reaching new all-time highs several times, similar movements for Ethereum and Solana are anticipated, driven by capital rotations in the markets. Currently priced at under $150, Solana remains significantly below its last ATH of about $260 in November ’21. However, its solid adoption metrics, which signal genuine user activity, suggest that we’re not only witnessing speculative interest but are also poised to see new ATHs due to this authentic engagement,” Frizza adds.

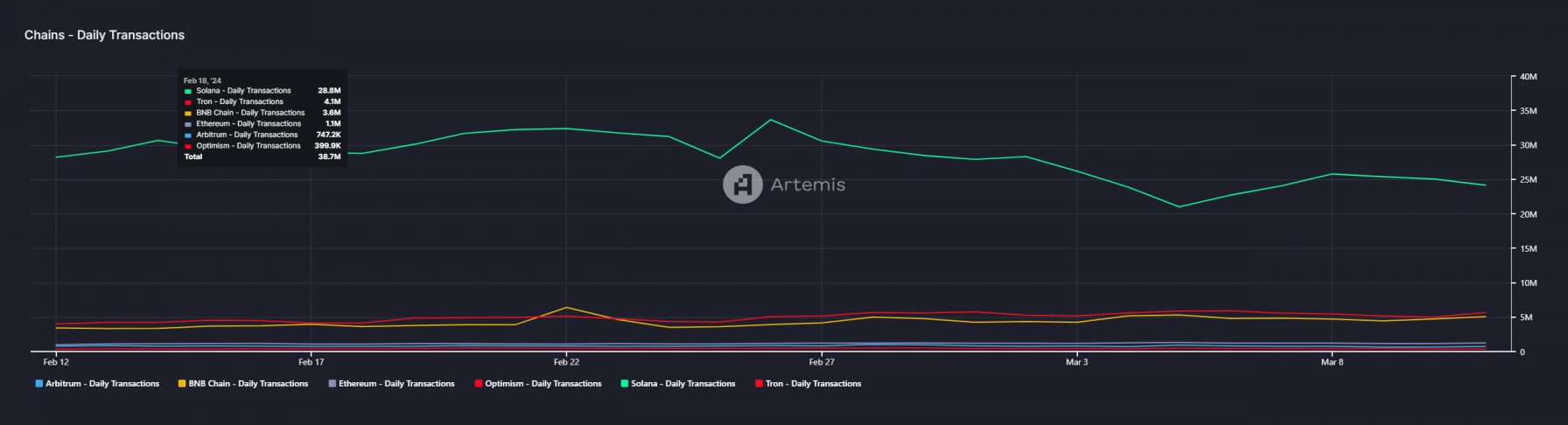

The founder of Zeta Markets believes that Solana’s ascent to a “top three blockchain by market cap seems inevitable,” highlighting that Solana has more daily transactions than Ethereum, Arbitrum, Optimism, BNB Chain, Tron, and Avalanche combined.

“The overall DeFi TVL climbing back above $100 billion further supports the deep-rooted belief in blockchain technology and its applications, as demonstrated by the growing engagement of users across platforms […] Its [Solana’s] unmatched speed, simplicity, and security render it the ideal platform for democratizing DeFi access for all.”

Moreover, Frizza also points out that Solana’s decentralized exchanges are rising in weekly and daily traded volumes, surpassing the $2 billion daily trading threshold since early March. Recently, Solana registered a new weekly record, surpassing $15 billion.

No significant changes after Dencun

One of the reasons behind the surge in Solana’s network usage is the low gas fees for transactions, making its blockchain the ideal place for the ‘meme coin frenzy’ happening in the crypto market right now.

However, the Dencun upgrade is set to happen on March 13, and it is expected to lower the gas fees for Ethereum’s layer-2 (L2) blockchains. While some analysts expect users to return to the Ethereum ecosystem after this upgrade, such as Flipside, Tristan Frizza doesn’t expect a significant capital rotation from Solana to EVM ecosystems.

“This is mostly because although Dencun greatly reduces fees for Ethereum L2s, the projected fees for a DEX swap according to IntoTheBlock would still be on the order of $0.01-0.40. However on Solana, despite increasing priority fee market prevalence, median gas prices hover around 0.00001 SOL or 1/10th of a cent at current prices which is still at least an order of magnitude cheaper,” Frizza concludes.

Share this article