Solana Is Consolidating Between Two Critical Price Points

Solana appears to be collecting liquidity for a bullish impulse, but it has not yet broken through resistance.

Key Takeaways

- Solana has retraced by more than 24% over the past three weeks.

- Now, the Layer 1 network's SOL token has reached a critical demand zone.

- A spike in buying pressure around the current levels could push the asset to $123.

Share this article

Solana continues to consolidate within a narrow price range, which appears to be encouraging sidelined investors to re-enter the market. A decisive close above a key resistance barrier could potentially result in a 22% upswing.

Solana Remains Stagnant

Solana is trading at a critical demand zone, which could help it rebound if volume starts picking up.

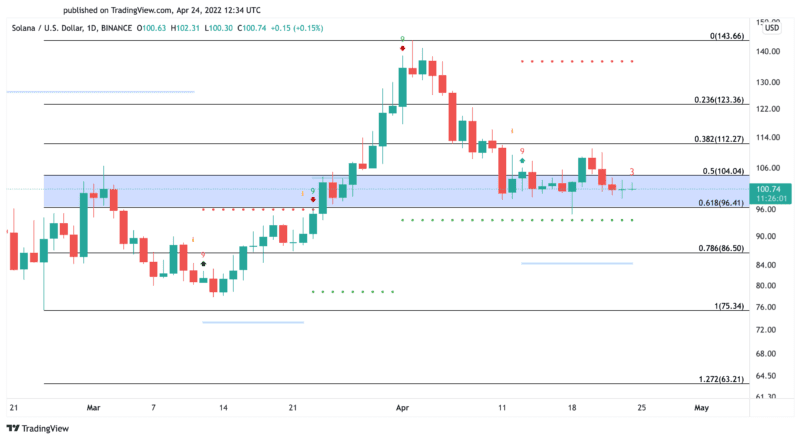

The Layer 1 blockchain’s SOL token has been in a steep downtrend over the past three weeks, following its rise to $143.70. It has since lost more than 34% in market value, recently hitting a low of $94.80. Despite the steep decline, Solana appears to be collecting liquidity for a bullish impulse.

The demand zone between $104 and $96 has kept Solana in a tight range since Apr. 11. However, few buyers have flocked to buy into the asset, even after the Tom DeMark (TD) Sequential indicator presented a buy signal on the daily chart. Such market behavior suggests that traders are waiting for the outlook to become more apparent from the sidelines.

A decisive daily close above $112 could provide an entry to go long. Breaching this critical resistance area could encourage traders to re-enter the market and send Solana toward $123 or even $137.

On the other hand, a sustained close below $96 and the TD’s setup trendline at $93.50 would indicate that Solana faces another dip. If this support cluster is lost, the $84 level will be crucial. A decisive close below $84 could result in a 25% correction to $63.

Disclosure: At the time of writing, the author of this piece owned ETH and BTC.

Share this article